Money market

Etranzact, Ardova, others halts negative performance of stock market

By Philemon Adedeji

Nigerian Equities Market cleared previous day loss to close in the green zone as the key market indicator went up by 52.52 basis points.

The NGX All-Share Index increased up by 0.11 per cent to close at 49,652.25 basis points as against 0.09 per cent loss recorded previously to close at 49,599.73 basis points at the end of the last trading session. Absolutely, the market capitalisation value gained N28.33 billion to close at N26.781 trillion.

The total volume traded advanced by 25.55 per cent to close at 161.88 million units worth N1.63 billion and exchanged in 3,541deals.

TRANSCORP was the most traded stock by volume with 30.97 million traded while MTNN was the most traded stock by value which is put at N692.20 million.

Sectoral performance was broadly positive as thirteen (13) NGX sector index closed northward, two closed southward while three closed flat. The NGX MERIVAL Index inched up by 1.24 per cent to top the gainers chart while the NGX Consumer Goods Index dipped by 0.15 per cent to top the losers’ chart.

At the close of trade on Thursday, 20 stocks were recorded as the gainers as against 9 stocks that declined.

ETRANZACT topped the list of gainers with 9.81 per cent increased to close at N2.91 per share, as Ardova grew by 8.94 per cent to close at N13.40 per share while Chams rose by 7.41 per cent to close at N0.29 per share

FTNcocoa processor and Union Bank of Nigeria gained 7.14 per cent each to close at N0.30 and N6 per share while VITAFOAM topped the list of losers with 9.96 per cent to close at N21.25 per share, as followed by Multiverse and Mining Exploration dropped 9.92 per cent to close at N2.35 per share while Champion breweries declined by 4.16 per cent to close at N3.69 per share

Afripud depreciated by 3.51 per cent to close at N5.50 per share and Honey flour dipped by 3.51 per cent to close at N2.50 per cent

Transaction in the share of Transcorp topped the activities chart with 30.967 million share worth 34.444 million, followed by Fidelity bank which traded 28.707 million share valued at 101.715 million while Sterling bank transacted 19.815 million share worth 29.117 million

First City Monument Bank accounted 11.506 million share valued at 37.950 million and United bank of Africa traded 9.404 million share worth 67.840 million

Thus, market breadth closed positive as the Market Breadth Index (MBI) is put at 0.17x.

MTNN tops the value’s chart with 41.50 per cent contribution and closely followed by Zenithbank and Fidelity bank

Money market

Oyebanji hails Alebiosu’s appointment as acting MD/CEO First Bank

Gov. Biodun Oyebanji has congratulated Mr Olusegun Alebiosu on his elevation as the Acting Managing Director/ CEO of First Bank Plc by the bank’s board.

Alebiosu, who was until the appointment, the Executive Director, Chief Risk Officer and Executive Compliance Officer of the Bank, takes over from Dr Adesola Adeduntan.

Oyebanji, in a statement by his Special Adviser on Media, Mr Yinka Oyebode, congratulated Alebiosu, describing the new position as a befitting cap to his illustrious career and meritorious service to the financial institution.

The governor described the Omuo-Ekiti born banker as a thoroughbred professional who rose to the peak of his career through hard work and commitment to excellence and innovation.

Oyebanji said he was convinced that the new Acting Managing Director possesses the track record, experience and expertise to successfully drive the bank’s development agenda.

In wishing Alebiosu a successful tenure, Governor Oyebanji prayed that God would grant him wisdom and speed needed to take the bank to a new level of greatness.

“I convey the best wishes of the Government and good people of Ekiti State to one of our stars, Mr Olusegun Alebiosu on his appointment as the Acting managing Director of First Bank plc.

“This, no doubt, is a recognition of his capacity and competence.

“We wish him a successful tenure that would be characterised by irreversible progress for the bank,” he said.

Money market

POS transactions crash by N226bn in Q1, 2024

Point-of-Sale (POS) transaction values witnessed a downturn in Nigeria for the first quarter of 2024, registering a N225.73 billion drop when compared to the corresponding quarter of the previous year.

This significant decline marks a 7.94 percent fall in the use of POS systems for transactions within the country as the currency outside banks surged.

The contrasting trends of POS transaction values and volumes—sourced from the Nigeria Inter-Bank Settlement System (NIBSS) with the data of the Central Bank of Nigeria (CBN) on currency circulation offer a complex picture of the financial habits of Nigerians in the first quarter of 2024.

While this analysis encompasses the first quarter of 2024, the CBN has not yet released the data for March 2024. This limits the analysis for cash outside banks to February 2024.

The quarter opened with a slight uptick in POS transaction values, which stood at N850.09 billion in January 2024, surpassing January 2023’s figures.

