Money market

UBA rewards 20 kids with N4m in kiddies & teens draw

United Bank for Africa (UBA) Plc, has rewarded a total of 20 kids with N200,000 each as scholarship grants in its just concluded Kiddies and Teens Draw, which held in Lagos on Thursday.

The winners had qualified to win in this year’s first draw because their parents/guardians had maintained standing instructions of N10,000 to their child/ward’s UBA Kiddies or Teens Accounts for a 6-month period.

The draw is an innovative first-of-its-kind initiative conceptualized by UBA with special intention to inculcate a Savings culture that set kids and teens up for a secure future as well as put them on a strong footing for independence and ultimately actualizing their dreams.

The virtual draw, witnessed by representatives of the National Lottery Regulatory Commission (NLRC) and the Consumer Protection Council (CPC), saw winners emerge from across all the regions of the country.

The 20 kids and teenagers who won N200,000 educational grants were Anderson Andikan Nathan, Salihu Yakubu Mahamud, Simeon Thankgod Ofomona, Nwaeze Annabel Chiziterem, Eva Favour Emmanuga Makuachukwu, Ifechukwudi Divine Ugbeh, Jeremiah Unekwuojo Isyaku, Iyare Francesca Owa and Okoye Gerald Munachi.

Others are Charles-Agwanyokha Salvation Ilamosi; Ngbede Godswill Ishor; Molokwu Ezidinma Kosisochukwu; Nancy Esohe Aigboduwa; Alika Anwuli Erika; Funebi j Tapre; Ebubechukwu Goodluck Ephraim; Uchegbu Benedicta Chidera; Ireoluwa David Aderinola; Njoku Chinecherem Judith and Mariam Odunayo Oyewole.

One of the winners, Okoye Gerald, whose father was contacted over the phone following his winning was very excited and expressed his heartfelt gratitude to the management of UBA for the opportunity.

“Thank you UBA, thank you.This is very thoughtful coming from the bank. It goes a long way in showing that UBA is indeed passionate and dedicated to the growth of its customers and their children. A bank that grooms the young is indeed a wise bank, he said.”

UBA’s Head, Personal Banking, Ogechi Altraide, who congratulated all the winners after the draw said that apart from the monthly and quarterly rewards that the bank gives to its loyal customers in the UBA Bumper and savings promo, the bank had gone a step further to encourage parents to instil the savings culture on their kids and teenagers.

She said, “I will like to let you know that this is another first from UBA, and of course, we are very excited at this because it again goes to show that we take very seriously the mandate of ensuring financial inclusion and this time, we are catching them young and ensuring that as they grow they increasingly become financially disciplined and can fuel their dreams to a happy end, which exactly what we are passionate about as a bank.”

Continuing, she said, “We know that the kids today are the future of tomorrow, and we are trying to groom them to imbibe the habit of savings, so that they can achieve their dreams as well as secure their future while putting away something for the future.”

Also speaking during the event, Head of Marketing, Diana Ubah, pointed out that, “Our bank, UBA, has continued to show and prove that we are passionate about the overall growth and success of every customer, and that is why we go ahead of others to innovate and come out with initiatives that are unique and can transform the lives of our customers for good.”

She further said, “In a tap-and-go society where money is rarely physically exchanged and quicker to spend, it is important to educate young people about the value of money. By including your kids so that they see how you spend money, it will help develop a basic understanding of transactions in the real world, as they grow up in an increasingly digital economy,” Ubah noted.

The UBA Kiddies is an account designed for children between the ages of 0-12 years while UBA Teens Accounts is between the range of 13-17 years. Other benefits of the account include a 13th-month cash reward and a special invitation to the bank’s children-focused events.

Beneficiaries of this account stand to earn 13 months reward of 10 per cent of the monthly savings plan for over 12 consecutive months, having maintained a standing instruction of a minimum of N5,000. They also have a chance to partake in a scholarship scheme through a raffle draw, having maintained a standing instruction of saving a minimum of N10,000 for six months. The account has an annual interest of 1.15 per cent, payable monthly.

To qualify, parents must have maintained a standing instruction of N10,000 for 6 months in their UBA Kiddies or Teens Accounts.

Altraide advised parents who had yet to open accounts for their kids to do so as soon as possible, to be eligible to participate in the next UBA Kiddies and Teens draw, which will be held soon.

