Oando-Agip $783m deal followed due process — NUPRC fires back at Atiku

By Seun Ibiyemi

The Nigerian Upstream Petroleum Regulatory Commission (NUPRC) on Monday approved the acquisition of Nigerian Agip Oil Company (NAOC) $783m acquisition by Oando Plc saying it conformed with current legislation and due procedure.

The Head of the Upstream Regulator’s Public Affairs Unit, Olaide Shonola said in a statement that NUPRC’s declared commitment to openness and faith in the public’s right to know about its regulatory actions made the explanation imperative.

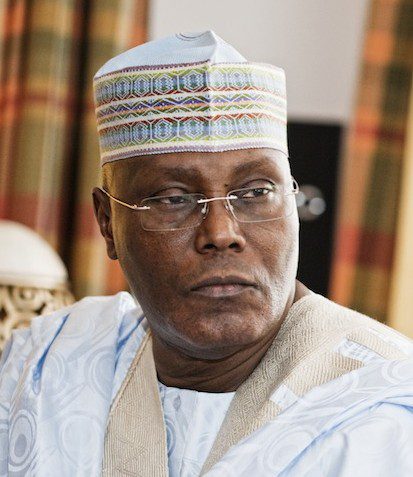

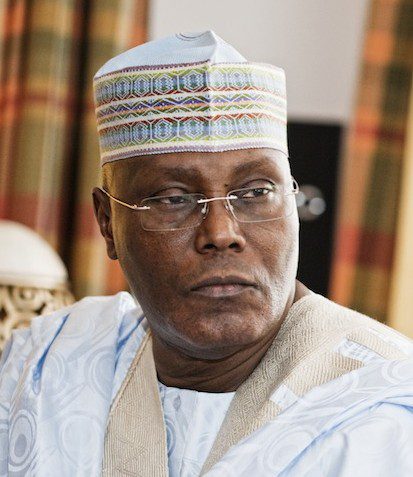

Recall that the former Vice President Abubakar Atiku had raised doubts over the expedited nature of the deal saying that President Bola Tinubu’s relationship with the CEO of the local oil company, Wale Tinubu caused the sale to be unnecessarily hurried.

Reacting, NUPRC disclosed that, “The commission wishes the public to be aware that the approvals given to the NAOC-Oando and Equinor – Chappal divestments were in accordance with the Petroleum Industry Act (PIA) 2021, defined regulatory framework, and standard consent approval process set by the Commission under the PIA.”

As for the divestment by Mobil Producing Nigeria Unlimited (MPNU) to Seplat Energy Offshore Limited (Seplat), which Atiku said was being unduly delayed, the statement noted that it is also currently undergoing the same consent approval process and is expected to be completed within the 120-day timeline provided by the PIA.

“Furthermore, the commission’s thorough evaluation and due diligence process, anchored on the Seven Pillars of the Divestment Framework, ensured that potential assignees were capable and compliant with legal requirements and that all legacy liabilities were identified and appropriately managed.

“The commission subsequently made recommendations to the Honourable Minister of Petroleum Resources based on comprehensive assessments which covered the timeline for review of application under the PIA and the commission’s regulatory process,” the upstream regulator pointed out.

On a comparative basis, it said that MPNU through a letter dated February 24, 2022, notified the commission of its intention to assign 100 per cent of its issued shares to Seplat Offshore Energy Limited.

It said the commission did not consent to this assignment because MPNU failed to obtain a waiver of pre-emption rights as well as the consent of NNPC, its partner on the blocks to the divestment.

“It is worth pointing out that NNPC’s right to pre-emption and consent under the NNPCL/MPNU Joint Venture Joint Operating Agreement was the subject of Suit No: FCT/HC/BW/173/2022 Nigerian National Petroleum Company Limited versus Mobil Producing Nigeria Unlimited, Mobil Development Nigeria Inc., Mobil Exploration Nigeria Inc. and Nigerian Upstream Petroleum Regulatory Commission,” it added.

But in June 2024, NNPC and MPNU, the commission said, resolved their dispute through a letter dated June 26, 2024, informing the commission of the resolution of the dispute.

“Upon resolution of this dispute, the commission communicated its no-objection decision to the assignment via a letter dated July 4, 2024 and requested MPNU to provide information and documentation required under the commission’s due diligence checklist to enable the Commission conduct its due diligence as required under the PIA.

“MPNU by letter dated July 18, 2024 provided the information requested by the commission. Accordingly, MPNU’s application to the commission for consent is currently undergoing due diligence review, under the same divestment framework applied to the NAOC-Oando and Equinor-Chappal divestment.

“The commission’s due diligence process is ongoing and within the 120-day timeline required by the PIA,” it added.

Meanwhile, the African Energy Chamber AEC has hailed the deal describing it as a milestone transaction.

According to the AEC Executive Chairman, NJ Ayuk, it affirms the influence of local exploration and production companies and their unwavering belief in harnessing the full scope of Africa’s energy resources.

“Oando is delivering on its pledge to expand upstream investments and its position in Nigeria’s oil and gas sector.

“The AEC congratulates and supports Oando on the successful completion of this milestone transaction, as it affirms the influence of local exploration and production companies and their unwavering belief in harnessing the full scope of Africa’s energy resources.

“We look forward to unpacking this deal and its many implications for the sector at this year AEW,” NJ Ayuk said.