Top Story

NCDMB earns $1m from investment in NEDOGAS

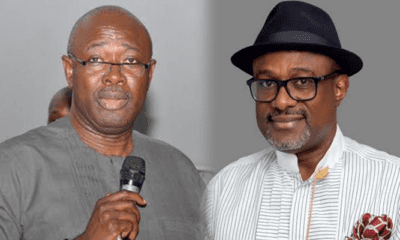

The Nigerian Content Development and Monitoring Board (NCDMB) on Monday received a cheque of $1 million from Nedogas Development Company Limited (NDCL), being part of the return on investment (ROI) on one of the Board’s strategic investments.

The cheque was presented by the Chairman of the company, Engr. Emeka Ene when he visited the Nigerian Content Tower in Yenagoa Bayelsa State, where he was received by the Executive Secretary, Engr. Felix Omatsola Ogbe and other members of the Board’s management.

Nedogas Development Company Limited (NDCL) is a joint venture company between Xenergi Limited and NCDMB Capacity Development Intervention Company.

As part of the project, Nedogas Development Company Limited (NDCL) constructed and commissioned a 300 MMscfd Capacity Kwale Gas Gathering (KGG) and injection facility located in the Umusam Community, near Kwale in Delta State, Niger Delta, Nigeria.

The KGG Facility was designed to handle stranded gas resources in Nigeria’s OML56 oil province by providing the opportunity for independent operators in the area to monetise natural gas from their fields through the gas gathering, compression, injection and metering infrastructure of the KGG for quick market access.

Nedogas is one of the several strategic and successful investments of the NCDMB funded from the Nigerian Content Development Fund (NCDF), in line with the Board’s mandate to build capacity and catalyze local projects in the Nigerian oil and gas industry as enshrined under the Nigerian Oil and Gas Industry Content Development (NOGICD) Act.

In his comments, the NCDMB boss stated that the success story of NEDOGAS at Kwale, Delta State could be replicated in other oil- and gas-producing communities to minimise gas flaring.

He declared the Board’s readiness to continue collaborating with the company.

“Their model should be extended to other parts of the country where gas flaring is continuing. They have shown that with the modular system, we can quickly remove flaring from our operations in Nigeria.”

He confirmed that NCDMB had continued to receive briefings from its investment partners, adding that “we are still waiting for them to come back with success stories. Some of them are near completion and have not started operations yet.”

Chairman of NEDOGAS, Mr. Emeka Ene, conveyed the company’s excitement in returning part of the credit and profit, adding that this “proves that NCDMB’s investment was a success and they are getting back that investment.”

He added that “we look forward to further collaboration with the NCDMB to expand the scope,” adding that “NCDMB is now doing effectively and practically and tangibly what it was set up to, which is to impact the economy by direct interventions. That is the way the economy can grow, improve the gas infrastructure in such a way that is sustainable despite the tight economic conditions.”

The value propositions of the NEDOGAS project include total eradication of flared gas and conversion of environmental pollutants into products of value and creation of a strategic gas gathering hub and injection node for quick access to market for gas owners to monetise gas. Other benefits include the provision of alternative gas supply to western flank of the OB3 line to add to the volumes of economic sustainability and increase in Nigeria’s Gross Domestic Product (GDP), among other reasons.

The partnership with NEDOGAS is one of NCDMB’s 15 strategic investments geared towards actualising the Federal Government’s aspirations in key areas of the oil and gas industry. Most of the projects were targeted at actualizing the Federal Government Decade of Gas programme.

Some of NCDMB’s notable third-party investments include Waltermith’s 5000 barrels per day (bpd) modular refinery in Imo State, Azikel Group 12,000 bpd hydro-skimming modular refinery in Gbarain, Bayelsa State and Duport Midstream’s 2,500bpd modular refinery in Edo State.

Other investments include Better Gas Energy for LPG terminal and gas distribution, partnership with Rungas Prime Industries Limited to establish a cooking gas cylinders manufacturing plant in Polaku, Bayelsa State and Alaro City in Lagos and the partnership with Butane Energy to deepen LPG utilisation in the North.

There was also the partnership with BUNORR Integrated Energy Limited in Port Harcourt, Rivers State to produce 48,000 litres of base oil per day and partnership with the Nigerian National Petroleum Corporation (NNPC) Limited, Brass Fertilizer and Petrochemical Company Limited and DSV Engineering to establish a 10,000 Ton Methanol Production Plant, Odioama, Brass, Bayelsa State.

Top Story

Black market resurfaces, as Lagos, Ogun commuters beg for relief as PMS supply worsens

…Product sells above N900/ltr

By Sodiq Adelakun

Lagos commuters faced a difficult Monday as the lingering petrol scarcity continued to bite, leaving many stranded at bus stops across the city.

The crisis deepened as motorists scrambled to fill-up at dispensing stations, leading to a hike in fares.

With many filling stations shut and others selling the scarce commodity at exorbitant prices, tricycles and buses – the lifeline for daily commutes – were scarce, struggling to access fuel.

Some motorists revealed to NewsDirect that they purchased petrol at N900 and N1,000 per litre at filling stations, while roadside dealers sold the product for as high as N1,200 and N1,300 per litre.

The situation worsened as many filling stations stopped selling fuel altogether, exacerbating the woes of commuters who were forced to pay inflated fares or trek long distances to their destinations.

