Money market

MPC increased rates as measure to control inflation — CBN

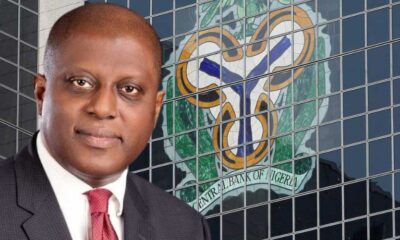

The Central Bank of Nigeria (CBN) says its Monetary Policy Committe (MPC) decision to increase Monetary Policy Rate (MPR) is to control rising inflation.

Hassan Mahmoud, CBN’s Director, Monetary Policy Department said this on Wednesday at a post-MPC briefing tagged: “Unveiling Facts behind the Figures”.

The MPC, in its 287th meeting on Tuesday, had increased the MPR by 150 basis points, from 14 per cent to 15.5 per cent.

The MPR is the baseline interest rate in an economy on which other interest rates within that economy are built on.

The CBN Governor, Mr Godwin Emefiele had said that the decision was informed by persistent rise in inflation rate and fragile economic growth.

According to Mahmud, the MPC got to a point where stringent measures have to be taken to control inflation.

He said that the Committee took cognisance of global as well as local economic issues in arriving at its policy decisions.

“We raised the MPR because it is necessary to do so. The quantity of money in the system was too much for the economy to absorb,” he said.

He said that monetary policy tools were meant to deal with short term risks, adding that the idea was to make cost of funds expensive to drive down inflation.

According to Mahmud, the stimuluses that governments across the world provided for their citizens during COVID-19 increased the ability of people to spend, thereby, creating challenges with global supply.

“A lot of households and small businesses were injected with stimuluses; the U.S did two trillion dollars, Nigeria did about five trillion Naira, these increased the ability of people to spend.

“But the supply side could not meet up with the demand because that volume of injection was far more than the regular intake for those economies, this made prices to go up,” he said.

Speaking on the various economic intervention initiatives by the Apex bank and the prospect of recouping the funds, Director, Development Finance Department,Dr Yusuf Yila, said about nine trillion Naira had been invested in the various development finance interventions.

He, however, said that all the monies would be recovered.

According to Yila, N9.3 trillion has been invested in various development finance interventions, out of which N3.7 trillion has been repaid.

“Most of the loans are still under moratorium, especially those in manufacturing. Manufacturing forms the largest part of our portfolio, about 31 per cent,” he said.

He, however, said that one of the best performing interventions was the Commercial Agriculture Credit Scheme (CACS), where out of the N800 billion that was lent out, about N700 billion had been repaid.

Yila said that through the flagship agriculture intervention scheme, the Anchor Borrowers Programme, one trillion Naira had been lent out to small holder farmers, while about N400 billion has so far been recovered.

According to him, the department will restrict intervention to critical sectors like the SMEs and the electricity sector for now.

Speaking on the depreciation of the Naira, the Director, Trade and Exchange Department, Mrs Ozoemena Nnaji, said the Apex bank was taking steps to firm up the currency.

Nnaji said that demand for foreign exchange outstripped supply currency, adding that the CBN was doing a lot to mop up supply.

“One of the steps is the Naira for dollar remittance drive, which has resulted to a huge increase in diaspora remittances.

“There is also the RT200 bringing in forex. Repatriation has gone up from 20 million dollars in the first quarter to about 600 million dollars in the second quarter.

“In this third quarter we are looking at more than one billion dollars of repatriated inflows,” she said.

Money market

Stanbic IBTC to seek shareholders’ approval for N400bn debt issuance

The Board Stanbic IBTC Plc will seek shareholders’ approval to establish a Debt Issuance Programme of up to N400 billion to issue diverse debt securities through various methods and terms, subject to the grant of all required approvals from the relevant regulatory authorities.

This was contained in the group’s notice of the Annual General Meeting seen by Nigerian NewsDirect.

According to the notice, the company will also request that the directors are authorised to execute all necessary agreements and engage professional parties for the Company’s N400 billion Programme, including compliance with regulatory directives.

Additionally, to seek endorsement for ordinary resolution granting the Directors authority, contingent upon regulatory approval and Clause Seven of the Company’s Memorandum of Association, to raise additional equity capital of up to N150 billion via a Rights Issue or offer for subscription, with terms to be determined by the Directors.

