Top Story

CBN warns against excessive borrowing practices in W’Africa

By Sodiq Adelakun

The Central Bank of Nigeria has issued a cautionary statement to Nigeria and other West African nations regarding their borrowing practices.

Traditionally, countries in the region have relied on loans from the Paris Club, a group of creditor nations. However, the CBN has noted a significant shift towards borrowing from non-Paris Club members and private lenders, such as banks and investors purchasing government bonds.

The West African Institute for Financial and Economic Management has raised concerns about Nigeria’s increasing risk of falling into debt distress and has urged the federal government to focus on enhancing revenue generation.

During the Joint World Bank/IMF/WAIFEM Regional Training on Medium Term Debt Management Strategy in Abuja, CBN Governor Yemi Cardoso, represented by Dr Mohammed Musa Tumala, Director of the Monetary Policy Department, highlighted the importance of this shift in borrowing patterns and its potential serious implications.

He argued that the way countries manage debt owed to the Paris Club may not be as effective for these new lenders.

Cardoso expressed concern that this new debt landscape could pose a threat to financial stability and economic recovery for many countries.

Cardoso said, “Public debt dynamics are increasingly influenced by significant debt servicing obligations to non-Paris Club members and private lenders, including commercial banks and bond investors.

“This shift in the debt structure represents a critical evolution in the global financial framework, with profound ramifications for public debt management in our countries.”

He also stated that recent events like the COVID-19 pandemic, geopolitical conflicts, and natural disasters have put a strain on many countries’ finances, making them more likely to seek loans from diverse sources.

However, these non-traditional lenders might come with stricter repayment terms and potentially higher risks compared to Paris Club loans.

“Following the COVID-19 pandemic, along with other developments such as geopolitical conflicts and natural disasters, the financial strain on our sub-region has escalated, posing a threat to their macroeconomic and financial stability and prospects for faster recovery,” he said.

Nigeria, despite being classified as having generally moderate debt risk, the CBN urged the federal government to remain cautious, particularly regarding potential liquidity risks. These risks, if not addressed effectively, could stem from weak revenue mobilisation, a persistent challenge hindering debt sustainability and economic stability.

The Central Bank of Nigeria (CBN) has stated that although Nigeria’s overall debt risk is considered moderate, the country must exercise caution regarding its ability to repay its loans, specifically in terms of liquidity risk.

This risk could pose a problem if the government fails to generate sufficient revenue in the future. According to Dr. Baba Yusuf Musa, the Director General of the West African Institute for Financial and Economic Management, Nigeria still has the capacity to borrow when compared to other countries, given its debt-to-GDP ratio of 37 percent.

However, the issue lies in the fact that Nigeria cannot use its GDP to repay debts; rather, it must rely on revenue generated to fulfill its debt obligations.

He added, “If you look at it from the revenue side Nigeria is at a high risk of debt distress in terms of our borrowing so what we need to do now is to step up our capacity to generate revenue, the more revenue we have, the less the ratio of debt to revenue we have.”

WAIFEM, he said, is “very much in support of what the federal government is doing because there is a window for the government to raise more revenue, all that the people need to do is to support the federal government diversify the sources of revenue and of course generate more sources of revenue, once we have this we don’t have debt problem but rather revenue problem.”

He added, “What the Medium Term Debt Strategy does is that it smoothens the debt service so that going forward when borrowing, you take into consideration the redemption profile that you have and the type of loans that you have in your existing portfolio and then it will enable you also to minimise the cost and risk the future loans will add to the debt portfolio.”

Top Story

Digital Economy: FG unveils SPV to improve internet penetration, GDP growth

…To build 3rd longest terrestrial fibre optic backbone in Africa

…Targets 1.5% GDP growth, 70% broadband penetration

By Blessing Emmanuel, Abuja

The Federal Government has unveiled the launch of a Special Purpose Vehicle (SPV) that will boost the country’s digitisation drive to increase the contribution of the digital economy to GDP growth.

