Top Story

Sanwo-Olu floats autonomous financing channel for Lagos’ tertiary schools, sets up dedicated trust fund

…Governor receives 322-page LASU Visitation Panel report

An autonomous funding mechanism that will keep all the three Lagos State’s tertiary institutions on the path of sustainability has just been initiated by the State Government.

Governor Babajide Sanwo-Olu, on Thursday, announced that the Government will be setting up Lagos State Tertiary Education Trust Fund, in a move that will creatively revolutionise the model for the funding of tertiary education in the country.

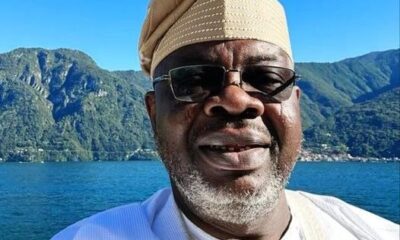

Sanwo-Olu made the announcement when he received members of the Visitation Panel to the Lagos State University (LASU) led by the former Vice-Chancellor of the University of Lagos (UNILAG), Prof. Abdulrahman Bello, at the State House, Marina.

The panel, set up in November 2021, turned in a 322-page recommendations for the Governor’s implementation towards meeting the university’s contemporary needs in academic growth and physical development.

Sanwo-Olu said the need to create an independent funding channels for the State’s tertiary institutions became pertinent, given the nature of disputes characterising the national university system which had led to the perennial staff strikes and closure of campuses across the country.

Although none of the three tertiary institutions in Lagos is taking part in the ongoing Academic Staff Union of Universities (ASUU) strike, the Governor said the Fund would be a pragmatic strategy to meet the schools’ requirements.

The Governor directed the Attorney General, Mr. Moyosore Onigbanjo, SAN, and the Special Adviser on Education, Hon. Tokunbo Wahab, to fashion out the statutory framework that will give legal approval to the Fund.

He said, “Now that we have three universities in Lagos, I believe there is a need for us to set up Lagos State Tertiary Education Trust Fund, which, in our view, will create a sustainable model and the funding that is required, both internally and externally, to strengthen academic research, learning and all that is necessary to keep these universities on track of their mission.

“This is an idea whose time has come at the appropriate period many schools are under closure due to industrial disputes. I am issuing the responsibility to Attorney General and Special Adviser on Education to create the legal framework for the birth of the Trust Fund. This will be another legacy initiative our Government is bringing to sustain education in our State. This will create a financial model that will ensure sustainability of these schools.”

Sanwo-Olu said the Trust Fund would create an additional funding source to the three universities, aside the monthly subventions and intervention funds from federal education agencies, including Tertiary Education Trust Fund (TETFund).

The Governor said the LASU Visitation Panel was set up to birth a new order of growth for the university ranked as the Second Best University in Nigeria by the Times Higher Education (THE) World University Rankings, 2020.

After receiving the panel report, Sanwo-Olu said the State Government, in the next seven days, would constitute a committee that will dissect the recommendations. The committee, he said, is expected to come up with a White Paper that would ensure seamless implementation of the panel’s recommendations.

”It is delightful for me to know that the panel took on the responsibility graciously with all the commitment required. I thank the chairman and members for your dedication and efforts invested in this tough assignment. Today, you are turning in the report. I assure you that we will review and take all suggestions offered. Lagos will continue to be beacon of hope for the country in education,” the Governor said.

Prof. Bello said the panel, in the course of its sittings, interacted with all stakeholders of the university on the 11 terms of reference given to the panel.

The chairman said the panel received and considered 40 memoranda from ASUU and the Senior Staff Association of Nigerian Universities (SSANU), which contained 58 separate issues, adding that members also visited the three campuses of the university.

Prof. Bello said: “LASU has to be assisted and supported to maintain this status. The fine details of what would need to be done have been catalogued under each term of reference. These include issues with academic and infrastructural needs, as well as other consideration for the Government, from funding needs to amendments to the University Law to ensure good governance and peace.”

The panel, in its report, recommended the need to upgrade infrastructure in the Epe campus of LASU to meet the standards of the university.

Top Story

FG set to sell DisCos to reputable operators in three months — Adelabu

The Minister of Power, Chief Adebayo Adelabu, has said that the federal government would sell off the five electricity Distribution Companies (DisCos) now under the management of banks and Asset Management Company (AMCON) in the next three months to reputable technical power operators.

Adelabu disclosed this to the members of the Senate Committee on Power who were on an oversight visit to the ministry in Abuja.

The Minister added that the energy distribution assets are technical and as such, they should be under the management of technical experts.

As it stands, Abuja Electricity Distribution Company (AEDC) is currently under the management of the United Bank of Africa (UBA), Fidelity Bank manages Benin Electricity Distribution Company, Kaduna Electricity Distribution Company, and Kano Electricity Distribution Company while Ibadan Electricity Distribution Company is under the AMCON management.

They all found themselves under the new management arrangement owing to their inability to repay their loans.

He informed the committee that tough decisions on the DisCos have become necessary because the entire Nigerian Electricity Supply Industry (NESI) fails when they refuse to perform.

According to him, the ministry will prevail on the Nigerian Nigerian Electricity Regulatory Commission (NERC) to revoke underperforming licenses and also change the management board of the DisCos if it becomes the solution.

Adelabu said, “Lastly, on distribution. Very soon you will see that tough decisions will be taken on the DisCos. They are the last lap of the sector. If they don’t perform, the entire sector is not performing.