However, the initial growth was short-lived, as February 2024 saw a reduction in transaction values to N805.05 billion, down from N883.45 billion in February of the previous year. The downward trajectory extended to March 2024, where the value of transactions through POS systems further decreased to N961.86 billion from March 2023’s high of N1.15 trillion.

The total value of transactions for Q1 2024 summed up to N2.62 trillion, failing to match the N2.84 trillion recorded in the same period in 2023.

The decline in Nigeria’s POS transaction values for Q1 2024 is further mirrored by a similar fall in transaction volumes. Alongside the N225.73 billion drop in transaction value, the number of POS transactions also reduced considerably.

January 2024 saw an initial rise in transaction volumes to 112.78 million, an increase from 96.35 million in January 2023. Despite this initial rise, the overall trend for the quarter was a decline.

In February 2024, the volume of POS transactions decreased to 97.57 million from the 113.53 million recorded in the same month of the previous year. March continued this decline, with volumes falling to 103.65 million, down from the high of 177.93 million seen in March 2023.

When totaled, the first quarter of 2024 saw POS transaction volumes reach 314 million, which is a significant drop of 73.81 million, or 19.03 percent, from the 387.81 million transactions recorded in the first quarter of 2023.

This decline in POS transaction values and volumes can be seen in the context of the cash scarcity that hit Nigeria in the first quarter of 2023.

The cash shortage during that period led to a surge in cashless transactions, including the use of POS systems, as citizens sought alternatives to conduct their daily business in the absence of sufficient cash circulation.

The recent decline in POS usage suggests a reversal of the cashless trend, possibly indicating that the aftereffects of the previous year’s cash scarcity might be normalising, or that new patterns in consumer transaction behavior are emerging.

Despite the downturn in POS transaction values and volumes in Nigeria for Q1 2024, there has been an uptrend in the registration of POS terminals during the same period.

In Q1 2023, the number of registered POS terminals increased by 218,475, from 2,318,947 in January 2023 to 2,537,422 by March 2023. By the same quarter in 2024, the number of registered POS terminals had increased by 289, 154, from 3,441,287 in January 2024 to 3,730,441 by March 2024.

Overall, between the end of Q1 2023 and that of Q1 2024, Nigeria has witnessed an additional 1,193,019 POS terminals, marking a 47.02 percent increase.

This rise in terminal registration seems counterintuitive given the simultaneous decrease in transaction value and volume. It could suggest that while the immediate usage of POS systems has dropped, the infrastructure continues to expand.

Amid the decline in POS transaction values and volumes, alongside the significant rise in registered POS terminals in Nigeria for Q1 2024, the scenario is further compounded by the increasing trend of cash outside the banking system.

The CBN data show a notable preference among Nigerians to keep cash at home. In January 2024, cash outside banks escalated to N3.28 trillion, which is an increase of 314 percent from N792.18 billion in the same month of 2023. For February, the amount skyrocketed further to N3.411 trillion, marking a 305 percent increase from the N843.31 billion recorded in February 2023.

Similarly, the amount of currency in general circulation followed this upward trajectory. The CBN reported that in January 2024, the currency in circulation rose by 163 percent to N3.65 trillion, from January 2023’s N1.39 trillion. In February 2024, the amount reached N3.69 trillion which represents a 276 percent increase from February 2023’s figure of N982.1 billion.

Approximately 92 percent of all currency in circulation in February 2024 was outside the banking system. This is a notable increase from February 2023, when the figure stood at 86 percent.

The growth in the proportion of currency held outside banks is significant and suggests a deepening trend of cash retention by Nigerians, a pattern that may have influenced the observed decrease in POS transaction activities despite the expanding availability of POS terminals.

Together, these figures from NIBSS and CBN suggest a period of adjustment and a possible recalibration of trust in cash-based transactions, likely still echoing the cash scarcity challenges of the previous year.