Money market

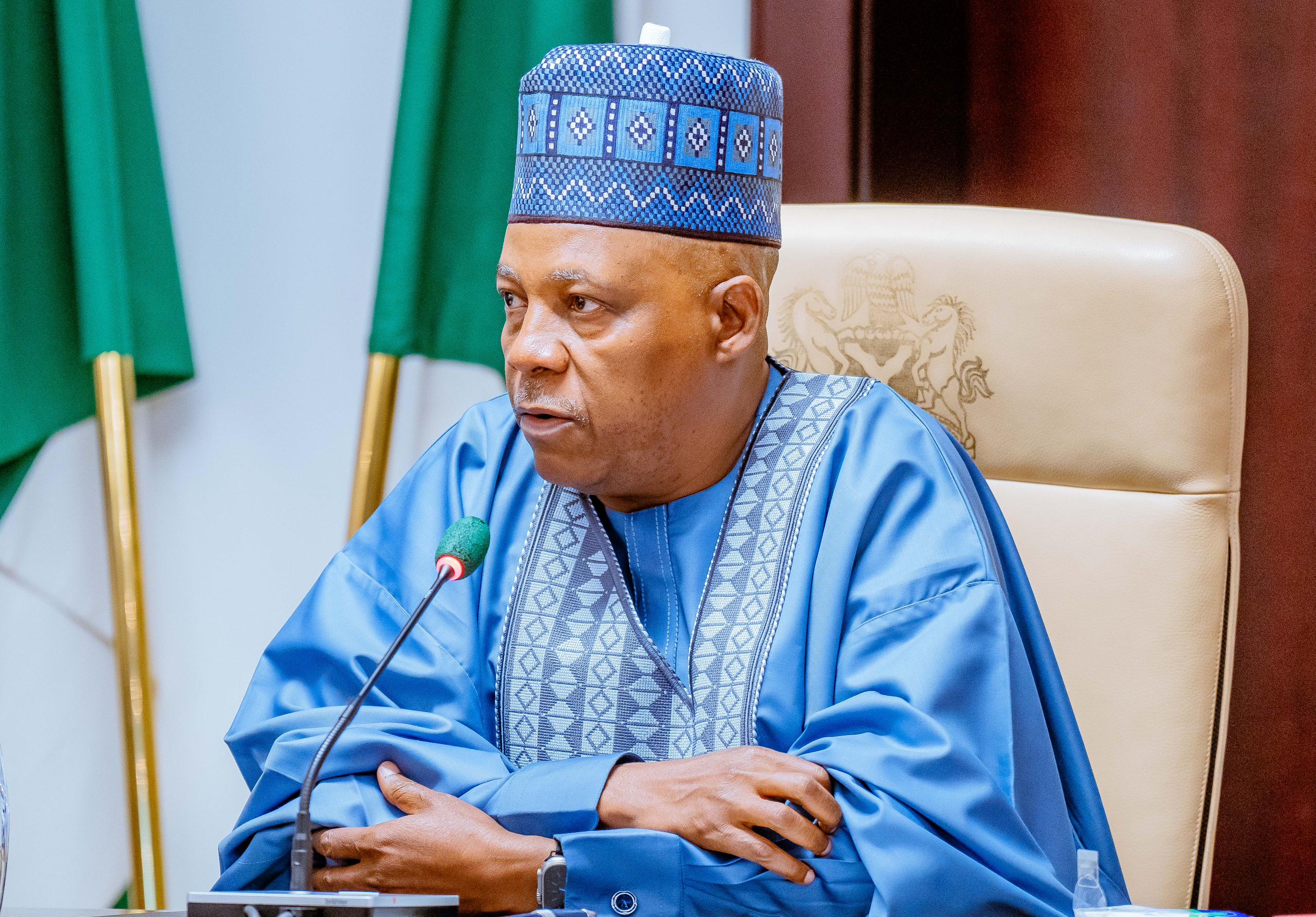

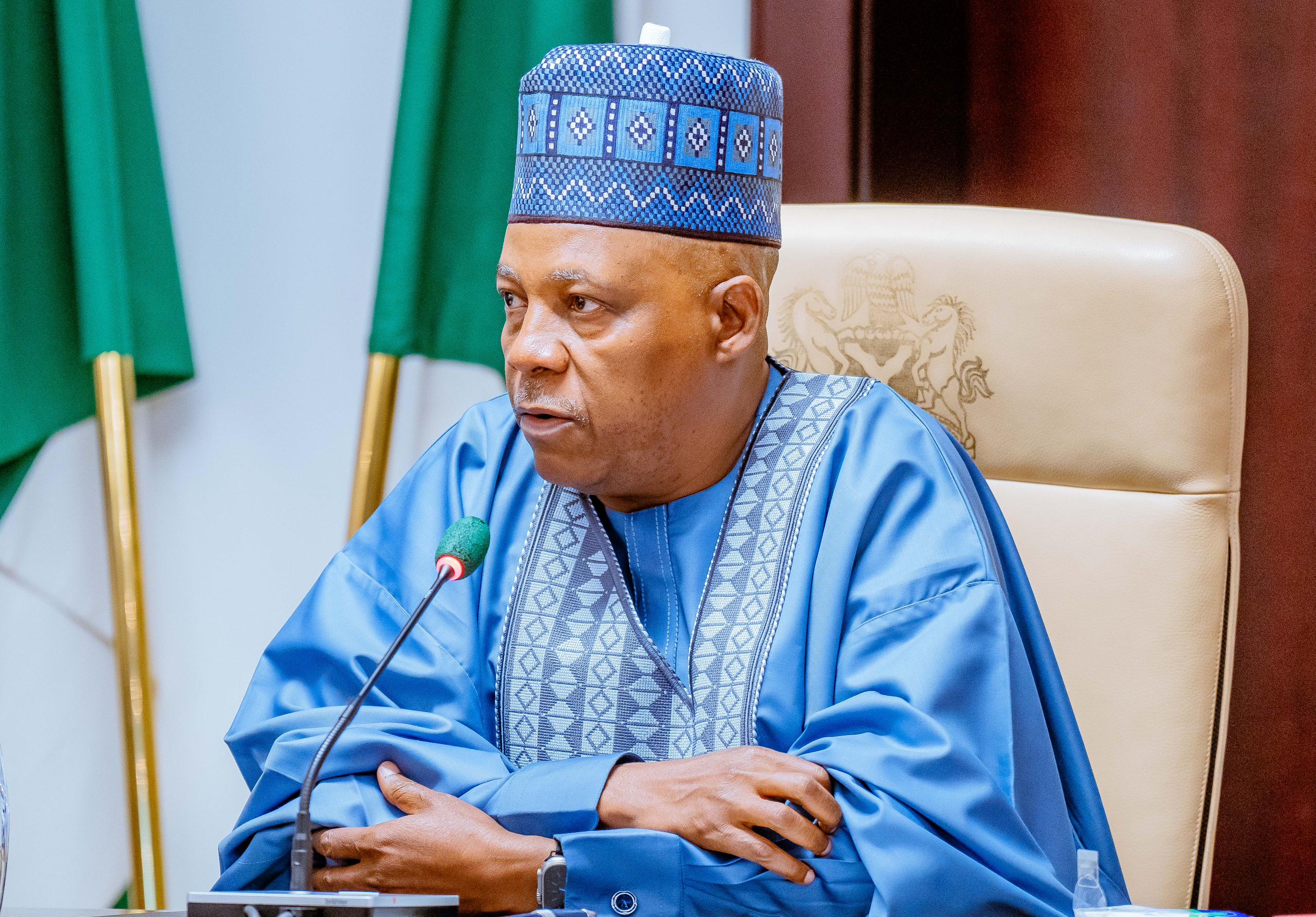

Naira will continue to appreciate against dollar – Shettima

Vice President Kashim Shettima has expressed optimism that the Naira would continue to appreciate against the dollar at the forex market.

Spokesperson of the Vice-President, Mr Stanley Nkwocha, in a statement on Saturday, said Shettima stated this at a meeting with officials of the Lagos Chamber of Commerce and Industry (LCCI), at the President Villa, Abuja.

He said President Bola Tinubu ended the fuel subsidy and ensured the unification of the multiple exchange rate because the former arrangement was producing billionaires overnight.

“Naira went haywire and some people were celebrating but inwardly we were laughing at them because we knew that we have the leadership to reverse the trend.

“Asiwaju knows the game, and truly the Naira is gaining and the difference will drop further.”

He recalled that the quality of leadership provided by President Tinubu as governor of Lagos laid the foundation for the massive development witnessed in the state.

Shettima assured that the Tinubu administration is doing its best to address challenges in the power sector.

According to him, Tinubu’s administration is aware that power is absolutely essential for development.

“We are determined to ensure that we generate jobs for our youths. Honestly, the President’s obsession is to live in a place of glory, to transform this country to a higher pedestal.

“He wants to leave a legacy, one of qualitative leadership because the hope of the black man, the hope of Africa rests with Nigeria.

“I want to assure you that President Bola Ahmed Tinubu is one of you. He understands your ecosystem. In this government, you have an ally and a friend.”

Earlier, the President of LCCI, Gabriel Idahosa, emphasised the need for the Federal Government to consider more innovations to address the insecurity challenge in the country.

He also urged the Tinubu administration to ensure a significant upswing in the pace and scale of alternative policy measures that promote credit access, stimulate investment, and support entrepreneurship.

