Top Story

Nigeria@63: 63 indigenous companies and agencies powering Nigeria’s economic growth (Pt.1)

As Nigeria marks her 63rd anniversary of gaining independence, Nigerian NewsDirect, Daily National Newspaper and “Local Content Newspaper of the Year (2020)” has choosen to mark the anniversary with a special report to spotlight on indigenous companies and agencies that have hugely contributed to the human capital and economic growth of the country even as the nation looks inward for solutions to experience progress.

Nigerian Content Development and Monitoring Board (NCDMB) – Championing local content development and capacity building

The Nigerian Content Development and Monitoring Board (NCDMB) was established in 2010 by the Nigerian Oil and Gas Industry Content Development (NOGICD) Act. NCDMB is vested with the mandate to make procedures that will guide, monitor, coordinate and implement the provisions of the NOGICD Act signed into law on April 22, 2010.

When the Local Content law came into being, the industry was just at about five per cent in terms of growing local content in the country and today, the NCDMB prides itself to have increased the figure of local content to about 47 per cent.

Under the leadedship of Engr Simbi Wabote, the NCDMB through its flagship programme, NOGOF raised the percentage of local content to 50 percent in the multi-billion dollar NLNG train 7 project thereby creating 12,000 jobs directly and indirectly and also engendering peace in the Niger Delta region.

Furthermore, the NCDMB in deepening local content invested and partnershed towards the completion of Waltermith’s 5,000 barrels per day (bpd) modular refinery in Imo State, Azikel Group12,000 bpd hydro-skimming modular refinery in Polaku, Bayelsa State; Atlantic International Refinery’s 2,000 barrels plant in Brass, Bayelsa State; and Duport Midstream’s 2,500bpd modular refinery in Edo State. These investments created over 3,000 jobs in the refining value chain and ensured value addition to Nigeria’s crude oil. It also grew Nigeria’s domestic refining capacity, created jobs in-country and curbed pipeline vandalism.

For its giant strides, NCDMB was adjudged the best among all Ministries, Departments and Agencies in the country in the Executive Order (EO1) performance ranking for Ease of Doing Business from January to June 2022 – a report compiled by the Presidential Enabling Business Environment Council (PEBEC), under the office of the Vice President.

By boosting the manpower and technological capacity of Nigerians and Nigerian-owned businesses in the sector, NCDMB has aided in powering Nigeria’s economy growth and rewriting the fortunes of Nigeria’s oil and gas sector from well-known negatives to self-reliance and progress.

Century Energy Group —Promoting energy security and crude oil Commercialisation

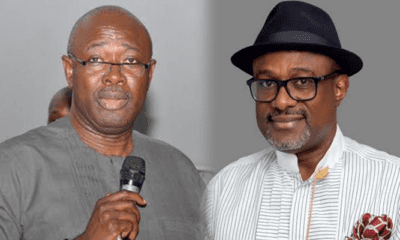

Founded by Ken Etete, Century Energy Group is an investment de-risking firm focused on the delivery of bespoke operations and asset development solutions, adaptive technology in the energy mix and supply.

Since 2002, Century Enegy has indirectly participated in about 50 valuable and impactful energy projects worth over US$ 10 Billion, Oil installations, equipment, and other assets estimated at over $ 1 Billion and a cumulative contribution to a daily production of over 200,000 bpd.

The organisation has been able to achieve this daring feats being the first domestic energy infrastructure provider to fully own & manage two FPSOs (Tamara Tokoni and Tamara Nanaye). Presently, Century Energy has within its operational portfolio three Floating Production Storage Offloading Units (FPSOs), four flow-stations, one MOPU, and one FSO which it operates on behalf of various clients in Nigeria.

In April 2023, Century Energy Group partnered with Energy Link Infrastructure (Malta) Limited (ELI) for the completion, operations and maintenance of the ELI AKASO floating storage and offloading (FSO) terminal in Oil Mining Lease (OML) 18.

