Money market

FCCPC bars Flutterwave, Opay, others from providing services to online loan sharks

The Federal Competition and Consumer Protection Commission (FCCPC) has barred all financial technology companies (FinTechs) from providing payment or transaction services to online money lenders under its investigation.

The identified FinTechs such as Flutterwave, Opay, Paystack and Monify were said to be operating payment systems and providing services to such online lenders under its investigation or not operating with applicable regulatory approvals.

This is coming several months after the Commission had ordered Google and Apple to enforce the withdrawal of these money lending applications from their stores where evidence of inappropriate conduct or use of the application in violation of the rights of consumers has been established.

This was made known by the Executive Chairman of FCCPC, Mr Babatunde Irukera, during a chat with journalists while on an enforcement exercise on some of the digital money lenders on Thursday in Lagos.

Irukera said the Commission also ordered telecommunication and technology companies which include Mobile Network Operators (MNOs) to stop providing server, hosting or other key services such as connectivity to such disclosed or known lenders.

Irukera said, “The information available to the Commission demonstrates that Soko Lending appears to be the most consequential digital money lender with multiple apps and brand names.

“It is covering a significant share of the digital or online lending market, and one of the most prolific actors in violating consumer privacy, fair lending terms and ethical loan repayment/recovery practices.

“Prior to this operation, the commission had previously, on March 11, 2022 carried out a similar enforcement action with respect to multiple lenders; which action and continuing investigation has reduced previously high and escalating unethical, obnoxious and unscrupulously exploitative practices in the industry.”

The FCCPC boss noted that some of these online lenders who had been subject of investigation had devised methods to leverage on technology and other financial services alternatives to circumvent account freezing and app suspension Orders.

He said, “With the operations today, the Commission expects appreciable additional reduction in these unacceptable practices.

“The Commission has also today entered further Orders that will disable or diminish violators’ ability to devise circumvention efforts or alternative mechanisms to circumvent the objective of the investigation and protection of citizens.”

Going further, he said the Order requires permission to proceed in digital lending and provides a limited moratorium period for existing businesses to comply in order to continue in digital lending.

Irukera added, “The guidelines also mandate different service providers in the relevant ecosystem such as banks, access/download platforms or stores, technology providers and payment systems to require regulatory approval before providing services.

“The commission expresses its gratitude to victims and citizens who have provided information or contributed to the investigation; and welcomes the continuing engagement that provides the relevant information or intelligence through the already established and publicised channels.”