“This could include targeted interventions such as concessional lending facilities, loan guarantees, and interest rate subsidies tailored to the needs of SMEs and key sectors of the economy like agriculture, manufacturing and power technology.”

Money market

LCCI advocates discipline, export to sustain Naira appreciation

LCCI advocates discipline, export to sustain Naira appreciationThe Lagos Chamber of Commerce and Industry (LCCI) has emphasised the importance of maintaining discipline in the foreign exchange market to sustain the steady appreciation of the Naira.

The President and Chairman of the Council of LCCI, Mr Gabriel Idahosa, made the call in an interview with newsmen on Wednesday in Lagos.

Idahosa praised the efforts of the Central Bank of Nigeria in imposing discipline, attributing the recent Naira appreciation to curbing speculative activities.

“On the monetary side, the CBN is doing it. The primary efforts should continue to impose discipline in the foreign currency market.

“The abuses in the foreign currency market were prevalent and most of the fall in the value of the Naira in the last six months is not because there was any sudden calamity in the Nigerian economy.

“It was primarily because of very reckless speculations, that people were just speculating in the dollar, they had nothing to export, nothing to import, they were just buying the dollar for speculative reasons.

“And once the Central Bank started to impose discipline in the foreign currency market, we saw the value of the Naira rising very quickly by stopping speculation,” he said.

According to him, the strategies of the Central Bank, now, are designed to achieve a sustained discipline in the foreign currency market.

Idahosa highlighted the need to continue reducing the number of Bureau de Change operators, stressing that many operated without contributing to international trade.

He applauded the Central Bank’s move to enforce documentation and identification of buyers and sellers at BDCs, aiming to deter reckless speculation and curb illicit financial flows.

On the fiscal side, Idahosa urged President Bola Tinubu to prioritise a nationwide export drive, citing it as the key to bolstering the Naira and providing essential foreign exchange.

He emphasised the importance of fostering a culture of export among Nigerians across all scales of enterprise to reduce reliance on imports and strengthen the country’s economic resilience.

Money market

Foreign reserves decline to $32.29bn

The foreign reserve has depleted to $32.29 billion, which is a six-year low in the Central Bank’s course to save the naira.

This is the lowest level the reserves have been since September 25, 2017, when it was $32.28 billion.

The country’s foreign reserves declined by 6.2 percent, losing $2.6 billion since March 18, when the naira started its rebound from record-low levels against the dollar to $32.29 billion as of Monday, based on the latest available data from the CBN.

At the beginning of the month, the reserve was at $33.57 billion, then further dipped to $32.6 billion by April 12.

This comes as the CBN has attempted to save the naira through various interventions such as raising interest rates to 24.75 percent and managing foreign exchange trades.

It stepped up its intervention in the FX market with sales at both the official market and to BDC operators who sell dollars on the streets.

The apex bank, which sells $10,000 to each BDC every week, mandated them to only sell at a spread of 1.5 percent, which comes to N1,117 per US dollar.

The rate sold by the BDCs has set a defacto floor for the naira in the black market since the apex bank resumed sales to them in February.

Also, last month the CBN said it had cleared a backlog of $7 billion since the beginning of the year. That was built over the years as the central bank pegged its currency against the dollar, leading to a scarcity of foreign currency that deterred foreign portfolio investment. However, it’s unclear how much dollar debt the CBN retains on its books.

Akpan Ekpo, a professor of economics and public policy, said the CBN’s managed float system in which it is trying to ensure supply and curtail demand is not sustainable in the long term.

He said the CBN needs to be careful with how it depletes the foreign reserves as its main source is oil revenue.

“We need to manufacture non-oil goods and services, export them, and get foreign exchange and not depend on oil income,” he said.

-

Finance3 months ago

Court orders Sen. Victor Umeh to repay N136m bank debt to AMCON

-

Abuja Update2 months ago

Abuja Update2 months agoUNDP, FG partnership needed to achieve inclusion, equity- Minister

-

Abuja Update4 weeks ago

Banks drive stock market performance with N147bn gain

-

Infotech3 weeks ago

Infotech3 weeks agoWorld Backup Day: NITDA urges Nigerians to ensure backup of data

-

capital market2 years ago

Rt.briscoe, FBNH, Others halts negative performance of stock market

-

Health2 weeks ago

Health2 weeks agoImmunisation: FG, GAVI seek synergy with Sokoto Govt.

-

Infotech2 weeks ago

Forex for Beginners: Unveiling the currency exchange and how to trade it

-

Submission Guidelines4 months ago

CALL FOR SUBMISSIONS: POETRY COLUMN-NND