Business

Dangote takes lead, declares N808bn in revenue as BUA, Lafarge report 375bn in H1

By Seun Ibiyemi

Both Dangote cement, BUA cement and Lafarge cement are popular amongst cement producers in Nigeria. Also they are all listed on the Nigerian stock exchange.

The similarity ends here, however,for the 2022 half year review, Dangote cement led the two in all the profitability ratio examined, making it clear winner in respect to this comparison analysis

Turnover growth rate

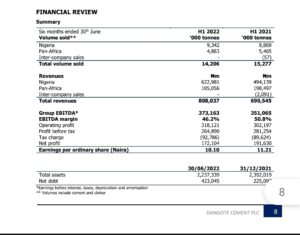

For the 2022 financial half year, Dangote Cement reported N808.04 billion revenue in H1 2022, representing an increase of 17 per cent from N690.5 billion earned in H1 2021. On its part, BUA Cement recorded a revenue of N188.56 billion in H1 2022, representing an increase of 51.7 per cent over N124.3 billion reported in H1 2021.

Also, Lafarge Africa announced N186.6 billion revenue in H1 2022 from N146.02 billion recorded in H1 2021, representing an increase of 29 per cent.

Analysis of the three companies’ H1 unaudited results for the period under review showed that revenue grew by 23.3 per cent to N1.18 trillion from N959.84billion reported in Half year ended June 30, 2021.

With about 14,206,000 tonnes sales volume in H1 2022 from 15,277,000 tonnes reported in H1 2021, Dangote Cement maintained lead in revenue generation, followed by BUA Cement and Lafarge Africa Plc.

Capacity

In terms of capacity, Dangote Cement is Africa’s leading cement producer with nearly 51.6 million metric tonnes/pa capacity across Africa, followed by BUA Cement, the largest producer of cement in North-West, South South and South-East regions; with a combined installed capacity of 11million metric tonnes/pa and with plans underway to increase existing capacity to 20 million metric tonnes/pa, through the commissioning of three new lines.

Lafarge Africa has a current installed cement production capacity of 10.5 metric tonnes/pa and its cement operations in the South West (Ewekoro and Sagamu in Ogun State), North East (Ashaka, in Gombe State), South East (Mfamosing, Cross Rivers State) with Ready-Mix operations in Lagos, Abuja and Port Harcourt.

Specifically, Dangote Cement reported 16.8 per cent increase in cost of sales to N322.46 billion in H1 2022 from N276.12 billion in H1 2021, driven primarily by 31.3 per cent hike in fuel & power consumed that closed H1 2022 at N129.96 billion from N98.98 billion in H1 2021.

The leading cement company also suffered N40.66billion foreign exchange loss in H1 2022 from N4.94billion reported in H1 2021, attributable to dwindling Naira at the foreign exchange market.

For BUA Cement, its production cost rose by 47.4 per cent to N97.5 billion in H1 2022 from N66.16 billion in H1 2021, while Lafarge Africa announced N90.52billion in production cost of sales in H1 2022, representing an increase of 25 per cent from N72.54billion reported in H1 2021.

As a result of increase in production cost and finance expenses, Dangote Cement closed H1 2022 with profit of N172.1billion, representing a decline of 10.2 per cent from N191.63billion in H1 2021.

Contrarily, BUA Cement’s grew its profit by 41.4 per cent to N61.36billion in H1 2022 from N43.4 billion in H1 2021, while Lafarge Africa announced N37.4 billion profit in H1 2022 from N28.32 billion reported in H1 2021.

Reacting on the results, Dr Muda Yusuf said that marginal increase in price of cement impacted on these companies profit declaration in the period under review.

He stressed that these companies might surpasses 2022 performance, given demands by government and domestic use of their products.

According to him,“The demand in the construction sector has contributed to these companies revenue which eventually impacted on profit in the H1 2022. Since there is improvement in government spending as a result of hike in global oil prices and non-oil revenue, we have seen government spending more in infrastructure and it is expected to grow cement sales.

“I know also that some of these companies export to neighbouring countries and it also contributed to their price. Mind you, we have seen hike in prices of cement which is responsible for an impressive profit.”

Analysts at Vetiva research in a report titled, ‘Nigeria H2’22 Outlook: A strange labyrinth,’ explained that over the past six months, overall cement demand has increased, owing to the significant rise in real estate activities from private sector housing constructions as well as ongoing infrastructure construction by the Federal Government.

