Tackling Nigeria’s high food prices: Strategies for mitigating soaring inflation

Amidst the vibrant composition of global commerce, Nigeria stands as a nation grappling with formidable challenges that threaten to stifle its economic aspirations.

The latest findings from Africa’s Pulse, a prestigious biannual survey conducted by a prominent global lending institution, cast a spotlight on Nigeria’s enduring struggle with exorbitant trade costs.

With trade expenses in Nigeria towering four to five times higher than those in the United States, the report paints a portrait of a nation hamstrung by systemic barriers to economic growth and development.

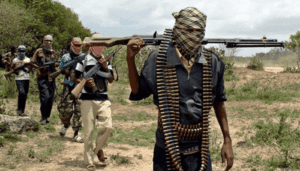

The primary culprits behind these exorbitant trade costs are identified as steep transportation expenses, inadequate road infrastructure, and pervasive insecurity. Addressing these entrenched issues demands urgent and concerted efforts from President Bola Tinubu, his economic team, and security authorities.

It’s worth noting that many of these challenges were inherited by Tinubu’s administration.

Insecurity, for instance, has long plagued the nation, with farmers abandoning their fields due to the threats posed by various forms of violence, including terrorism, banditry, and clashes with herdsmen.

The toll of this insecurity is staggering, with tens of thousands losing their lives and many more falling victim to kidnappings and displacement.

Coupled with Nigeria’s daunting infrastructure deficit, estimated at a staggering $100 billion annually over three decades, the consequences are dire, particularly reflected in soaring food prices.

Currently, food inflation stands at a staggering 37.2 percent, a sharp contrast to the modest 2.20 percent recorded in the United States during March.

Addressing these systemic challenges demands decisive action and innovative solutions to enhance Nigeria’s competitiveness on the global stage and unlock its full economic potential.

While grappling with longstanding trade challenges, President Bola Tinubu’s policies have inadvertently exacerbated the situation. Initiatives such as the removal of petrol subsidies and the floating of the naira, introduced shortly after his inauguration, have catapulted business costs, prices, and inflation to unprecedented heights.

The recent decision to eliminate subsidies for Band A electricity consumers further compounds the issue, with consumers facing a staggering increase from N68 to N225 per kilowatt hour, despite expectations of consistent power supply.

These policy shifts have cascading effects, significantly inflating the cost of production for both domestic and imported goods. Diesel prices, crucial for manufacturing due to unreliable electricity, have surged to an average of N1,600 per litre in the first quarter.

Meanwhile, the impending rise in petrol prices, post-subsidy removal, threatens to push costs even higher, amplifying the financial strain on businesses and consumers alike.

Compounding these challenges is the absence of a robust railway system to alleviate transportation burdens. Hindered by political constraints centralized at the federal level, the railway network remains underdeveloped, leaving a critical gap in Nigeria’s infrastructure landscape.

As the nation grapples with these complex dynamics, finding sustainable solutions demands a holistic approach that addresses both policy missteps and systemic deficiencies. Only through decisive action and strategic investment can Nigeria hope to chart a course towards economic resilience and prosperity.

In the intricate dance of trade dynamics in Nigeria, imported essentials like food, medicines, raw materials, petroleum products, and machinery have taken center stage, their prices soaring to astronomical heights. This relentless surge has dealt a heavy blow to countless organizations and small-to-medium enterprises, pushing many to the brink of closure.

At the heart of this economic opera lies the exorbitant lending rate, standing at a staggering 24.75 percent—a sharp contrast to the more modest 3.76 percent average witnessed in the Euro Area during the same period. This glaring imbalance in interest rates further amplifies the financial strain on businesses, stifling growth and innovation.

Yet, the cacophony of challenges doesn’t end there. Multiple taxation, sluggish port operations, and the stranglehold of government oversight on state-owned enterprises contribute to the symphony of woes plaguing Nigeria’s trade landscape.

Seaports have become bottlenecked corridors, with imported goods languishing in limbo as demurrage fees accumulate—a burden ultimately borne by consumers. Meanwhile, the choreography of trade is disrupted by a chorus of non-state actors, who levy tolls and extort fees from hapless owners seeking to unload their cargo.

In this tangled web of fiscal complexities, the Chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, Taiwo Oyedele, has counted a staggering 200 taxes, a bewildering array that stifles economic vibrancy.

While the government officially collects 62 taxes—divided among federal, state, and local government authorities—another 108 informal or ‘nuisance’ taxes are levied daily by non-state entities, further entangling businesses in a web of financial burdens.

Oyedele center stage, poised to orchestrate a transformational shift towards simplicity and efficiency. With determination coursing through its veins, the committee sets its sights on streamlining the labyrinth of taxes, aiming to reduce the cacophony to a melodious single-digit harmony.

Yet, the fiscal symphony is not without its dissonance. State governments, echoing the Federal Government’s VAT collection efforts, persist in extracting consumption taxes from the same businesses—a redundant cacophony that stifles economic vibrancy.

Meanwhile, the haunting refrain of poorly managed State-Owned Enterprises (SOEs) casts a shadow over Nigeria’s economic landscape. Despite being Africa’s largest crude exporter, Nigeria finds itself importing petroleum and steel products—a paradox born of SOEs mired in a state of dormancy.

To strike a harmonious chord and alleviate the burdens weighing down Nigeria’s trade, President Tinubu must take decisive action. Accelerating efforts to streamline taxation, privatizing SOEs, and embarking on a fervent quest to rebuild infrastructure stand as imperative measures on the path to economic revitalization.

Furthermore, the melody of progress demands a deepening of electricity supply and a symphonic collaboration with sub-national governments to realize the vision of state police—a harmonious fusion of security and governance.