The statement reads, “That subject to receipt of any required regulatory approvals and pursuant to Article One of the Company’s Articles of Association, the Directors be and are hereby authorised to establish a Debt Issuance Programme (the “Programme”) in an amount of up to N400,000,000,000 (four hundred billion naira) or such foreign currency equivalent thereof as the Directors may consider appropriate, for the purpose of issuing debt securities (to include senior unsecured or secured, subordinated, convertible, preferred, equity linked or such other forms of debt obligations) by way of public offering, private placement, additional tier one or tier two capital raising, investments, book building process or any other method, in tranches of such amounts and at such dates, coupon or interest rates and upon such terms and conditions as may be determined by the Directors, subject to the grant of all required approvals from the relevant regulatory authorities

“That the Directors be and are hereby authorised to enter into and execute all such agreements, deeds, notices and documents as may be necessary for or incidental to the Company’s N400 billion Programme and the Directors are also authorised to appoint all such professional parties necessary for or incidental to, the actualisation of the Programme, including, without limitation, complying with the directives of any regulatory authority.

“To consider and if thought fit pass the following sub-joined resolutions as an ordinary resolution: 9.1 ‘That subject to receipt of any required regulatory approvals and pursuant to Clause Seven of the Company’s Memorandum of Association: a. The Directors be and are hereby authorised to raise additional equity capital of up to N150,000,000,000 (One Hundred and Fifty Billion Naira) by way of a Rights Issue or offer for subscription on such terms, tranches, conditions and dates as may be determined by the Directors.

“In the event of an under-subscription to any Rights Issue or Offer for Subscription, the Directors are authorised to offer the unsubscribed shares first to interested existing shareholders; and where following such offer, any portion of the shares, remain unsubscribed, then the Directors are hereby authorised to offer such unsubscribed shares that may be outstanding, to interested investors on similar terms to the Rights Issue or Offer for subscription.

“Other resolutions to be passed: At the upcoming AGM, the shareholders will also have the opportunity to consider and pass the following special resolutions:

“That in accordance with Article Six of the Company’s Articles of Association, the Board of Directors (‘the Board’) be and unconditionally authorised to exercise the power conferred on them by Article Six of the Company’s Articles of Association as may from time to time be varied so that, to the extent and in the manner determined by the Directors, the holders of ordinary shares in the Company may be permitted to elect to receive new ordinary shares in the Company, credited as fully paid, instead of the whole or any part of any cash dividends (including interim dividends) paid by the Directors or declared by the Company in general meeting (as the case may be) from the date this resolution is passed until the earlier of five years from the date of the passing of this resolution and the date on which the annual general meeting of the Company to be held in 2029 occurs.

“Directors be and are hereby authorised to issue such new Ordinary Shares and/or make such allotments of shares or approve any allotment proposals as may be deemed necessary and expedient to give effect to the above resolution, subject to obtaining the approvals of the relevant regulatory authorities.

“That Directors be authorised to enter into any agreement and/or execute any document necessary to give effect to the above resolutions;

“That Directors be and are hereby authorised to appoint such professional parties and advisers and to perform all such other acts and do all such other things as may be necessary to give effect to the above resolutions, including without limitation, complying with the directives of any regulatory authority.

“That following the completion of the additional equity capital raise as contemplated in Clause 9 above, the Issued and Paid Up Share Capital of the Company be increased from N6,478,498,581.50 (six billion, four hundred and seventy eight million, four hundred and ninety eight thousand, five hundred and eighty one Naira, fifty kobo) divided into 12,956,997,163 ordinary shares of 50 Kobo each to a maximum of up to N8,250,000,000.00 (Eight billion, two hundred and fifty million Naira) by the creation of up to 3,543,002,837 (Three Billion, five hundred and forty three million, two thousand eight hundred and thirty seven) Ordinary shares of 50 Kobo each; such new shares to rank pari passu in all respects with the existing ordinary shares in the capital of the Company, among others.”

Money market

FirstBank garners top honours at 2024 Global Finance Awards

First Bank of Nigeria Ltd. has won ‘Best Private Bank in Nigeria’ and ‘Best Private Bank for Sustainable Investment in Africa’ at the 2024 Global Finance annual awards.

This was disclosed in a statement on Wednesday by Group Head, Marketing and Corporate Communications, First Bank of Nigeria Ltd, Folake Ani-Mumuney.

Ani-Mumuney said the ninth annual World’s Best Private Banks Awards for 2024 held at the Harvard Club of New York on March 21.