According to the report, “This was reflected in the sector’s contribution to GDP which improved 4.08ppts q/q to 9.57 per cent in Q1’22. Another factor underpinning this growth is investors’ renewed interest in alternative investment outlets, due to the lowered yields in the Fixed Income market. Consequently, cement producers recorded double-digit revenue growth in Q1’22. For context, backed by increased real estate activities by the private sector, Julius Berger’s building works increased by 85 per cent.

“Cement producers have benefited from the ongoing construction of infractrucure projects, like rail and roads by the Federal Government and the demand for housing infrastructure by the private sector. During the Q1 2022 period, Real estate sector growth expanded by 2.67ppts to 4.14 per cent, reflecting the surge in housing demand.

“Furthermore, raw input costs have remained elevated, driven by persistent FX challenges and rising inflationary pressures. Also, the upward impact of the ongoing Russian-Ukraine crisis on energy prices has caused an increase in diesel and gas prices, which has emerged as a major threat to profitability. To combat these rising cost lines, cement players like Dangote Cement, through its Alternative Fuel Project, and Lafarge Africa, through its subsidiary geocycle, are tilting towards alternative fuels like biomass for cement production in their plants.

“Most of the components of the biomass fuel are locally sourced, reducing their dependence on imported and costly energy sources. Consequently, input cost worries moderated, thereby improving profitability margins. Looking ahead, as the election period draws close, we expect a sustained rise in cement demand, as the current administration aims to complete all ongoing infrastructure projects, which could drive revenue growth for cement manufacturers.”

Business

NDIC sustains fight against corruption with inauguration of ‘Anti-corruption & transparency unit’

By Seun Ibiyemi

The Nigeria Deposit Insurance Corporation (NDIC) has inaugurated its Anti-corruption & Transparency Unit.

“NDIC has a culture of zero tolerance for corruption, which is further strengthened by its core values of Teamwork, Respect and Fairness, Integrity, Professionalism, and Passion,” said MD/CE, NDIC Mr. Bello Hassan.

He was represented by NDIC Executive Director, Operations Mr. Mustapha M. Ibrahim during the inauguration of the Corporation’s Anti-Corruption and Transparency Unit (ACTU) by officials of the Independent Corrupt Practices and Other Related Offences Commi ssion (ICPC) at the NDIC headquarters in Abuja.

He said, the NDIC ACTU has strengthened the Corporation’s operational system through the implementation of various compliance measures to ensure ethics, integrity, transparency and accountability in the workplace.

He explained that the specific measures include robust Internal Controls, regular Risk Assessments, strict adherence to regulatory guidelines, and comprehensive training programs for employees.

Mr. Hassan described the inauguration as a significant step in the Corporation’s ongoing commitment in the fight against corruption and enhance transparency. He emphasised that NDIC Management remains committed to supporting ACTU activities, recognising the unit’s critical role in ensuring the Corporation’s operations are conducted with integrity, free from corruption, and fostering public trust.

The ICPC Chairman, Dr. Musa Adamu Aliyu who was represented by ICPC Acting Director System Study and Review, Mr. Olusegun Adigun, praised NDIC Management for their dedication and active support in establishing and advancing the activities of the ACTU to address corruption issues and foster ethical practices.

He applauded the efficiency and diligence of the NDIC ACTU in fulfilling its mandate, resulting in the Corporation retaining the first position for two consecutive years on the annual ICPC Ethics and Integrity Compliance Scorecard.

He urged the new ACTU members to see their nomination as an opportunity to build on the good legacies of the previous members and to complement Management’s efforts in promoting the core valu es of the Corporation through their assigned duties.

He stressed the need for the NDIC Management to sustain its commitment and support to ACTU so that the Unit can perform optimally and remain a veritable tool in embedding laid down ethical standards amongst staff and sustaining a positive image for the Corporation.

Ten (10) members of staff were sworn in as members of the NDIC ACTU during the inauguration. Their key functions include annual sensitisation of staff against corruption; Conduct of System Study & Review and Corruption Risk Assessment to strengthen internal systems; monitoring budget implementation of the Corporation, co ordinating whistleblowing platforms, identifying and rewarding outstanding members of staff amongst other responsibilities.

