Money market

Naira Redesign: First Bank threatens to shut down branches

Nigeria’s oldest bank, First Bank of Nigeria Plc has threatened to shut down its branches if attacks on bank facilities persist.

The bank notified customers that the current attacks on banks will force it to open where it is safe to do so.

Banks have been under pressure since the Central Bank of Nigeria began the move to withdraw the N1,000, N500 and N200 from circulation.

The apex bank has withdrawn N1.9trn from circulation and printed only N300bn, complicating liquidity issues across the country.

Cash scarcity has hit most banks as customers spend time on ATMs without being able to withdraw their money.

In Edo, Lagos and Abeokuta, bank facilities have been vandalised by angry customers who are unable to get their cash.

First Bank said, “We know these are challenging times and our commitment to support does not waver. We will keep our doors open and have greatly increased capacity across all our electronic platforms.

“However, should we observe skirmishes around certain locations, we may have to temporarily shut our doors as we also take the safety and welfare of our staff seriously.

“We believe that we are in this together and here to find and provide solutions. Unfortunately, those attacking bank branches only make it more difficult for us to do our part in resolving the challenge we collectively face.”

Zenith Bank Plc posted a similar notice about the closure of selected branches over the safety of members of staff.

Money market

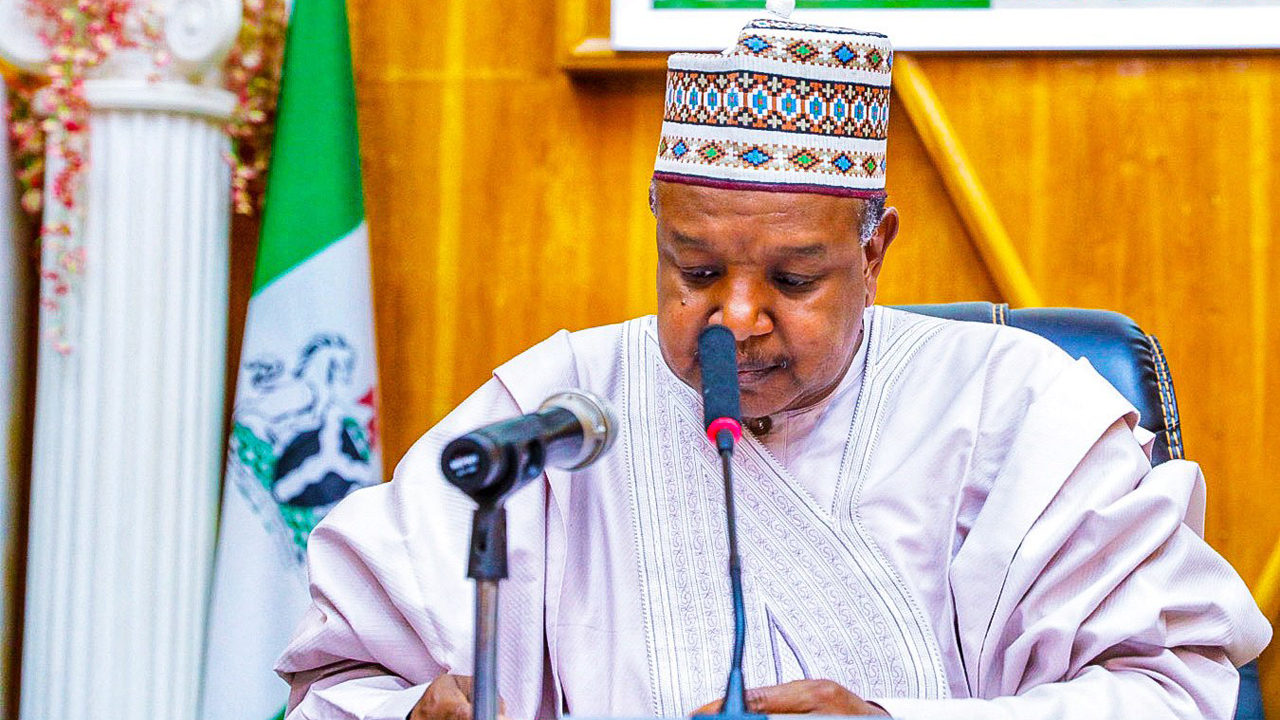