In most of the bus stops visited by NewsDirect on Monday, survival of the fittest was the prevailing philosophy as hordes of commuters were seen running after a few commercial buses.

However, chaos erupted at bus stops across Lagos on Monday as observed by our correspondent when desperate commuters scrambled to secure a spot on the few available commercial buses.

The transportation system has been thrown into disarray, leaving many wondering when the situation will improve.

Recall the crisis began after President Bola Tinubu announced the end of the petrol subsidy regime on May 29, 2023, aiming to allow market forces to determine pump prices, boost government revenue, and reduce disruptions in the value chain.

However, the move has triggered severe petrol scarcity, leading to a hike in fares across Lagos.

Commuters are feeling the pinch, with fares skyrocketing by as much as 50 percent.

For example, the journey from Kola roundabout to Agege, which previously cost N400 or N300, now costs N800. Similarly, the trip from Agege to Alausa in Ikeja has increased from N300 to N400.

According to one of the commuters, Temitope, he said, “Oh my goodness, I can totally relate to this! I was at the bus stop yesterday and it was like a war zone! People were pushing and shoving, trying to get on the few buses available.

“I was lucky to get on one, but I had to pay N800 for a journey that normally costs N400! It’s like they’re taking advantage of our desperation. And to think it’s all because of the petrol scarcity caused by the removal of the subsidy.

“I understand the government’s intention, but they should have had a better plan in place to mitigate the effects on commuters like us. This is really tough, and I hope they find a solution soon!”

Also, a female marketer, Promise, has lamented the devastating impact of the ongoing petrol scarcity on her business, echoing the plight of many others in the sector.

She said, “This petrol scarcity is affecting my business so much! I sell perishable goods at the market, and I need to transport them daily from one place to another.

“But with this scarcity, the few buses available are hiking their fares and it’s eating into my profit. I used to pay N400 or N300 from Kola roundabout to Agege, but now they’re asking for N800! And from Agege to Alausa, it’s now N400 instead of N300.

“How am I supposed to make a living like this? The government should do something to help us, we’re suffering! I’m a widow with three children to feed, and this is really affecting my family. Please, something needs to be done urgently!”

Top Story

Obaseki approves new minimum wage of N70,000 for Edo workers

…Urges FG to follow suit

By Elvis Omoregie, Benin

The Edo State governor, Mr. Godwin Obaseki has announced a 90 percent increase in workers salary, instead of N40,000 the least worker in the state will now go home with N70,000 as a result of the increment effective May 1.

He disclosed this on Monday during the Commissioning of the newly built Labour House, an edifice that would house the Nigeria Labour Congress (NLC) and Trade Union Congress (TUC) secretariat in Edo State

The Governor said workers have continued to be challenged due to devaluation and inflation which, according to him, has made the workers wages insignificant.

Obaseki also urged the Federal government to increase workers salaries more than what his administration was offering and vowed to also adjust the State workforce wage.

According to him, “I am one of those governors advocating that we must adjust the minimum wage of workers in Nigeria.”

Obaseki also put aside partisan politics and named the edifice after his predecessor, Senator Adams Oshiomhole.

The Governor was joined in the exercise by Comrade Joe Ajero and Festus Uwaifo, National presidents of Nigeria Labour Congress (NLC) and Trade Union Congress (TUC) respectively.

Top Story

Naira appreciates by 5.93% on parallel market

The Naira on Monday gained 5.93 percent on the parallel market, popularly called the black market.

The local currency exchanged with the US dollar at the rate of N1,350 on Monday, as against N1,430 exchanged on Friday on the black market.

According to currency traders, the naira appreciation followed a moderation in the demand for the greenback, which was scarce on Friday due to scarcity of dollars.

At the Nigerian Autonomous Foreign Exchange Market (NAFEM), the naira depreciated by 2.24 percent as the dollar was quoted at N1,339.23 on Friday compared to N1,309.88/$1 quoted on Thursday last week, according the data released by the FMDQ Securities Exchange.

The intraday high closed at N1,410 per dollar on Friday, stronger than N1,435 closed on Thursday. The intraday low also appreciated to N1,051 per dollar on Friday, from the low of N1,100/$1 quoted on the spot trading on Thursday.

Dollar supplied by the willing buyers and willing sellers declined marginally by 2.85 percent to $309.01 million on Friday from $318.08 million recorded on Thursday.

-

capital market2 years ago

Rt.briscoe, FBNH, Others halts negative performance of stock market

-

Finance3 months ago

Court orders Sen. Victor Umeh to repay N136m bank debt to AMCON

-

Abuja Update2 months ago

Abuja Update2 months agoUNDP, FG partnership needed to achieve inclusion, equity- Minister

-

Abuja Update1 month ago

Banks drive stock market performance with N147bn gain

-

Business1 week ago

Business1 week agoTingo Group unveils Tingo Electric, Tingo Cola drink at Lagos launch

-

Health2 weeks ago

Health2 weeks agoCapacity training will reduce migration of health workers- NPHCDA

-

Infotech4 weeks ago

Infotech4 weeks agoWorld Backup Day: NITDA urges Nigerians to ensure backup of data

-

News4 months ago

Oil thieves sponsoring malicious media campaign against Navy – Spokesman