ELI’s ACOES infrastructure comprises a new 47km secure undersea pipeline from OML 18 and the FSO ELI AKASO terminal. This ACOES infrastructure will enhance crude oil commercialisation primarily through the reduction of downtime and crude losses associated with the existing export routes. The pipeline component is expected to have a throughput capability of 100,000 barrels per day (b/d) of oil, while the FSO ELI AKASO has a storage capacity of 2 million barrels of oil.

CG also acquired a floating production, storage, and offloading vessel from BW Offshore for $15m.

The vessel, named Sendje Berge, according to Upstream, was purchased as part of Century’s strategy to focus on long-lived, higher-return projects by offloading non-core vessels. Built in 1974, it has a carrying capacity of 274,333 DWT and a reported draught of 13.7 metres. The vessel has an overall length of 348.77 meters and a width of 51.87 meters.

Century Group continues to develop its capacity and skilled competencies to boost Nigeria’s crude oil commercialisation thereby generating foreign exchange for the nation.

Zenith Bank Plc – Deepening access to financial services with creative and cutting edge banking solutions

Zenith Bank Plc has in 33 years grown to become one of the strongest and most profitable banks in Nigeria as well as in the entire Africa.

The financial institution which was founded in May 1990 by Jim Ovia and commenced operations in July of same year with N20 million has continued to contribute significantly to Nigeria’s financial services sector. The Bank became one of the latest companies to join the exclusive group of stocks worth over one trillion, as its market capitalisation on the Nigerian Exchange (NGX) crossed the N1 trillion mark in the third week of June 2023.

The Bank reputes itself as the leading lender in Nigeria having explored business opportunities in strategic sectors to bring the much needed development to boost Nigeria’s economy.

Zenith Bank has also remained a clear leader in the Nigerian financial services industry, distinguishing itself through unique customer experience and sound financial indices.

The bank is also the pioneer in the digital space with several firsts in deploying innovative products and solutions that ensure convenience, speed and safety of transactions.

When Zenith Bank first opened its doors in 1990, there were no automated teller machines (ATMs) in Nigeria, no debit or credit cards, and no digital networks. In 1995, the need to integrate digital technologies in the business led Mr. Jim Ovia to establish Cyberspace, a network and ICT-service company.

The Bank also pioneered the integration and launch of Unstructured Supplementary Service Data (USSD) payments on Point of Sales (USSD on POS), enabling customers to pay for goods and services via POS terminals in merchant locations or on ecommerce websites without the use of cards.

In recognition of its track record of excellent performances under the current Managing Director, Ebenezer Onyeagwu, Zenith Bank had been recognised as the Number One Bank in Nigeria by Tier-1 Capital, for the 13th consecutive year, in the 2022 Top 1000 World Banks Ranking published by The Banker Magazine; Bank of the Year (Nigeria) in The Banker’s Bank of the Year Awards 2020 and 2022; Best Bank in Nigeria, for three consecutive years from 2020 to 2022, in the Global Finance World’s Best Banks Awards; Best Commercial Bank, Nigeria 2021 and 2022 in the World Finance Banking Awards; Best Corporate Governance Bank, Nigeria in the World Finance Corporate Governance Awards 2022; Best in Corporate Governance’ Financial Services’ Africa, for three consecutive years from 2020 to 2022, by the Ethical Boardroom; Best Commercial Bank, Nigeria and Best Innovation In Retail Banking, Nigeria in the International Banker 2022 Banking Awards.

Little wonder, Zenith Bank delivered its financial results for the first quarter (Q1) ending March 31, 2023—including a phenomenal 41-percent growth in gross earnings to ¦ 270 billion from Q1 2022.

With a team of dedicated professionals, the bank powers Nigeria’s economic growth through the deploymemt of robust Information and Communication Technology (ICT) infrastructure to deepen financial inclusion and promote sustainable banking through its network of branches and electronic/digital channels.

