NACCIMA seeks legislative action for establishment of ‘Customs, Excise Duties Appeal Tribunal’

The Nigerian Association of Chambers of Commerce, Industry, Mines and Agriculture (NACCIMA) has called for a legislative action to establish an independent appeal ombudsman to be known and called Customs and Excise Duties Appeal Tribunal.

The tribunal will serve as a vehicle for resolution of disputes arising from, relating to, and connected with assessment, payment and collection of duties and tariffs by the Nigeria Customs Service, thereby making going to court unattractive and as a last resort.

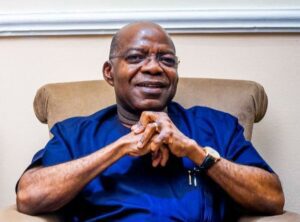

It is in pursuance of this, that the National President of NACCIMA, Ide John Udeagbala, held several advocacy meetings with the Chairman of the Senate Committee on Customs, Excise & Tariff, Senator Francis Alimikhena, requesting the Committee to present a Bill for the Amendment of the Customs and Excise Management Act to allow for the establishment of an appeal tribunal.

In response to this request, the House of Representatives Committee on Customs & Excise invited NACCIMA and key stakeholders to a Public Hearing and Call for Memoranda on a bill for an Act to repeal the Customs & Excise Management Act, CAP. C45, Laws of the Federation of Nigeria 2004, and to Enact an Act to Establish the Nigerian Customs Service and other Related Matters Act 2021.

Udeagbala who was represented by 1st Deputy President of Abuja Chamber of Commerce, Chief Emeka Obegolu presented a position paper for NACCIMA.

While making his presentation, Udeagbala stated the need for a Customs & Excise Duties Tribunal by shedding light on growing conflicts/disputes between Nigeria Customs Service and importers/investors on matters of product valuation and harmonized system of product classification (HS code), among other issues.

“The situation has made port users that have options to shun our ports. It has also presented myriad of difficulties for importers/investors and discouraged trade and investment.”

Udeagbala further cited examples of existing tribunals for similar revenue agencies like FIRS which has Tax Appeal Tribunal, and Securities Exchange Commission (SEC) which has Securities & Exchange Tribunal; and urged the Senate Committee to move for the establishment of a Customs appeal system in accordance with the provisions of Chapter 10 of the General Annex to the Revised Kyoto Convention of which Nigeria has assented.