“The entire ministry is not performing. We have put pressure on NERC, which is their regulator to make sure they raise the bar on regulation activities.

“If they have to withdraw licenses for non-performance, why not? If they have to change the board of management, why not?

“And all the DisCos that are still under AMCON and Banks, within the next three months, they must be sold to technical power operators with good reputations in utility management.

“We can no longer afford AMCON to run our DisCos. We can no longer afford the banks to run our DisCos. This is a technical industry and it must be run by technical experts.”

The Minister also noted that it has become necessary to reorganise the DisCos for efficiency.

He stressed that Ibadan DisCo is too large for one company to manage.

Top Story

Five arrested for attacking, injuring four LASTMA officers

…Operational vehicles damaged

…54 trucks impounded for illegal parking

Five miscreants have been arrested for assaulting and injuring LASTMA personnel during an enforcement operation in the Oba Akran Avenue area of Ikeja, Lagos and the state government has finalised preparations to prosecute them

Firector of Public Affairs and Enlightenment of LASTMA, Mr. Adebayo Taofiq, disclosed this in a press statement made available to journalists on Thursday.

According to him, April 23, LASTMA operatives conducted an operation to remove illegally parked Viju Milk trucks on Oba Akran Avenue in response to numerous complaints from the public about the trucks causing traffic congestion.

During the operation, four LASTMA officers sustained serious injuries from weapons wielded by Viju Milk truck drivers and local miscreants.

“While LASTMA operational vehicles were vandalised, 54 Viju Milk truck were evacuated by LASTMA during the enforcement operations.”

He said, “The police, working alongside LASTMA, arrested five of these individuals namely: Falomo Oluwafemi, Afeniyi Stephen, Olamide Adekunle, Chukwu Guaja Eze and Adeshina Sulaimon, seized various weapons including broken bottles, iron rods, charms, knives, and cutlasses.”

The injured LASTMA officers were promptly taken to the hospital for medical attention.

Hon. Sola Giwa, the Special Adviser to the Governor on Transportation, stated that the arrested individuals would be prosecuted by the government as a deterrent to others.

Top Story

Hardship: FG kicks off N100bn consumer credit scheme

…Civil servants to benefit in first phase

By Grace Olatundun

The Federal Government of Nigeria has kicked off the N100 billion Consumer Credit Scheme for Nigerians as a tool to alleviate the escalating economic hardship in the country.

In a press statement on Wednesday by the President’s spokesperson, Ajuri Ngelale, he disclosed that interested Nigerians are expected to visit the portal of Nigerian Consumer Credit Corporation before May 15, 2024.

The President noted that the “consumer credit serves as the lifeblood of modern economies, enabling citizens to enhance their quality of life by accessing goods and services upfront, paying responsibly over time. It facilitates crucial purchases, such as homes, vehicles, education, and healthcare, which are essential for ongoing stability and the pursuit of their aspirations.

“Individuals build credit histories through responsible repayment, unlocking more opportunities for a better life. The increased demand for goods and services also stimulates local industry and job creation.”

The President stated further that every hardworking Nigerian should have access to social mobility, with consumer credit playing a pivotal role in achieving this vision.

“The Nigerian Consumer Credit Corporation (CREDICORP) achieves its mandate through the following: Strengthening Nigeria’s credit reporting systems and ensuring every economically active citizen has a dependable credit score. This score becomes personal equity they build, facilitating access to consumer credit, Offering credit guarantees and wholesale lending to financial institutions dedicated to broadening consumer credit access today and Promoting responsible consumer credit as a pathway to an improved quality of life, fostering a cultural shift towards growth and financial responsibility.

“In line with the President’s directive to expand consumer credit access to Nigerians, the Nigerian Consumer Credit Corporation (CREDICORP) has launched a portal for Nigerians to express interest in receiving consumer credit.

“This initiative, in collaboration with financial institutions and cooperatives nationwide, aims to broaden consumer credit availability.

“Working Nigerians interested in receiving consumer credit can visit www.credicorp.ng to express interest. The deadline is May 15, 2024.

“The scheme will be rolled out in phases, starting with members of the civil service and cascading to members of the public,” the statement read.

Recall that two months ago, a presidential spokesman, Bayo Onanuga, announced that the Federal Executive Council had given the nod for the establishment of the Consumer Credit Scheme.

He said the President’s Chief of Staff, Femi Gbajabiamila, will lead a committee that includes the Budget Minister, Attorney-General, and Coordinating Minister of the Economy and Finance to make the scheme a reality.

In March, the Chairman of the Federal Inland Revenue Service Chairman, Zacch Adedeji, said the Nigerian government would unveil its proposed N100 billion consumer credit loan in a few days.

-

Finance3 months ago

Court orders Sen. Victor Umeh to repay N136m bank debt to AMCON

-

Abuja Update2 months ago

Abuja Update2 months agoUNDP, FG partnership needed to achieve inclusion, equity- Minister

-

Abuja Update1 month ago

Banks drive stock market performance with N147bn gain

-

Infotech4 weeks ago

Infotech4 weeks agoWorld Backup Day: NITDA urges Nigerians to ensure backup of data

-

Health1 week ago

Health1 week agoCapacity training will reduce migration of health workers- NPHCDA

-

capital market2 years ago

Rt.briscoe, FBNH, Others halts negative performance of stock market

-

Health3 weeks ago

Health3 weeks agoImmunisation: FG, GAVI seek synergy with Sokoto Govt.

-

Infotech2 weeks ago

Forex for Beginners: Unveiling the currency exchange and how to trade it