Galaxy Backbone Ltd — Leading digital transformation and cost savings in Nigeria’s public sector

Galaxy Backbone Limited is an Information and Communications Technology Services provider, wholly owned by the Federal Government of Nigeria. Galaxy Backbone continues to operate, improve and upgrade its common services platform to meet international standards. The agency offers cloud services, telepresence services, Internet connectivity services, data hosting in its Tier IV data center, amongst a host of others.

Nigeria has indeed begun to take digitalisation as a priority having made giant strides and bold steps to enhance digital transformation with Galaxy Backbone (GBB) Limited leading the forefront as the Backbone of Nigeria’s digital transformation.

One of such infrastructures deployed by GBB promoting digital transformation is the National Shared Service Centre (Now Muhammadu Buhari Galaxy Backbone Headquarters). The National Shared Service is housed in a seven-story twin building which sits beautifully at Central Business District area of the nation’s Federal Capital Territory. The National Shared Service Centre is helping to reduce the cost of governance by serving as a common platform for sharing data across ministries, departments and agencies (MDAs). It is also driving the digital transformation of the public sector by deploying world class tech equipment across MDAs to facilitate effectiveness in the fulfillment of various government functions.

Prior to the creation of Galaxy Backbone (GBB), technology had little or no impact on the operations ministries, departments and agencies (MDAs) but with the innovations and infrastructure of GBB, cost has been optimised and greater efficiency has been recorded. So far, 60 percent of MDAs have gotten on board the GBB infrastructure, over 40,000 email boxes and thousands of IP and video telephony devices distrubuted to MDAs across the country.

During the peak of the COVID pandemic in Nigeria, GBB installed over 150 Unified Communication devices, from Video Conferencing terminals to Video Phones in offices and residences of top government officials to ensure smooth government operations during the pandemic. Prof. Muhammad Abubakar noted that these services have enabled the executive officers of the Government to communicate amongst themselves without breaching COVID protocols. As of 2021, Professor Abubakar disclosed that the agency saved the Federal Government over N3bn from video conferencing.

Top Story

Account enrollment: Court validates CBN’s regulation, permits collection of customers’ social media handles

…Dismisses concerns, says social media handles not protected by privacy rights

…Financial institutions cleared to collect social media handles for KYC

By Sodiq Adelakun

The Federal High Court in Lagos has ruled in favour of the Central Bank of Nigeria (CBN) in a case challenging the regulation that requires financial institutions to collect their customers’ social media handles as part of the Know-Your-Customer (KYC) procedure.

Recall that the Socio-Economic Rights and Accountability Project (SERAP) had urged the court to compel CBN to withdraw its directive to banks and other financial institutions.

However, in the ruling, Justice Nnamdi Dimgba struck out the suit filed by Lagos-based lawyer, Chris Eke, who argued that the regulation violates the right to privacy of bank customers.

Eke had sought a declaration that the regulation contained in Section 6(a) (iv) of the Central Bank of Nigeria (Customer Due Diligence) Regulations, 2023, is undemocratic, unconstitutional, null, and void, as it contradicts Section 37 of the 1999 Constitution of the Federal Republic of Nigeria (as amended). However, Justice Dimgba ruled that the regulation does not breach the right to privacy of bank customers.

The CBN regulation is targeted to enhance customer due diligence and anti-money laundering measures, and requires banks to collect social media handles, among other personal information, from their customers.

The applicant had asked the court to grant an order of perpetual injunction, restraining CB from enforcing the regulation which requires financial institutions to request customers’ social media handles as part of normal bank customer due diligence requirements.

The CBN in its response to the suit, filed a notice of preliminary objection, challenging the competence of the suit. The apex bank also disagreed that the said regulation constitutes any interference with the private life of the applicant, as claimed.

The judgment came as Justice Dimgba dismissed a suit, stating that the notice of preliminary objection held merit and consequently struck out the case.

During the proceedings, Justice Dimgba emphasised that providing a social media handle is akin to furnishing email addresses, phone numbers, and other contact details for banking purposes.

He argued that such information aids in conducting due diligence to ascertain if an individual is suitable for conducting business with a bank.