Money market

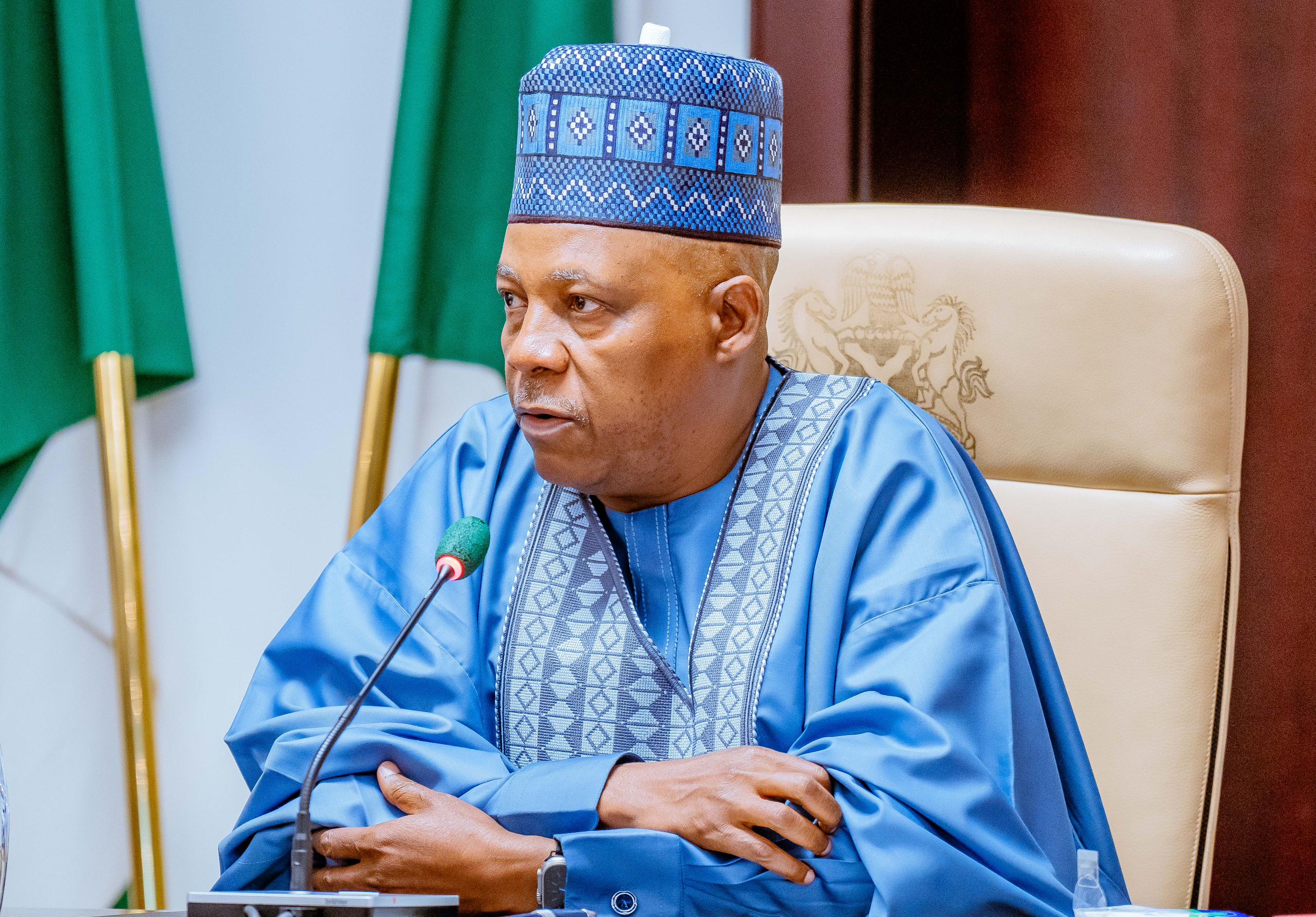

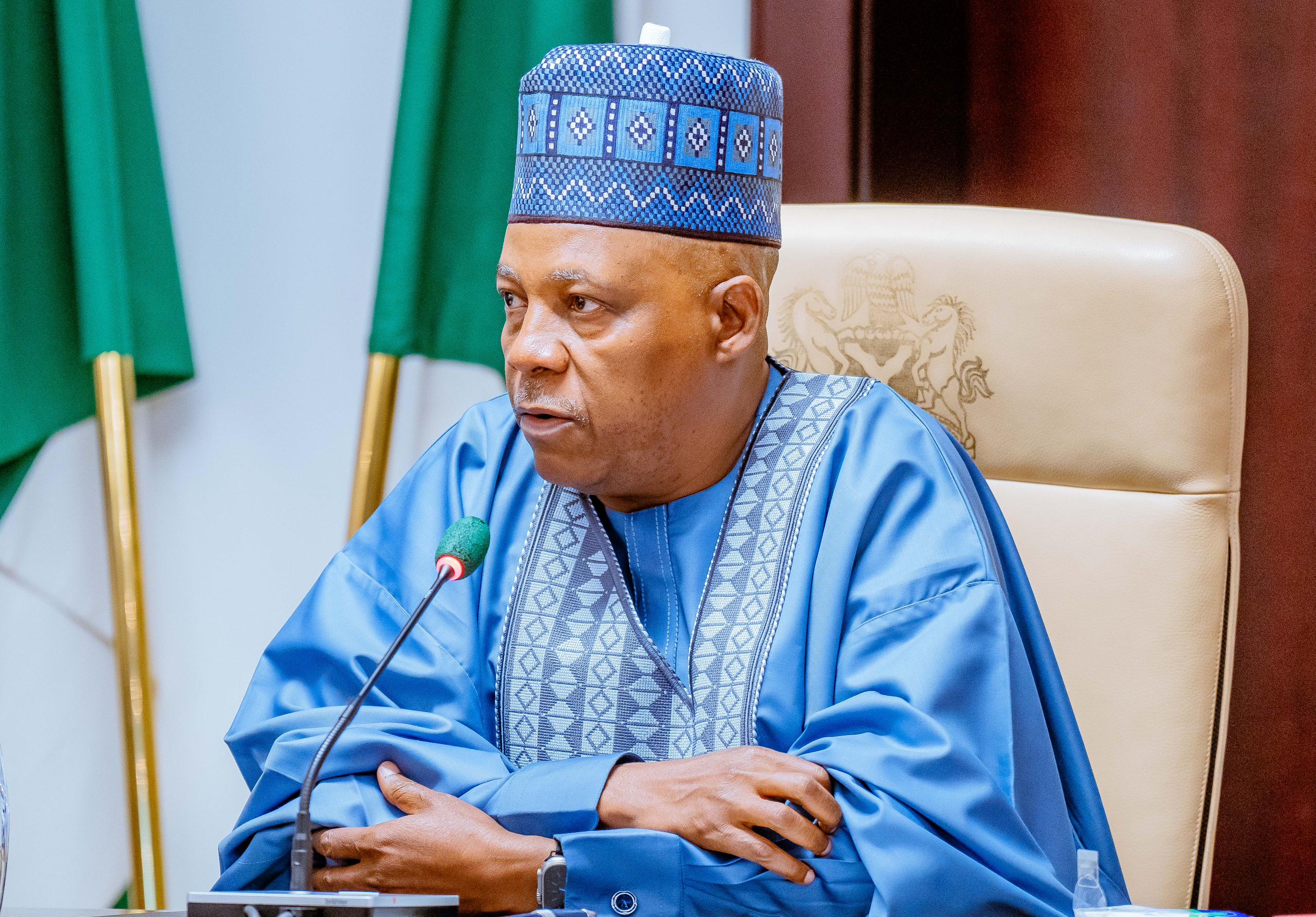

Naira will continue to appreciate against dollar – Shettima

Vice President Kashim Shettima has expressed optimism that the Naira would continue to appreciate against the dollar at the forex market.

Spokesperson of the Vice-President, Mr Stanley Nkwocha, in a statement on Saturday, said Shettima stated this at a meeting with officials of the Lagos Chamber of Commerce and Industry (LCCI), at the President Villa, Abuja.

He said President Bola Tinubu ended the fuel subsidy and ensured the unification of the multiple exchange rate because the former arrangement was producing billionaires overnight.

“Naira went haywire and some people were celebrating but inwardly we were laughing at them because we knew that we have the leadership to reverse the trend.

“Asiwaju knows the game, and truly the Naira is gaining and the difference will drop further.”

He recalled that the quality of leadership provided by President Tinubu as governor of Lagos laid the foundation for the massive development witnessed in the state.

Shettima assured that the Tinubu administration is doing its best to address challenges in the power sector.

According to him, Tinubu’s administration is aware that power is absolutely essential for development.

“We are determined to ensure that we generate jobs for our youths. Honestly, the President’s obsession is to live in a place of glory, to transform this country to a higher pedestal.

“He wants to leave a legacy, one of qualitative leadership because the hope of the black man, the hope of Africa rests with Nigeria.