Receiving the awards, Idowu Thompson, Group Executive, Private Banking and Wealth Management, FirstBank, said the institution was honoured for being Best Private Bank in Nigeria and Best Private Bank for Sustainable Investment in Africa.

Thompson said both awards revealed FirstBank’s enduring commitment to continuously creating value by strengthening financial awareness and driving inclusiveness in “customers journeys from wealth creation, growth, preservation and its orderly transfer”.

“We are delighted with the impact we have made in putting our customers first as this has played a very vital role in enabling their successes and contributing to national development.

“These awards are dedicated to our esteemed customers. We reaffirm our continued dedication to continuing to improve and delivering excellence in banking,” he said.

Founder and Editorial Director of Global Finance, Joseph Giarraputo, praised FirstBank’s experience and excellence.

“Private banking is an art as well as a science in which knowledge of economic and financial trends are paired with a deep understanding of client needs.

“Global Finance’s Private Bank Awards highlight institutions that deliver both,” he said.

He said that Global Finance Private Bank Awards honoured financial institutions that best served the specialised needs of high-net-worth individuals as they seek to enhance, preserve, and pass on their wealth.

Previous awards won by FirstBank include: Best CSR Bank in Nigeria 2024 by Global Banking and Finance; Most Innovative Digital Bank, 2024- Nigeria by Digital Banker Africa.

Others are the Most Innovative Banking Brand in Nigeria 2023 by Global Brands Awards; Financial Institution of the Year 2023 by Afrexim Bank; and Best Corporate Bank in Nigeria 2023 by Euromoney Awards for Excellence.

The FirstBank Private Banking business model was revamped in January 2023 on the back of a stellar performance in 2022.

This was to consolidate its position and maintain its pride of place as the leading Private Bank in Nigeria with distinct product offerings covering investment advisory, wealth management, asset management and lifestyle solutions.

The bank has remained consistent in reinventing itself, enabling success through the years of its existence for the last 130 years, responding to diverse changes and seizing global opportunities.

Amidst a rapidly evolving global landscape, First Bank of Nigeria Ltd. has demonstrated exceptional leadership in integrating sustainable practices into its banking operations.

Money market

Oyebanji hails Alebiosu’s appointment as acting MD/CEO First Bank

Gov. Biodun Oyebanji has congratulated Mr Olusegun Alebiosu on his elevation as the Acting Managing Director/ CEO of First Bank Plc by the bank’s board.

Alebiosu, who was until the appointment, the Executive Director, Chief Risk Officer and Executive Compliance Officer of the Bank, takes over from Dr Adesola Adeduntan.

Oyebanji, in a statement by his Special Adviser on Media, Mr Yinka Oyebode, congratulated Alebiosu, describing the new position as a befitting cap to his illustrious career and meritorious service to the financial institution.

The governor described the Omuo-Ekiti born banker as a thoroughbred professional who rose to the peak of his career through hard work and commitment to excellence and innovation.

Oyebanji said he was convinced that the new Acting Managing Director possesses the track record, experience and expertise to successfully drive the bank’s development agenda.

In wishing Alebiosu a successful tenure, Governor Oyebanji prayed that God would grant him wisdom and speed needed to take the bank to a new level of greatness.

“I convey the best wishes of the Government and good people of Ekiti State to one of our stars, Mr Olusegun Alebiosu on his appointment as the Acting managing Director of First Bank plc.

“This, no doubt, is a recognition of his capacity and competence.

“We wish him a successful tenure that would be characterised by irreversible progress for the bank,” he said.

-

Finance3 months ago

Court orders Sen. Victor Umeh to repay N136m bank debt to AMCON

-

Abuja Update2 months ago

Abuja Update2 months agoUNDP, FG partnership needed to achieve inclusion, equity- Minister

-

Abuja Update1 month ago

Banks drive stock market performance with N147bn gain

-

Infotech4 weeks ago

Infotech4 weeks agoWorld Backup Day: NITDA urges Nigerians to ensure backup of data

-

capital market2 years ago

Rt.briscoe, FBNH, Others halts negative performance of stock market

-

Health3 weeks ago

Health3 weeks agoImmunisation: FG, GAVI seek synergy with Sokoto Govt.

-

Health1 week ago

Health1 week agoCapacity training will reduce migration of health workers- NPHCDA

-

Infotech2 weeks ago

Forex for Beginners: Unveiling the currency exchange and how to trade it