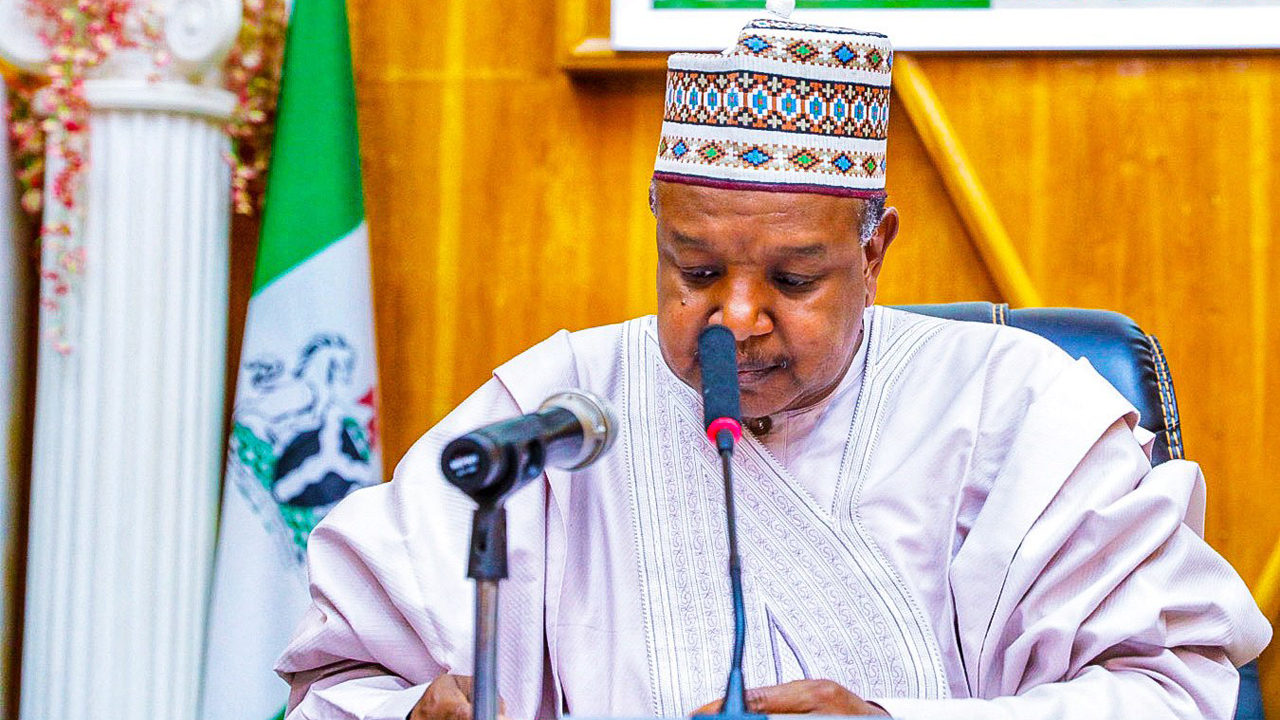

FG urges NIPSS members on creative solutions to national challenge

The Minister of Budget and Economic Planning, Atiku Bagudu, has urged members of the National Institute for Policy and Strategic Studies (NIPSS), to devise creative solutions to Nigeria’s social and economic challenges.

Bagudu received participants of the Senior Executive Course 46 of the institute in his office on Monday in Abuja.

According to him, some of the issues confronting Nigeria as a nation might require out of the box solutions.

“The NIPSS was created in the wisdom of our forefathers, to train senior management personnel that can bring unusual solutions to problems confronting us,” he said.

He urged the participants to eschew self-interest and make decisions that can assist the nation to make better choices.

Bagudu said that the national planning function of the ministry comes from the National Planning Commission.

He said that the digital economy is one area that the ministry was looking at for mass youth engagement and economic prosperity.

“Digital economy is an evolving process.which the country will have to leverage digital for overall growth and development.

“It is a new reality. Today trading platforms are closing shop and increasingly going digital.

“Nigeria needs to respond positively and reap benefits from the digital economy. But we have to make the space safe through effective regulation.

“Some countries have data protection laws which enable them to check and regulate excesses in the digital space,” he said.