“I want to assure you that President Bola Ahmed Tinubu is one of you. He understands your ecosystem. In this government, you have an ally and a friend.”

Earlier, the President of LCCI, Gabriel Idahosa, emphasised the need for the Federal Government to consider more innovations to address the insecurity challenge in the country.

He also urged the Tinubu administration to ensure a significant upswing in the pace and scale of alternative policy measures that promote credit access, stimulate investment, and support entrepreneurship.

“This could include targeted interventions such as concessional lending facilities, loan guarantees, and interest rate subsidies tailored to the needs of SMEs and key sectors of the economy like agriculture, manufacturing and power technology.”

-

Finance3 months ago

Court orders Sen. Victor Umeh to repay N136m bank debt to AMCON

-

Abuja Update2 months ago

Abuja Update2 months agoUNDP, FG partnership needed to achieve inclusion, equity- Minister

-

Abuja Update1 month ago

Banks drive stock market performance with N147bn gain

-

Infotech3 weeks ago

Infotech3 weeks agoWorld Backup Day: NITDA urges Nigerians to ensure backup of data

-

capital market2 years ago

Rt.briscoe, FBNH, Others halts negative performance of stock market

-

Health2 weeks ago

Health2 weeks agoImmunisation: FG, GAVI seek synergy with Sokoto Govt.

-

Infotech2 weeks ago

Forex for Beginners: Unveiling the currency exchange and how to trade it

-

Submission Guidelines4 months ago

CALL FOR SUBMISSIONS: POETRY COLUMN-NND