Money market

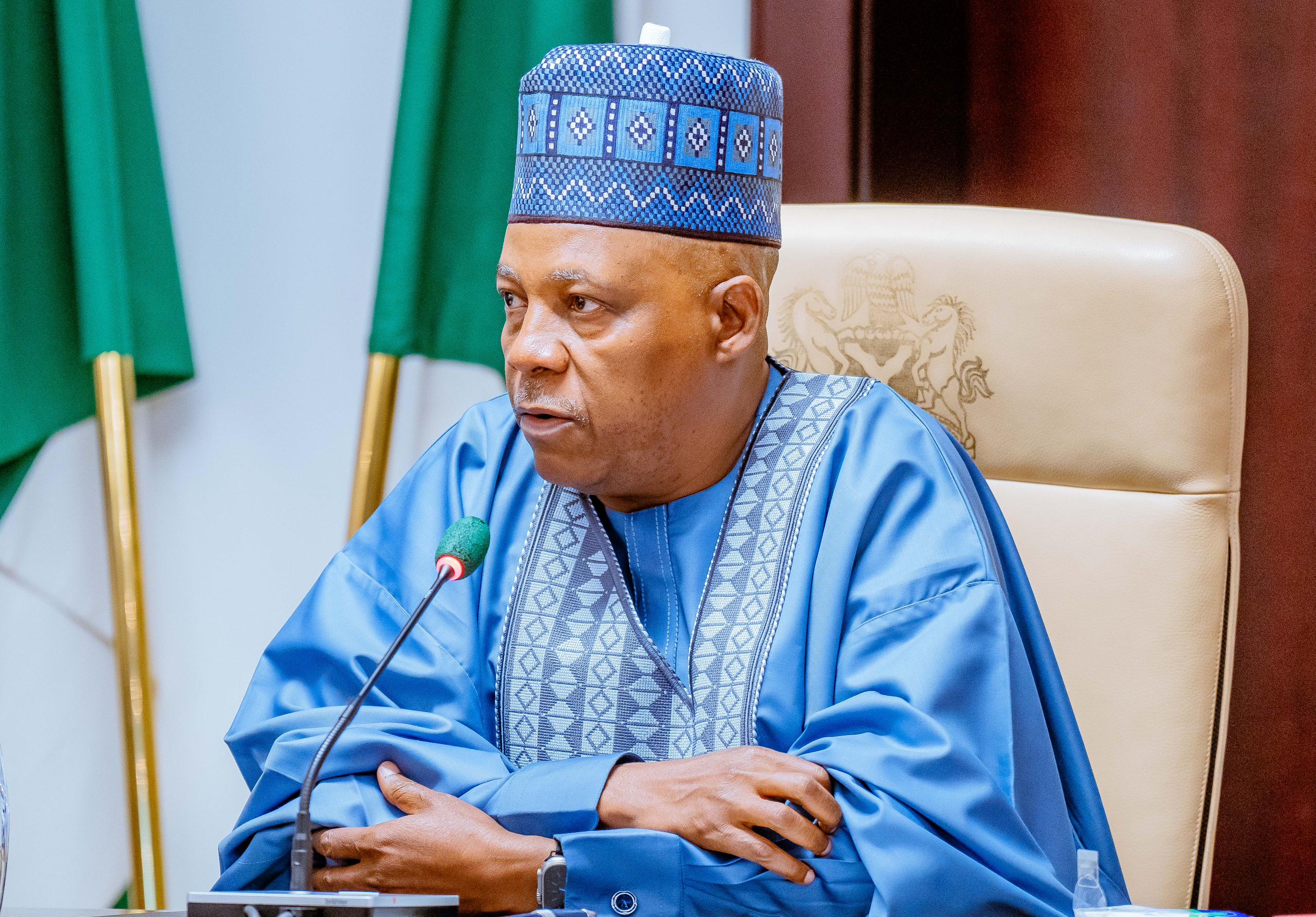

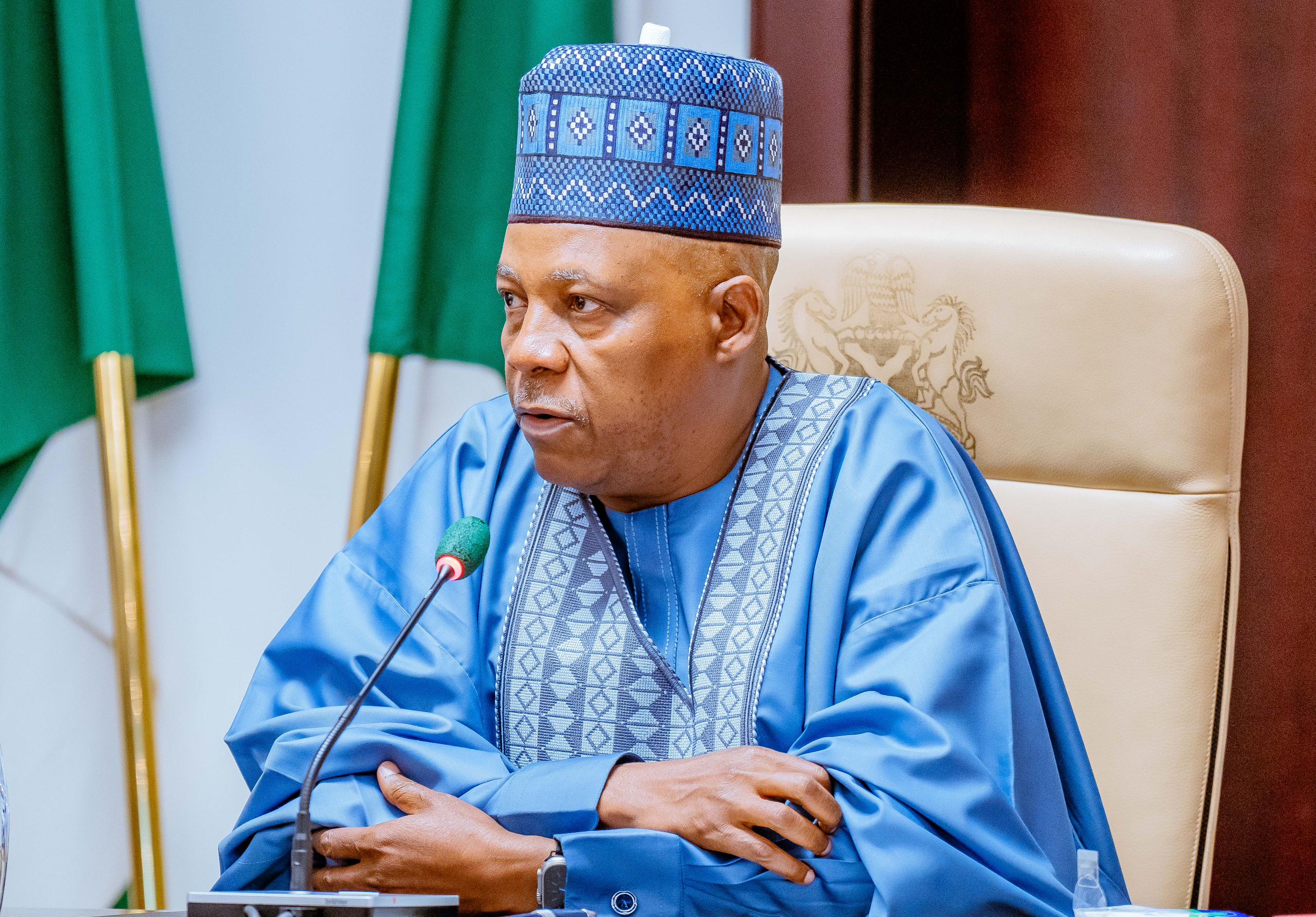

Naira will continue to appreciate against dollar – Shettima

Vice President Kashim Shettima has expressed optimism that the Naira would continue to appreciate against the dollar at the forex market.

Spokesperson of the Vice-President, Mr Stanley Nkwocha, in a statement on Saturday, said Shettima stated this at a meeting with officials of the Lagos Chamber of Commerce and Industry (LCCI), at the President Villa, Abuja.

He said President Bola Tinubu ended the fuel subsidy and ensured the unification of the multiple exchange rate because the former arrangement was producing billionaires overnight.

“Naira went haywire and some people were celebrating but inwardly we were laughing at them because we knew that we have the leadership to reverse the trend.

“Asiwaju knows the game, and truly the Naira is gaining and the difference will drop further.”

He recalled that the quality of leadership provided by President Tinubu as governor of Lagos laid the foundation for the massive development witnessed in the state.

Shettima assured that the Tinubu administration is doing its best to address challenges in the power sector.

According to him, Tinubu’s administration is aware that power is absolutely essential for development.

“We are determined to ensure that we generate jobs for our youths. Honestly, the President’s obsession is to live in a place of glory, to transform this country to a higher pedestal.

“He wants to leave a legacy, one of qualitative leadership because the hope of the black man, the hope of Africa rests with Nigeria.

“I want to assure you that President Bola Ahmed Tinubu is one of you. He understands your ecosystem. In this government, you have an ally and a friend.”

Earlier, the President of LCCI, Gabriel Idahosa, emphasised the need for the Federal Government to consider more innovations to address the insecurity challenge in the country.

He also urged the Tinubu administration to ensure a significant upswing in the pace and scale of alternative policy measures that promote credit access, stimulate investment, and support entrepreneurship.

“This could include targeted interventions such as concessional lending facilities, loan guarantees, and interest rate subsidies tailored to the needs of SMEs and key sectors of the economy like agriculture, manufacturing and power technology.”

Money market

LCCI advocates discipline, export to sustain Naira appreciation

LCCI advocates discipline, export to sustain Naira appreciationThe Lagos Chamber of Commerce and Industry (LCCI) has emphasised the importance of maintaining discipline in the foreign exchange market to sustain the steady appreciation of the Naira.

