Manufacturers query introduction of 7.5% VAT on diesel

The Nigerian business community has pleaded with President Bola Tinubu to allow reforms to settle down before implementing new ones.

The call came on the heels of the reintroduction of a 7.5 per cent Value Added Tax (VAT) on diesel imports into the country by Nigerian customs.

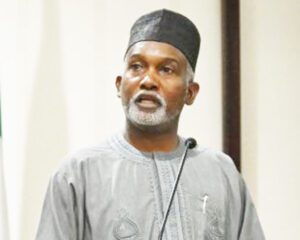

The former President of the Lagos Chamber of Commerce, Mr. Muda Yusuf, made this call in an interview with journalists.

He opined that it is not a good time for the Federal government to reintroduce any taxes on energy in the country considering the PMS industry was just deregulated and the unification of the exchange rate by the Central Bank.

In his words, “although diesel and some other petroleum products have been deregulated, this is not a good time to reintroduce taxes or duties on energy as the government just removed the subsidy on fuel.

“The new administration should give policies and reforms time to settle down- we don’t even know where the subsidy removal and unification of exchange rate will land us, and a 7.5 per cent VAT is being introduced to diesel.”

He further said the savings the government will make from the subsidy removal should be channelled into sectors like electricity.

He said, “The savings from subsidy removal should be able to meet up government expenditures. Rather than introduce more taxes, the government should instead be thinking of some measures to alleviate stress on businesses.”

When quizzed on the effect of the new VAT on diesel on prices of goods and services and the general cost of production.

“It will be difficult to give an estimate on the potential percentage increase a 7.5 per cent VAT will cause on goods and services. However, energy cost as a representation of the total cost of production is around 25 per cent and 30 per cent.

“Going by this, a 7.5 per cent VAT on diesel might result in something around 5 per cent to 10 per cent increase in the cost of locally manufactured goods.”

He also expressed fears that a new VAT on diesel could erode the profit margins of manufacturers if they refuse to increase the prices of goods and services.

He further said the government can introduce VAT on energy at such a time when electricity is stable.