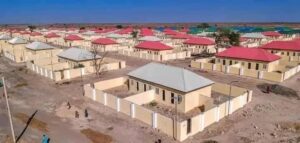

UPDC re-engineers plans to deliver 1,500 housing units

UPDC has re-engineered plans to deliver 1,500 housing units.

Part of this plan is to leverage its over 24 years experience developing first class real estate properties in Nigeria to deliver over 1,500 housing units to the real estate market over the next five years.

The plan leading to the development of the new estates is to be driven by the strategy which Odunayo Ojo, the company’s CEO, revealed at an interactive session with newsmen in Lagos recently.

Ojo disclosed that they took some corporate actions recently one of which was completing the unbundling of the company’s interest in the UPDC Real Estate Investment Trust (UPDC REIT) to its shareholders.

“UPDC, however, holds 5 percent residual stake in the REIT as a sponsor to the REIT,” he said, noting that this action would help UPDC to direct its focus on its core activities while unlocking additional value for its shareholders by granting them direct ownership in a REIT that has paid dividends since its inception.

Ojo added that the company, in 2020, raised about N16 billion through a rights issue, pointing out that the completion of this exercise has strengthened the company’s capital structure, leading to a significant reduction in its debt obligations from about N20.8billion to N5.4billion.

“The impact of this strengthening the capital structure is that it has positioned the company for profitability,” he said.

The most significant of the recent actions UPDC has taken pursuant to its growth strategy is its acquisition by Custodian Investment Plc. This transaction, Ojo said, is complete with Custodian securing 51 percent stake in UPDC and UAC retaining 43 percent stake. What this means is that UPDC is now operating as a subsidiary of Custodian Investment Plc and as an associate company to UAC.

Bond Repayment is yet another recent action taken by UPDC towards its growth plan. It exercised the call option on its bond in April 2021 and this was financed with the aid of an intercompany loan from Custodian and UAC. By this action, “UPDC was able to refinance its debt obligations at a significantly lower cost (16 percent to 9 percent). This will lead to a significant reduction in finance cost going forward,” Ojo predicted.

“We are putting these information out there because we want to tell our own side of the story and set the records right; we want to change the narrative; UPDC now has the capacity to do new developments and we have the right resources to put the company on the path of growth and profitability,” Ojo assured.

A close look at the composition of the company’s board and management staff shows that its human resource is unimpeachable. Ojo, for instance, is a consummate real estate professional that has been involved in property development, asset management, private equity and advisory services for various asset classes including master-planned communities, mixed-use schemes, shopping centres, commercial buildings and hotels.

He has held several roles such as CEO of Alaro City, Director of Development and Projects at Eagle Hills, Abu Dhabi; Development Director at Laurus Development Partners, Vice President at Ocean and Oil Holdings, and Business Manager at UPDC Plc.

A new development which the company says it is using to announce its rebound and return to reckoning is the Pinnock Prime Estate. This, the CEO explained, is a 1 .47-hectare site and service scheme located in Lekki Pennisula II right beside their existing Pinnock Beach Estate.

The new estate, according to him, is envisioned to become a sought-after development and estate of choice within the area, creating a new benchmark for suburban living. It has 18 plots that will be allocated and priced as High Density and Low Density Plots.

Whereas the high density has 5 plots that will accommodate 5 to 7 dwelling units per plot, the low density has 3 plots that will take 2 dwelling units per plot.

Among other facilities, the estate boasts recreational facilities and promises to be an embodiment of lifestyle consisting of pocket parks with a play area; tree-lined street and beautiful landscaping infrastructure such as gatehouse, secured access gate and signage.

In response to market realities, Ojo said they would also be going into mid-income developments that will be targeted at middle-level workers. These will be developed outside their traditional locations including Ikoyi, Victoria Island and Ikeja.

“Going into the future, besides estate development, we will also be focusing on development management in order to render services to other players in the industry, and to guide people who have projects to do but lack the appropriate expertise,” Ojo said.

He added that they would also be doing Asset management, Facilities management and also giving advisory services.

“We are also going to restructure our hotel business and, in the course of 2022, we are going to turnaround the whole company,” he posited.