The President and Chairman of the Council of LCCI, Mr Gabriel Idahosa, made the call in an interview with newsmen on Wednesday in Lagos.

Idahosa praised the efforts of the Central Bank of Nigeria in imposing discipline, attributing the recent Naira appreciation to curbing speculative activities.

“On the monetary side, the CBN is doing it. The primary efforts should continue to impose discipline in the foreign currency market.

“The abuses in the foreign currency market were prevalent and most of the fall in the value of the Naira in the last six months is not because there was any sudden calamity in the Nigerian economy.

“It was primarily because of very reckless speculations, that people were just speculating in the dollar, they had nothing to export, nothing to import, they were just buying the dollar for speculative reasons.

“And once the Central Bank started to impose discipline in the foreign currency market, we saw the value of the Naira rising very quickly by stopping speculation,” he said.

According to him, the strategies of the Central Bank, now, are designed to achieve a sustained discipline in the foreign currency market.

Idahosa highlighted the need to continue reducing the number of Bureau de Change operators, stressing that many operated without contributing to international trade.

He applauded the Central Bank’s move to enforce documentation and identification of buyers and sellers at BDCs, aiming to deter reckless speculation and curb illicit financial flows.

On the fiscal side, Idahosa urged President Bola Tinubu to prioritise a nationwide export drive, citing it as the key to bolstering the Naira and providing essential foreign exchange.

He emphasised the importance of fostering a culture of export among Nigerians across all scales of enterprise to reduce reliance on imports and strengthen the country’s economic resilience.

Money market

Foreign reserves decline to $32.29bn

The foreign reserve has depleted to $32.29 billion, which is a six-year low in the Central Bank’s course to save the naira.

This is the lowest level the reserves have been since September 25, 2017, when it was $32.28 billion.

The country’s foreign reserves declined by 6.2 percent, losing $2.6 billion since March 18, when the naira started its rebound from record-low levels against the dollar to $32.29 billion as of Monday, based on the latest available data from the CBN.

At the beginning of the month, the reserve was at $33.57 billion, then further dipped to $32.6 billion by April 12.

This comes as the CBN has attempted to save the naira through various interventions such as raising interest rates to 24.75 percent and managing foreign exchange trades.

It stepped up its intervention in the FX market with sales at both the official market and to BDC operators who sell dollars on the streets.

The apex bank, which sells $10,000 to each BDC every week, mandated them to only sell at a spread of 1.5 percent, which comes to N1,117 per US dollar.

The rate sold by the BDCs has set a defacto floor for the naira in the black market since the apex bank resumed sales to them in February.

Also, last month the CBN said it had cleared a backlog of $7 billion since the beginning of the year. That was built over the years as the central bank pegged its currency against the dollar, leading to a scarcity of foreign currency that deterred foreign portfolio investment. However, it’s unclear how much dollar debt the CBN retains on its books.

Akpan Ekpo, a professor of economics and public policy, said the CBN’s managed float system in which it is trying to ensure supply and curtail demand is not sustainable in the long term.

He said the CBN needs to be careful with how it depletes the foreign reserves as its main source is oil revenue.

“We need to manufacture non-oil goods and services, export them, and get foreign exchange and not depend on oil income,” he said.

-

Finance3 months ago

Court orders Sen. Victor Umeh to repay N136m bank debt to AMCON

-

Abuja Update2 months ago

Abuja Update2 months agoUNDP, FG partnership needed to achieve inclusion, equity- Minister

-

Abuja Update4 weeks ago

Banks drive stock market performance with N147bn gain

-

Infotech3 weeks ago

Infotech3 weeks agoWorld Backup Day: NITDA urges Nigerians to ensure backup of data

-

capital market2 years ago

Rt.briscoe, FBNH, Others halts negative performance of stock market

-

Health2 weeks ago

Health2 weeks agoImmunisation: FG, GAVI seek synergy with Sokoto Govt.

-

Infotech2 weeks ago

Forex for Beginners: Unveiling the currency exchange and how to trade it

-

Submission Guidelines4 months ago

CALL FOR SUBMISSIONS: POETRY COLUMN-NND