NPA secures $700m facility from Citibank to rehabilitate Apapa, Tin-Can Ports

By Seun Ibiyemi

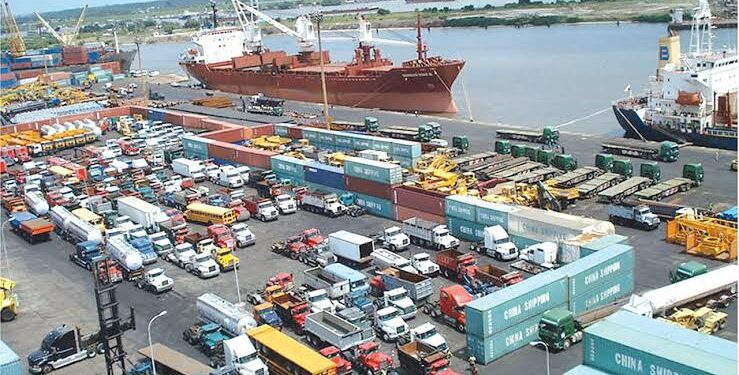

The Nigerian Ports Authority (NPA) has negotiated a loan of $700million from Citibank to be funded by the UK Export Finance (UKEF), an export credit agency, to rehabilitate the Apapa and Tin-Can Island ports, Lagos.

The Ports Authority has also opened a discussion with another funding agency to secure financing for upgrading of the Eastern Ports including Calabar, Warri, Onne and Rivers Ports as well as the reconstruction of Escravos breakwater.

Speaking in Lagos on Wednesday during the signing of a mandate letter with Citibank Nigeria, Managing Director of the NPA, Mohammed Bello-Koko, said the mandate letter will be sent to the Debt Management Office for final review and approval.

He said the funds are ready and the reconstruction of the Lagos Ports will start soonest even as the NPA perfects plans to sign another mandate letter for the upgrading of the Eastern Ports in about a month.

“In the last two years, the Federal Government has realised the need for us to rehabilitate and reconstruct the ports all over the country. We have been having discussions with multilateral funding agencies who have sent various proposals that we have reviewed.

“What we did is to further discuss with interested parties and we realised it is better to separate the ports in Lagos from the ports in the East, and we are in discussion with other funding agencies to fund the construction of ports outside Lagos,” the NPA MD said.

According to him, the Citibank facility is the cheapest for the Ports Authority because it comes with affordable interest rates.

“Port efficiency is not about automation which we have already begun, it’s also about the physical infrastructure, which must be in place and that’s why we are automating. Automation will naturally bring efficiency, increase revenue and plug leakages,” he added.

Bello-Koko said that the NPA is putting the Port Community System in place, which is a platform that will improve trade facilitation.

“Currently in Nigeria, importers or exporters fill up to 30 to 40 forms for one transaction but the Port Community System will reduce the numbers of forms, human interference and ensure speedy clearance process in or out of the country,” he added.

Earlier, Managing Director of Citibank Nigeria Limited, Ireti Samuel-Ogbu, said the bank is committed to supporting NPA and the Federal Government in bridging infrastructure gaps.

“We are absolutely delighted to be partnering with NPA especially being the collection bank for foreign and local currency port levies. Now, supporting this strategic initiative through export credit financing to upgrade port infrastructure in Tin-Can and Lagos Ports is commendable. However, we are committed in supporting NPA and the Nigerian Government in all its endeavours especially in the infrastructure space,” Ireti Samuel-Ogbu stated.

According to her, Citibank was opportune to have met with Wale Edun, Minister of Finance, a few weeks ago where the port upgrading project was mentioned and he was very delighted about the project.

“Since NPA generates its own foreign revenue, we will be able to support foreign facilities from our resources because this project is very strategic and an important project for NPA and the country at large.

“We are looking forward to this project and we thank NPA for giving us this opportunity and hope to bring this into fruition as soon as possible,” Samuel-Ogbu added.