SEC to unveil recapitalisation framework for banks

The Securities and Exchange Commission has announced plans to release a framework that will guide the capital market in the proposed recapitalisation exercise by banks.

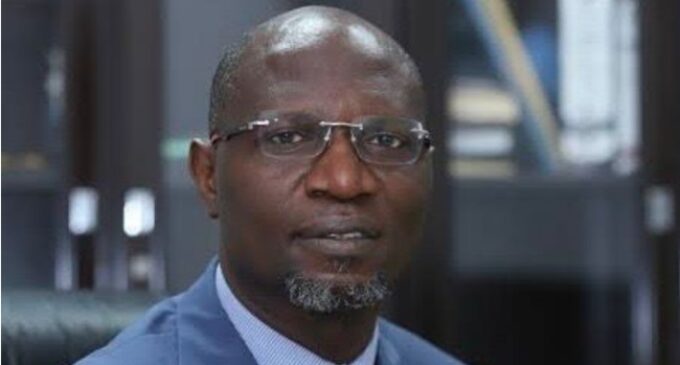

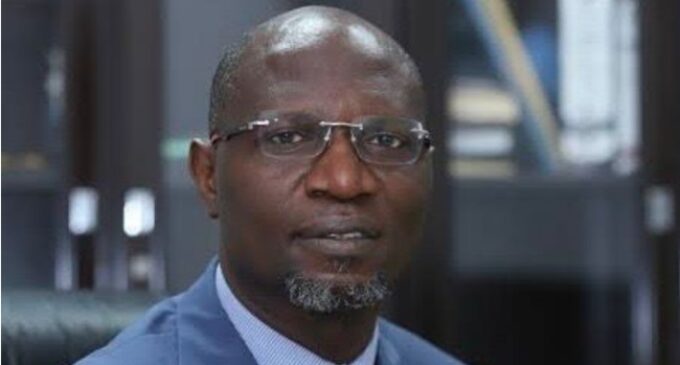

The acting Director General of the SEC, Emomotimi Agama, disclosed this during a meeting with the executives of the Institute of Capital Market Registrars in Abuja on Friday.

He stated that to guarantee that all outstanding matters were settled in the best interests of the market, the commission was prepared to communicate with different sectors of the capital market.

“We are on top of the issues around the recapitalisation exercise. Very soon, we will come up with a framework to guide the market. The idea is to interact with you all. There may be things hanging, and due to the transition, we do not want to miss anything. It will still be attended to in the interest of the market.

“We will come up with a framework to move the market. We are in this together, and we will continue to work and do our best. This is our constituency, and we will do our best. We crave your cooperation to help us deal with major challenges.”

He urged the registrars to adopt technology to guarantee that the problem of unclaimed dividends in the capital market was resolved.

“Unclaimed dividends are a monster that we must deal with now. Whatever it will take to deal with it, we must do it. We must embrace technology as one of the ways to deal with it.

“Let us put our thoughts together and provide a workable solution; let us ensure that this becomes a thing of the past. We need to provide a solution, and the time is now. As custodians, we implore you to provide practicable steps to address this issue,” he stated.

According to SEC’s acting Executive Commissioner of Operations, Bola Ajomale, technology adoption is the most effective approach to guarantee punctuality and sanitise the system.

The President of the institute, Seyi Owoturo, noted that the registrars would act in the capital market’s best interests.

“I congratulate the new SEC management on their appointment, and I pledge that the registrars will continue to work in the interest of the capital market,” he averred.