Minister of Communications, Innovation and Digital Economy, Dr Bosun Tijani made this known on Tuesday.

Noting that it was an outcome of the Federal Executive Council meeting (FEC) presided over by President Bola Ahmed Tinubu, the minister said that the FEC also approved the establishment of the Nigeria Startup House in San Francisco.

He said the two projects would attract the attention of local tech ecosystem players and investors as key indicators of the government’s commitment to addressing the country’s connectivity and startup funding objectives.

He averred that the project, upon delivery, will become Africa’s 3rd longest terrestrial fibre optic backbone, after Egypt and South Africa.

According to him, “This extensive coverage will enable us to optimise the unique benefit of having eight submarine cables already landed in Nigeria and therefore drive uptake of the data capacity that the cables offer beyond the current usage level of 10 percent.”

“Building on our existing work with the Broadband Alliance, this increased connectivity will help plug the current non-consumption gap by connecting over 200,000 educational, healthcare, and social institutions across Nigeria, ensuring that a larger section of our society can enjoy the benefits of internet connectivity.”

The Minister also added that the SPV will support the delivery of an additional 90,000km of fibre optic cable to complement our existing connectivity infrastructure and deliver a stronger national backbone for universal access to the internet across Nigeria.

“Over the last few months, we have put in extensive groundwork to set up this SPV which will be modelled in governance and operations similarly to some of the best Public-Private Partnership setups in Nigeria, such as NIBSS and NLNG.

“Working with partners and stakeholders from the government and private sector, this SPV will build the additional fibre optic coverage required to take Nigeria’s connectivity backbone to a minimum of 125,000km, from the current coverage of about 35,000km. Upon delivery, this will become Africa’s 3rd longest terrestrial fibre optic backbone, after Egypt and South Africa.

“This extensive coverage will enable us to optimise the unique benefit of having 8 submarine cables already landed in Nigeria and therefore drive an uptake of the data capacity that the cables offer, beyond the current usage level of 10 percent,” He explained.

Enumerating some of the immediate benefits, Tijani said it will increase internet penetration in Nigeria to over 70 percent, reduce potentially the cost of access to the internet by over 60 percent, inclusion of at least 50 percent of the 33 million Nigerians currently excluded from access to the internet.

He also added that the SPV will aid in delivering up to 1.5 percent of GDP growth per capita raising GDP from $472.6 billion (2022) to $502 billion over the next 4 year.

The Minister also applauded the President’s directives compelling MDAs to procure Compressed Natural Gas (CNG) powered vehicles.

Tijani noted that the directive offers a number of opportunities in the value chain that, if properly harnessed by the tech startup ecosystem, will provide a boost to the economy.

Top Story

Removal of APC logo, Tinubu portrait from Aregbesola’s office fuels mixed reactions

By Jeleel Olawale

The removal of all paraphernalia of the All Progressives Congress (APC) from the campaign office of former Osun State Governor, Rauf Aregbesola has sent shivers across political gladiators in the state.

Political analysts anticipate the former Governor’s next move noting that this may be a sequence to many surprising events that may unfold in the build up to the Osun 2026 gubernatorial elections.

The campaign office which is domiciled inside the four-storey building at Ayinke Towers, rechristened Oranmiyan House is located along the Gbongan-Ibadan road in Osogbo, the state capital.

The highrise building served as Aregbesola’s campaign office and later the office of The Osun Progressives, TOP, before its dissolution in 2022.

The white-coloured building which hitherto wore the colours of APC and with several poles bearing flags of the party and the National flags adorning its frontage, has been given a distinctly new look.

This development is coming as preparations are being set in motion for the 2026 gubernatorial election in the state.

The insignia and identity of APC and the gigantic photos of Asiwaju Bola Ahmed Tinubu, former governor and later APC National Chairman, Bisi Akande and the ex-President Muhammadu Buhari which formerly adorned the building have been removed.