Justice Dimgba further explained that the essence of having a social media account implies a willingness to engage in public communication, thus rendering privacy concerns unfounded.

According to him, “First, the Applicant claims that the requirements on the CBN Regulations for financial institutions to request and collect the social media handle of its customers as part of KYC infringes on his right to privacy.”

“This claim is very ambitious and amounts to a very far throw. The said Regulations are directed to and apply to financial institutions. It does not apply to private individuals such as the Applicant.

“Even if, as appears to be argued, that the Regulations itself would inevitably affect the Applicant, this claim is speculative for the simple reason that in nowhere in the affidavit in support was it stated that the Applicant operates an account with a financial institution and that the said institution had demanded his social media handle. So the suggestion that he would be affected by this Regulation, albeit negatively, is very speculative and at large.

“Secondly, there is also no deposition to the effect that any financial institution had begun to implement this Regulation and that its implementation had begun to create disruptions and inconvenience against the general population, in which case one could infer that the suit should be legitimated as a public interest litigation.

“Thirdly, assuming even that the banks had begun to implement these regulations, the applicant assuming he maintained any bank accounts or sought to open one, but is being hindered or irritated by the requirement of the Regulation to avail his social media handle as part of KYC, the Applicant still had a choice, which is to refuse to do business with any bank insisting on the information as part of its social media handle, but to seek other alternatives.

“Fourthly, and for all it is worth, I do not see how asking a banking or potential banking customer to provide his social media handle can ever amount to a breach of privacy.

“Granted that Section 37 of the Constitution of the Federal Republic of Nigeria 1999 (as amended) provides inter alia: The privacy of citizens, their homes, correspondence, telephone conversations and telegraphic communications is hereby guaranteed and protected.

“My view is that the provision of a social media handle is of the same genre as the provision of email address, phone numbers and other means by which a potential customer of a bank can be contacted.

“Thus, it is clear from the face of the Regulations as set out above that email addresses, phone numbers and social media handles are all provided for under clause 6iv just to show that the aim was not to pry on anyone but rather to provide alternative ways by which a customer of the bank can be contacted, and or due diligence conducted on the person to determine if the person is a fit and proper person to extend banking services to.

“I do not see how this infringes on the right to privacy. I should even say that the essence of having a social media account was for one to be publicly visible communication-wise. It, therefore, appears quite ironic, though wryly, that one can suggest that asking for information about a social media handle with which the individual exposes and immerses himself or herself in the public, can amount to a violation of privacy rights, which rights itself is all about isolation of one from public glare.

“It is also to my knowledge that even in filling some business applications, personal information of this sort, is sometimes requested, and parties generally oblige. If it does not constitute a breach of privacy, why should it now?

“A social media handle is left at large for the world to see, being in the public space, everyone enjoys the liberty to have access to it whether or not consent was obtained. It would be highly unreasonable to hold the Respondent in breach of privacy for what other persons have access to.

“The apprehension of the Applicant of his social interactions being monitored is manifestly speculative in itself and rather incredulous to believe that the financial institutions have the luxury of time to concern itself with such frivolities.

“On the whole, if I did not sustain the NPO, I would have dismissed the suit for the reasons stated. But the NPO having been sustained, the suit is therefore hereby struck out.”

Top Story

N1.3trn power debt: Tinubu approves payment, unveils plan to liquidate gas debts

President Bola Ahmed Tinubu has given approval for the payment of N1.3trn legacy debts owed power generation companies.

Minister of Power, Chief Adebayo Adelabu speaking at the 8th Africa Energy Market Place 2024 in Abuja said that President Bola Tinubu has approved a plan to liquidate the debts.

According to him, “Mr. President has approved the submission made by the Minister of State Petroleum (Gas) to defray the outstanding debts owed to the gas supply companies to power generation companies. The payments are in two parts, the legacy debts and the current debts. For the current debt, approval has been given to pay about N130 billion from the gas stabilisation fund which the Federal Ministry of Finance will pay.”

