TotalEnergies Marketing Nigeria: Lifted cost pressures lower profit

By Philemon Adedeji

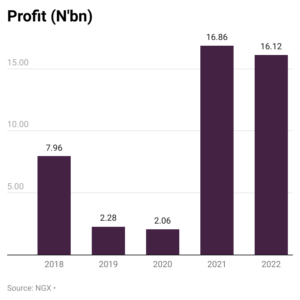

TotalEnergies Marketing Plc delivered a significant increase in dividend payout to shareholders in 2022 Financial year (FY) but lifted cost pressures comprising of cost of sales and finance cost lowered its profit generation in the period under review.

The petroleum marketing company announced N25 dividend to shareholders amid per cent drop in Profit Before Tax (PBT) and Profit After Tax (PAT) by 1.22 per cent and 4.4 per cent in 2022 financial year (FY) respectively.

The Company had earlier distributed the sum of N1.36 billion as interim dividends, representing N4.00 per share in 2022. The board proposes for approval by shareholders the sum of N7.13 billion representing another N21.00 to be distributed as final dividend for the year 2022FY.

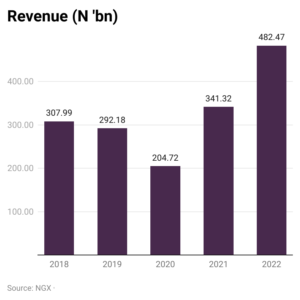

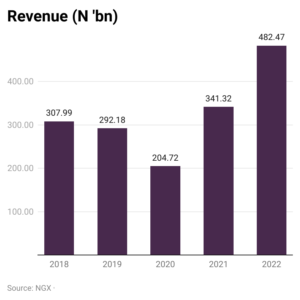

TotalEnergies Marketing in 2022 reported N482.47 billion, representing an increase of 41.4 per cent compared to N341.32 billion recorded in 2021.

There was significant growth recorded across the three revenue segments TotalEnergies Marketing is known for that these are Network, General trade and Aviation.

Its network business appreciated by 25.35 per cent to N226.76 billion in 2022 from N180billion in 2021; General trade rose by 48per cent to N188.16 billion in 2022 from N126.3 billion in 2021 and Aviation increases significantly by 97per cent to N67.55 billion in 2022 from N34.13 billion in 2021.

The largest contribution was from the increase in sales of both Petroleum Products and Lubricants (+22.17 per cent) and others (+32.60 per cent to the network segment.

The growth in revenue was driven by the price increases in fuel products caused by the geopolitical tensions and the intermittent fuel scarcity.

Elsewhere, cost of sales significantly increased 47.49 per cent to N422.29 billion in 2022 compared to N286.32 billion in 2021, driven by significant surge in inventory cost 102.98 per cent.

This brings gross earnings to N60.18 billion in 2022 from N55 billion reported in 2021. Thus, gross profit margin declined by -3.64 per cent to 12.47 per cent, as the increase in input cost surpassed the revenue growth.

Moving down to TotalEnergies Marketing Nigeria profit and loss figures, administrative expense and selling and distribution costs increased by 7.23 per cent and 14.57 per cent while other income declined by 22.25 per cent due to a significant decrease in net foreign exchange gains by 96.68 per cent.

Nonetheless, operating profit increased by 7.34 per cent to N27.67 billion in 2022 from N25.77 billion in 2021 which can be attributed to the positive impact of N40.19 million made from financial assets in 2022.

Elsewhere, net finance cost expanded by 234.03 per cent to N3.14 billion in 2022 from N938.62 million in 2021, as finance cost appreciates by 204.70 per cent to outweighed finance income that gained 171.58 per cent.

As such, Profit Before Tax declined by 1.22 per cent to N24.53 billion in 2022 from N24.84 billion in 2021 while Profit After Tax followed suit by 4.41per cent to N16.11 billion in 2022 from N16.86 billion reported in 2021 Financial year.

The same performance was reported by the company in first quarter (Q1) ended March 31, 2023.

Profit Before Tax closed Q1 2023 at N6.42 billion from N6.55 billion reported in Q1 2022. Following a tax expense of N2.26 billion, Profit After Tax printed N4.16 billion in Q1 2023 from N4.37 billion reported in Q1 2022.

Net finance cost increased significantly to N858.19 million in Q1 2023 from N77.64 million in Q1 2022 due to a 110.6 per cent increase in finance cost, outpacing the slight 9.1 per cent increase recorded from finance income.

Specifically, the higher finance cost was driven by increased expense on interest on import (339.6 per cent to N893.88 million) and other (+33.3 per cent to N686.83 million loans).

Trade and other payables contribute 74 per cent to total liabilities

Totalenergies Marketing Nigeria recorded significant increase in its Trade and other payables that impacted on Total current liabilities in 2022.

Trade and other payables increased to N190.09 billion in 2022, an increase of 41.3 per cent from N134.55 billion. It contributed about 74 per cent of the total liabilities in 2022 from 81 per cent in 2021.

As total Current Liabilities moved to N247.96 billon in 2022 from N159.44 billion in 2021, total non-current liabilities stood at N9.57 billion in 2022 from N7.67 billion in 2021.

Total Non-current Assets increased to N51.98 billion in 2022 from N49.55 billion as current assets closed 2022 at N255.83 billion from N159.18 billion reported in 2021.

This brings its total assets to N307.82 billion in 2022, representing an increase of 47 per cent from N208.73 billion in 2021.

Conclusion

According to analysts at Investment One Research, “Total’s financial performance remained resilient, regardless of the high cost of sales.

“Going forward, we believe that the anticipated petrol deregulation/subsidy removal should further support the company’s revenue in the near term. However, the elevated inflationary pressures and the significant finance cost are a downside risk to bottom line performance.”