It was observed that they have been replaced with equally large size images of the late sage, Chief Obafemi Awolowo, the late Chief Bola Ige and with the former Minister of Interior, Raid Aregbesola’s picture inserted in the middle.

Also, the huge inscription of the APC logo has finally been replaced with that of the Omoluabi Progressive Caucus.

It was gathered that the same remodelling was carried out at Aregbesola’s campaign office in his Ilesa hometown.

Reacting to the development, a member of the Omoluabi Progressive Caucus in Ilesa, Kazeem Olanrewaju said, they are trying to return to the progressive ideas that led to the creation of the APC.

Olanrewaju posited that, “Tinubu and Akande have both derailed from the progressive ideas, saying the progressive politics which started with Awolowo and Bola Ige, is not about power, but about about impacting lives.”

He condemned Tinubu’s government for having “no achievement in a year of running Nigeria. What is progressive about running Nigeria for a year without achievement.”

Olanrewaju, however, assured that the APC logos and banners would be brought back later.

In his words: “We will bring back banners later.”

Aregbesola fell out with Tinubu following his outburst against the president in January 2022.

He was also observed to be visibly absent during all the APC rallies across the country before the 2023 presidential election.

Top Story

Nigeria gains additional 16,300sqkm maritime territory

The Federal Government of Nigeria has gained an additional 16,300sqkm maritime territory.