“The payment of the legacy debt will be made from future royalties in exchange for incomes in the gas subsector which is quite satisfactory to the gas suppliers. This will allow the companies to enter into firm contracts with power generation companies.

“For the power generation companies, the debt is about N1.3 trillion and I can also tell you that we have the consent of the President to pay, on the condition that the actual figures are reconciled between the government and the companies. This we have successfully done and it is being signed off by both parties now. Majority has signed off and we are engaging to ensure that we have 100 percent sign off.

“The debt will be paid in two ways, immediate cash injection and through a guaranteed debt instrument, preferably a promissory note. This assures the companies that in the next three to five years, the government is ready to defray these debts.”

The Minister further stated that the government was working to get the distribution companies solvent and effective by unbundling their operations along state boundaries.

He insisted that the areas covered by the current DisCos were too large for them to deliver effective services to consumers.

In the same vein, the Chairman of the Nigerian Electricity Regulatory Commission (NERC), Engr. Sanusi Garba lamented the poor financial state of the DisCos, noting that it is difficult for them to raise the needed capital to invest.

Engr. Garba pointed out that the challenges facing the sector were a culmination of all past inactions and missteps by those saddled with the responsibilities of managing the sector both at policy and operational levels.

According to him, “Today when you look at distribution companies they are clearly and technically insolvent, and you also want them to raise capital in terms of debt or equity. It’s a Herculean task. I also want to mention that implementing the power sector reform requires very strong political will to implement decisions that impact on the wider public.”

However, the African Development Bank (AfDB) disclosed that it has so far spent over $450 million to support various power sector projects and programmes with another $1 billion planned to support the power sector reform effort by the government.

Top Story

Emirates Airline to resume Lagos-Dubai flights October 1

Emirates Airline has disclosed that it will resume services to Nigeria from October 1, 2024, operating a daily service between Lagos and Dubai.

This development was announced in a statement on Thursday by the airline, which has its hub in the United Arab Emirates (UAE).

The airline disclosed that flight services will be operated using a Boeing 777-300ER.

“We are excited to resume our services to Nigeria. The Lagos-Dubai service has traditionally been popular with customers in Nigeria and we hope to reconnect leisure and business travellers to Dubai and onwards to our network of over 140 destinations.

“We thank the Nigerian government for their partnership and support in re-establishing this route and we look forward to welcoming passengers back onboard,” Emirates’ Deputy President and Chief Commercial Officer, Adnan Kazim, said.

Recall that Emirates Airlines had suspended its Dubai-Lagos flights in 2022 over its inability to repatriate trapped funds in Nigeria in the heat of the diplomatic row between the two countries.

This comes after Festus Keyamo, Minister Of Aviation And Aerospace Development in a post on his X (formerly Twitter) page had disclosed that he got correspondence from Emirates Airline when he visited Salem Saeed Al-Shamsi, ambassador of the United Arab Emirates (UAE) in Abuja.

”Yesterday, I paid a working visit to the Ambassador of the UAE to Nigeria, His Excellency, Salem Saeed Al-Shamsi at the UAE Embassy in Abuja. He handed me a correspondence from the Emirates Airline indicating a definite date for their resumption of flights to Nigeria,” Keyamo said.

-

Finance4 months ago

Court orders Sen. Victor Umeh to repay N136m bank debt to AMCON

-

Abuja Update3 months ago

Abuja Update3 months agoUNDP, FG partnership needed to achieve inclusion, equity- Minister

-

capital market2 years ago

Rt.briscoe, FBNH, Others halts negative performance of stock market

-

Abuja Update2 months ago

Banks drive stock market performance with N147bn gain

-

Health1 month ago

Health1 month agoCapacity training will reduce migration of health workers- NPHCDA

-

Submission Guidelines4 months ago

CALL FOR SUBMISSIONS: POETRY COLUMN-NND

-

Business4 weeks ago

Business4 weeks agoTingo Group unveils Tingo Electric, Tingo Cola drink at Lagos launch

-

News4 months ago

Oil thieves sponsoring malicious media campaign against Navy – Spokesman