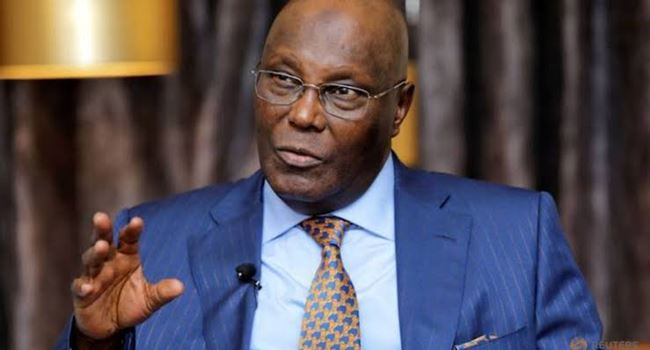

What I would have done differently — Atiku slams Tinubu’s economic policy, offers alternative solution

…Says ‘trial and error’ approach will only lead to more hardship

…Warns overkill reforms will lead to business collapse

…Proposes $10bn economic stimulus fund for MSMEs, calls for robust reform agenda to prevent business collapse

By Sodiq Adelakun & Babatunde Opoola, Abuja

Former Vice-President Atiku Abubakar has criticised President Bola Tinubu’s economic policy, describing it as “trial and error” and alleging that it is causing hardship for Nigerians.

In a statement he personally signed on Sunday, the Peoples Democratic Party’s presidential candidate in the last election alleged that the President Tinubu administration is undertaking a ‘palliative’ economy, something his administration would not have done.

Atiku argued that the president’s reforms are ‘overkill’ and that his administration would have taken a more gradual approach to subsidy removal, similar to that of Malaysia and Indonesia.

He emphasised the need for a robust reform agenda that protects the economy and prevents business collapse.

“We would have planned better and more robustly: My journey of reforms would have benefited from more adequate preparations; more sufficient diagnostic assessment of the country’s conditions; more consultations with key stakeholders; and better ideas for the final destination,” Atiku said.

Atiku further said, “Unleashing reforms to determine an appropriate exchange rate, cost-reflective electricity tariff, and PMS price at one and the same time is certainly an overkill. Add CBN’s bullish money tightening spree. As importers of PMS and other petroleum products, removing subsidy on these products without a stable exchange rate would be counterproductive.

“We would have planned better and more robustly: My journey of reforms would have benefited from more adequate preparations; more sufficient diagnostic assessment of the country’s conditions; more consultations with key stakeholders; and better ideas for the final destination,” Atiku said.

Atiku further said, “Unleashing reforms to determine an appropriate exchange rate, cost-reflective electricity tariff, and PMS price at one and the same time is certainly an overkill. Add CBN’s bullish money tightening spree. As importers of PMS and other petroleum products, removing subsidy on these products without a stable exchange rate would be counterproductive.”

Atiku also highlighted the need to tackle corruption, particularly in the oil sector, and to improve Nigeria’s refining infrastructure.

He criticised the current approach of simultaneous reforms on multiple fronts, arguing, “Unleashing reforms to determine an appropriate exchange rate, cost-reflective electricity tariff, and PMS price at one and the same time is certainly an overkill.”

He suggested that reforms should have been sequenced to ensure fiscal and monetary congruence. Atiku’s proposals include launching an Economic Stimulus Fund with an initial investment of approximately $10 billion to support micro, small, and medium enterprises (MSMEs).

He also advocated for a skills-to-job program aimed at addressing youth unemployment, emphasising the need for extensive public sector reforms to maximise impact.

On the topic of subsidy removal, Atiku reaffirmed his long-standing stance against the current subsidy regime, describing it as “opaque with so much scope for arbitrariness and corruption.”

He outlined a gradualist approach to subsidy reform, drawing on examples from other countries that have successfully navigated similar transitions.

Also, he called for significant improvements to Nigeria’s refining infrastructure and a commitment to privatising state-owned refineries to boost local production capacity.

“We would have commenced the privatisation of all state-owned refineries and ensure that Nigeria starts to refine at least 50 percent of its current crude oil output,” he stated.

Atiku also proposed reforms in the foreign exchange market, advocating for the elimination of multiple exchange rate windows.

He suggested a managed-floating exchange rate system as a balanced approach to currency management.

“I would have led by example,” Atiku concluded, emphasising the importance of transparency and accountability in governance.

“My reforms would wear a human face, offering genuine support to the poor and vulnerable.”