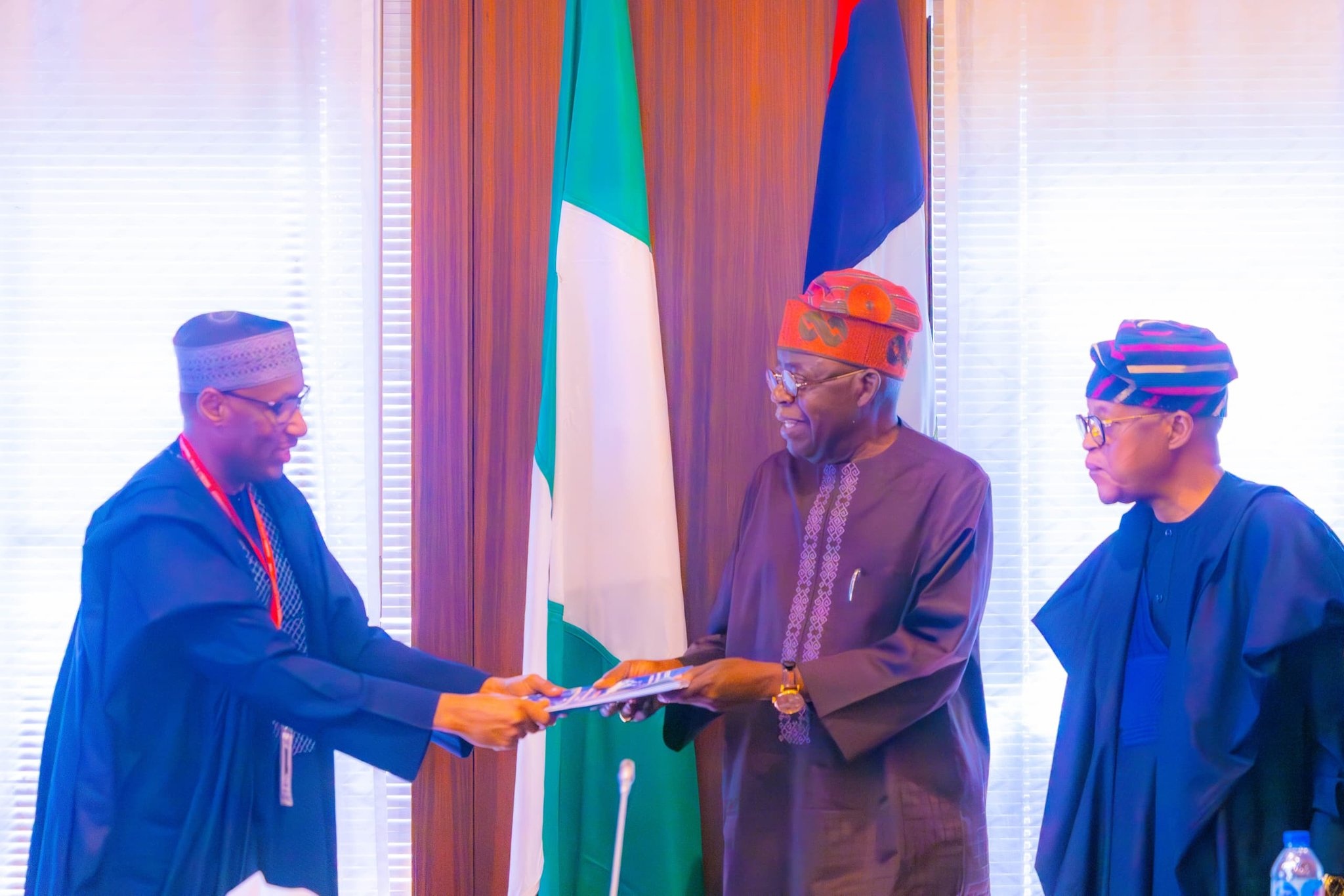

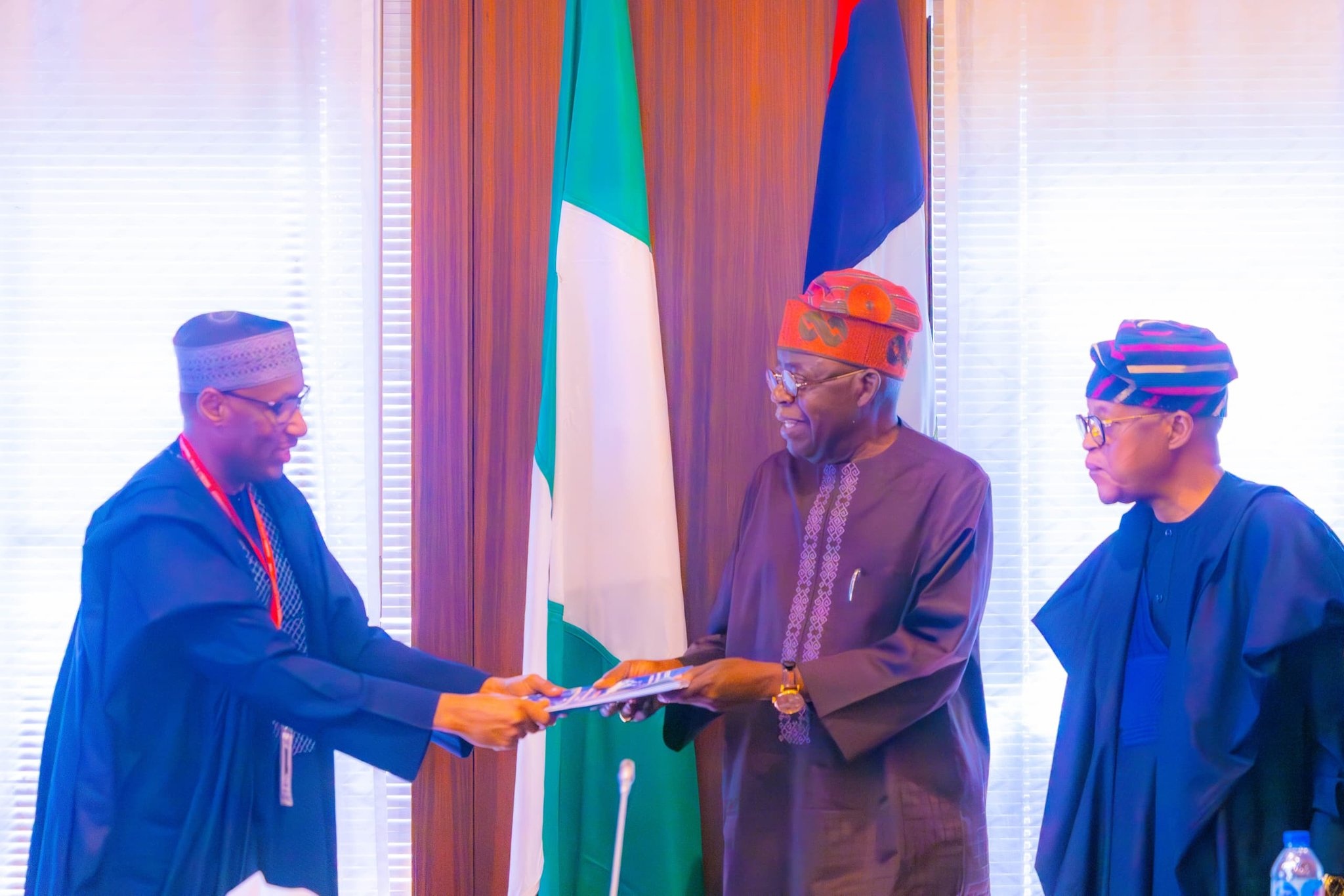

This was revealed when President Bola Tinubu received the report of the High Powered Presidential Committee (HPPC) on Nigeria’s Extended Continental Shelf Project.

The President receiving the committee commended the team of experts who worked hard over the years to advance the project, which aims to extend Nigeria’s maritime boundaries in accordance with the United Nations Convention on the Law of the Sea (UNCLOS), 1982.

The President expressed his appreciation on Tuesday in Abuja after listening to technical presentations by Professor Larry Awosika, a marine scientist and member of the Committee, and Surveyor Aliyu Omar, Secretary of the HPPC.

The experts have been involved in the project since Nigeria’s initial submission to extend its continental shelf to the United Nations Commission on the Limits of the Continental Shelf (CLCS) in 2009.

They informed the President that the UN has approved Nigeria’s submission, granting sovereignty over additional square kilometres of maritime territory.

‘’When the HPPC briefed former President Muhammadu Buhari in 2022 on the status of the project, the United Nations Commission on the Limits of the Continental Shelf (CLCS) was still considering Nigeria’s submission and having technical interactions with the HPPC.

