ICPC tightens noose on real estate developers, others for Illicit financial flows

The Chairman of the Independent Corrupt Practices and Other Related Offences Commission, Prof Bolaji Owasanoye gave credence to this when he said that, “Corruption, illicit financial flows, tax evasion have resulted in massive resource leakages which have hampered Nigeria’s development.”

He spoke at a capacity building workshop organised by the ICPC for investigators, prosecutors, and tax inspectors on investigating/prosecuting IFFs.

This workshop was targeted at building the capacity of the ICPC to check leakages and ensure there are more resources for the development of the country.

It is also part of a determined effort of the current leadership of the Commission to tackle the menace of IFFs which had affected the economy negatively.

The ICPC Boss said that Illicit Financial Flows impact a country’s economic and social development in a myriad of ways.

He said that undocumented flights of wealth to and from — as well as within — a country have severe repercussions on government revenues, noting that this wealth could otherwise have been invested in public spending and other forms of economic and social reforms.

Owasanoye told participants at the workshop that Nigeria is losing billions of dollars from expected revenue due to poorly structured contractual agreements and tax laws which encourage illicit financial flows by multinational corporations.

He said, “The drain on resources and tax revenues caused by IFFs has thwarted the expansion of basic social services and infrastructure programmes that are targeted at improving the wellbeing and capacities of all citizens, in particular, the very poor.

“IFFs in many developing countries, including Nigeria, mean fewer hospitals, schools, roads and job opportunities, as well as lower pensions. It is for these reasons that States must place significantly higher priority on seizing and confiscating illicitly obtained assets, and to channel such recovered assets to high-priority development needs.

“New paradigms and policies to counter IFFs must be established to produce an unbroken chain of work from tracing, freezing, seizure, confiscation and recovery of illicitly-obtained assets, through transparent management and liquidation of such assets, to distribution of the proceeds to high-priority development needs.

“It is this mechanism and paradigm that will enable countries to capture billions in assets and to directly channel them into, for example, more schools, hospitals, community clinics and infrastructure, as well as the much-needed payment of salaries for teachers, nurses and doctors. Such policies also can enable States to significantly reduce youth unemployment.”

The Chairman of the inter-agency committee on stopping illicit financial flows in Nigeria, Dr. Adeyemi Dipeolu, who also spoke at the event identified poorly negotiated and hidden contract as one of the most identifiable ways through which IFFs are perpetrated.

However, he offered practical tips for successful negotiations and stressed on the need to have a strong inter-disciplinary committee.

Adeyemi further noted that training was necessary to develop a group of Nigerian officials skilled in international negotiations in general.

He emphasised that the capacity building is being organised to help investigators, prosecutors, and tax inspectors cope with international obligations.

Adeyemi said, “We want to develop core people who will make sure that agreement signed for the country and government do not lead to illicit financial flows.

“It is very important that you pay close attention to the other causes on disputes settlement matters, the agreements must comply with Nigeria’s legal regulations.”

Adeyemi advised the participants at the workshop to focus on areas of disputes during negotiations of contract agreements.

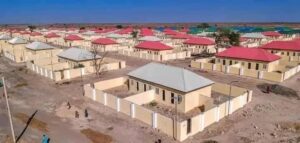

But the Director, Asset Tracing, Recovery and Management of the ICPC, Adedayo Kayode revealed that the Commission has commenced investigation into hundreds of real estates scattered in the Federal Capital Territory over suspected illicit financial flows.

In his paper on ‘Illicit Financial Flow in Real Estate’ delivered at the workshop, he said the probe will identify the property that was being funded with illicit financial flows.

As at 2012, the National Bureau of Statistics said the country’s housing gap was around 17 million housing units.

According to him, filling the gap has made the real estate sector lucrative. while it has also promoted illicit financial flows. He accused some real estate investors of concealing illicit financial flow in the sector.

According to him, most empty estates in the FCT were developed through illicit financial activities, adding that the nation needed a coordinated and concerted approach to fighting IFFs.