Business

IPMAN hinges erratic petrol availability on allocation issues from NNPC

The Independent Marketers Association of Nigeria (IPMAN) says petrol availability has been erratic because of the small allocation currently allotted to its members by the Nigerian National Petroleum Corporation (NNPC).

IPMAN National Vice-President, Alhaji Hammed Fasola, disclosed this in an interview with journalists in Ibadan on Tuesday.

Fasola said the allocation issue has led to haphazard operations by its members, who now buy from third parties (private depot owners) at prices they can no longer afford.

According to him, NNPC has been the one bringing the product to the country and sharing it with major marketers until the involvement of the private depot owners.

He added that there had been a shortfall in the supply of the product because NNPC would naturally supply its retail outlets first.

“That is why you see a kind of on-and-off situation from the independent marketers’ filling stations.

“We still get some trucks directly, but very inadequate to the number of marketers we have.

“We are waiting for when the product will be available, especially through NNPC depots, the Port Harcourt refinery, and by the time Dangote comes up with its petrol, that is PMS.

“We believe that all these problems will be solved,” he said.

However, he said the association would continue to engage NNPC because it had been a long-term partner.

”We are very positive that when things come to normal, they will be giving us our due allocation,” he said.

On the issue of subsidy, Fasola said he believed there was no more fuel subsidy because the government had said so.

Many filling stations are not selling due to the unavailability of the commodity.

Others, who open for business intermittently, sell between N620 per litre to N700 with NNPC retail outlets selling at the official rate but with long queues.

Business

Finance Ministry launches digital incentives, evaluation platform

By Matthew Denis

In a significant advancement to streamline fiscal management, the Honourable Minister of Finance and the Coordinating Minister of the Economy, Mr Wale Edun has announced the integration of the Incentive Monitoring and Evaluation Platform (IMEP) into the Import Duty Exemption Certificate (IDEC) programme, thereby allowing for enhanced monitoring and evaluation.

This is contained in a statement signed by Mohammed Manga Director, Information & Public Relations of Federal Ministry of Finance and made available to NewsDirect on Tuesday.

“The IDEC programme strategically reduces import duty burdens for priority sectors such as manufacturing, agriculture, and healthcare, stimulating economic growth and national development.”

The statement stressed that integrated into the IDEC framework, the newly launched IMEP ensures that only eligible entities benefit, rigorously enforcing compliance and optimising tax expenditures to reduce waste, block leakages and enhance economic equity.

“Key features of the IMEP include an automated claw-back mechanism for recouping waivers from defaulters, real-time e-report generation and a centralised database that enhances the efficiency of our verification processes.

“IMEP aims to ensure that tax incentives are rationalised to deliver maximum economic impact, aligning with the government’s commitment to reducing waste, blocking leakages, and fostering a robust and equitable economic environment. IMEP’s precise monitoring capabilities will significantly enhance the strategic allocation of exemptions and support the government’s objective to ultimately reduce tax expenditures.”

To acquaint all stakeholders with the upgraded IDEC framework, the Ministry of Finance will host a webinar on April 25th, 2024, by 12 noon (WAT). Key industry participants, including manufacturers, importers, and representatives from MDAs and NGOs, have been invited to engage in this session to understand the enhanced features and benefits of the IMEP. Details for the webinar will be available on the Ministry of Finance’s official website and the IDEC YouTube channel.

-

Finance3 months ago

Court orders Sen. Victor Umeh to repay N136m bank debt to AMCON

-

Abuja Update2 months ago

Abuja Update2 months agoUNDP, FG partnership needed to achieve inclusion, equity- Minister

-

Abuja Update1 month ago

Banks drive stock market performance with N147bn gain

-

Infotech3 weeks ago

Infotech3 weeks agoWorld Backup Day: NITDA urges Nigerians to ensure backup of data

-

capital market2 years ago

Rt.briscoe, FBNH, Others halts negative performance of stock market

-

Health3 weeks ago

Health3 weeks agoImmunisation: FG, GAVI seek synergy with Sokoto Govt.

-

Infotech2 weeks ago

Forex for Beginners: Unveiling the currency exchange and how to trade it

-

Submission Guidelines4 months ago

CALL FOR SUBMISSIONS: POETRY COLUMN-NND