‘’These interactions and consideration have now culminated in the approval for Nigeria to extend its continental shelf beyond 200M (200 nautical miles).

‘’As it stands now, the area approved for Nigeria is about 16,300 square kilometres, which is about five times the size of Lagos State,” Surveyor Omar told the President.

He added that the official notification of the decision was conveyed to Nigeria by the UN Nations Commission on the Limits of the Continental Shelf (CLCS) in August 2023, shortly after President Tinubu assumed office.

Omar outlined the available options for Nigeria following the approval:

-

Finance4 months ago

Court orders Sen. Victor Umeh to repay N136m bank debt to AMCON

-

capital market2 years ago

Rt.briscoe, FBNH, Others halts negative performance of stock market

-

Abuja Update3 months ago

Abuja Update3 months agoUNDP, FG partnership needed to achieve inclusion, equity- Minister

-

Abuja Update2 months ago

Banks drive stock market performance with N147bn gain

-

Health4 weeks ago

Health4 weeks agoCapacity training will reduce migration of health workers- NPHCDA

-

Business3 weeks ago

Business3 weeks agoTingo Group unveils Tingo Electric, Tingo Cola drink at Lagos launch

-

Submission Guidelines4 months ago

CALL FOR SUBMISSIONS: POETRY COLUMN-NND

-

News4 months ago

Oil thieves sponsoring malicious media campaign against Navy – Spokesman