The Minister commended the law enforcement agencies for promptly going after digital platforms like Binance, which was used to disrupt the foreign exchange market and to weaken the Naira.

He also commended the Governor of the Central Bank of Nigeria (CBN), Yemi Cardoso, for his various monetary policy decisions that restored confidence in the Nigerian economy.

Money market

Cardoso to speaks at IMF meeting on FX reforms

The Governor of the Central Bank of Nigeria (CBN), Olayemi Cardoso will speak on foreign exchange (FX) market reforms at the ongoing International Monetary Fund (IMF) Spring Meetings on Wednesday in Washington D.C.

The meetings of the Boards of Governors of the IMF and the World Bank Group (WBG) bring together central bankers, ministers of finance and development, parliamentarians, private sector executives, representatives from civil society organisations and academics to discuss issues of global concern, including the world economic outlook, poverty eradication, economic development, and aid effectiveness.

Also featured are seminars, regional briefings, press conferences, and many other events focused on the global economy, international development, and the world’s financial system

Cardoso assumed office as the Governor of the CBN in September 2023. Since then he has introduced some new FX policies and adjusted some existing ones to ensure the stability of the naira.

According to Cardoso, the exchange rate in Nigeria has increased/depreciated due to the simultaneous occurrence of two factors: a decline in the supply of US Dollars coinciding with a surge in the demand for US dollars.

He said in February 2023 that the foreign exchange market is currently facing increased demand pressures, causing a continuous decline in the value of the naira. Factors contributing to this situation include speculative forex demand, inadequate forex supply due to non-remittance of crude oil earnings to the CBN, increased capital outflows, and excess liquidity from fiscal activities.

To address exchange rate volatility, he said a comprehensive strategy has been initiated to enhance liquidity in the FX markets.

This includes unifying FX market segments, clearing outstanding FX obligations, introducing new operational mechanisms for BDCs, enforcing the Net Open Position limit, and adjusting the remunerable Standing Deposit Facility cap.

As part of measures to control inflation and stabilise the naira, the CBN last month raised its benchmark interest rate, known as the Monetary Policy Rate (MPR) by 200 basis points to 24.75 percent from 22.75 percent in February 2024.

In her second term message, Kristalina Georgieva, IMF managing director, who was recently reappointed by the executive board of the IMF, said, “I am deeply grateful for the trust and support of the Fund’s Executive Board, representing our 190 members, and honoured to continue to lead the IMF as managing director for a second five-year term.”

Money market

PenCom recovers N12.45bn from erring employers

The National Pension Commission (PenCom) said it has recovered N12.45 billion from employers that failed to contribute towards their employees retirement.

The recovery would indeed help in wealth creation for the workers, thereby securing them against old age poverty in retirement.

PenCom in its 4th quarter 2024 report, said it has maintained the services of Recovery Agents (RAs) for the recovery of unremitted pension contributions and penalties from defaulting employers.

It submitted that during the quarter, the sum of N319,468,587.45 comprising principal contributions N128,176,029.95 and penalties N191,292,557.50 was recovered from 32 defaulting employers.

It noted that meanwhile, the Commission Secretariat/Legal Advisory Services Department had been requested to take legal action against 4 defaulting employers.

The pension industry regulator maintained that from the commencement of the recovery exercise in June 2012 to 31 December 2023, a total sum of N25,447,085,186.71 comprising of principal contributions N12,929,415,445.52 and penalties N12,517,669,741.19 was recovered from defaulting employers.

-

Finance3 months ago

Court orders Sen. Victor Umeh to repay N136m bank debt to AMCON

-

Abuja Update2 months ago

Abuja Update2 months agoUNDP, FG partnership needed to achieve inclusion, equity- Minister

-

Abuja Update3 weeks ago

Banks drive stock market performance with N147bn gain

-

Infotech2 weeks ago

Infotech2 weeks agoWorld Backup Day: NITDA urges Nigerians to ensure backup of data

-

capital market2 years ago

Rt.briscoe, FBNH, Others halts negative performance of stock market

-

Health1 week ago

Health1 week agoImmunisation: FG, GAVI seek synergy with Sokoto Govt.

-

Submission Guidelines3 months ago

CALL FOR SUBMISSIONS: POETRY COLUMN-NND

-

News3 months ago

Oil thieves sponsoring malicious media campaign against Navy – Spokesman