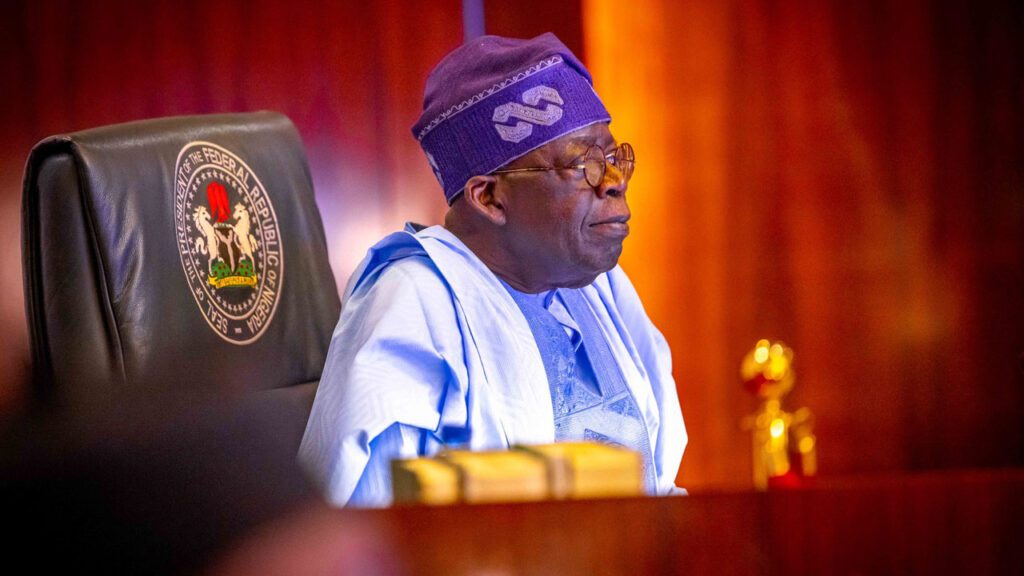

In a move to revamp Nigeria’s tax administration, President Bola Ahmed Tinubu has sought the approval of the National Assembly to rename the Federal Inland Revenue Service (FIRS).

The President is also seeking the passage of three other bills to aid his tax reforms.

Recall that President Tinubu upon assumption of office had approved the establishment of a Presidential Committee on Fiscal Policy and Tax Reforms.

The committee comprises experts from both the private and public sectors and have responsibility for the various aspects of tax law reform, fiscal policy design and coordination, harmonisation of taxes, and revenue administration and it is headed by a renowned Tax Leader, Mr. Taiwo Oyedele.

One of the reforms is seeking to rename the Federal Inland Revenue Service (FIRS) to the Nigeria Revenue Service (NRS).

The name-changing bill for FIRS is contained in the letter read on the floor of the Senate by its President, Godswill Akpabio, and the Speaker, House of Representatives, Tajudeen Abbas.

Entitled “The Nigeria Revenue Service (Establishment) Bill,” according to President Tinubu, it seeks to repeal the Federal Inland Revenue Service (Establishment) Act, No. 13, 2007, and establishes the Nigeria Revenue Service, to assess, collect, and account for revenue accruable to the government of the federation.

Another reform bill in the letter entitled “Transmission of Fiscal Policy and Tax Reform Bills to the National Assembly,” is The Nigeria Tax Bill, which seeks to provide a consolidated fiscal framework for taxation in Nigeria.

Also, there is the Nigeria Tax Administration Bill. It seeks to provide a clear and concise legal framework for the fair, consistent and efficient administration of all the tax laws to facilitate ease of tax compliance, reduce tax disputes and optimise revenue.

Furthermore, there is the Joint Revenue Board (Establishment) Bill. It aims to establish the Joint Revenue Board, the Tax Appeal Tribunal and the Office of the Tax Ombudsman for the harmonisation, coordination and settlement of disputes arising from revenue administration in Nigeria.

According to President Tinubu, the proposed tax bill presents substantial benefits to a library, government connectives and economic growth by enhancing taxpayers compliance, strengthening fiscal institutions, and fostering a more effective and transparent fiscal regime.

The President said, “In this, I am confident that these bills, once passed into law, will encourage and stimulate the economy.

“While I pray that the House of Representatives will, in their usual expeditious manner, consider and enact these bills into law, please accept, Mr Speaker, the assurances of my highest consideration and regards.”