How 10trn intervention funds by previous administrations damaged Nigeria’s economy — Cardoso

…As CBN raises benchmark interest rate to record 22.75%

…Forensic analysis fingers $2.4bn false FX claims

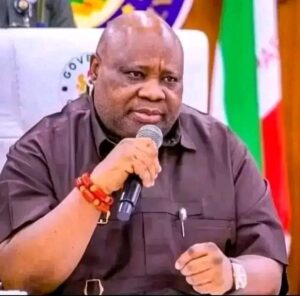

The Governor of the Central Bank of Nigeria (CBN) has explained that an estimated sum of N10 trillion naira interventions funded by the CBN by previous administrations has done a great harm to the economy.

Speaking during the first Monetary Policy Committee (MPC) meeting of the year, Cardoso noted that the interventions dome in time past has two dysfunctions.

According to him, the interventions are time wasting and are areas the CBN has no business dealing with since it lacks expertise.

He also added that the interventions created a lot of distortions in the economy through inflows of money supply.

“The interventions are estimated to be over 10 trillion naira. What was the budget of the federal government of Nigeria? What was the budget of the largest state in Nigeria? This would tell you the extent of damage it has done to the economy,” he lamented.

Recall that Cardoso last year at the Annual Bankers dinner held in Lagos said the CBN under his watch will not focus on programmes outside its mandates.

He said, “I am aware that events over the past few years have also put the CBN in a bad light. These issues can be attributed to various factors, such as corporate governance failures, diminished institutional autonomy of the Central Bank of Nigeria, a deviation from the core mandate of the Bank, unorthodox use of monetary tools, an inefficient and opaque foreign exchange market that hindered clear access, a foray into fiscal activities under the cover of development finance activities. There was also a lack of clarity in the relationship between fiscal and monetary policies, among other challenges.

“Hitherto, the CBN had strayed from its core mandates and was engaged in quasi-fiscal activities that pumped over 10 trillion naira in the economy through almost different initiatives in sectors ranging from agriculture, aviation, power, youth and many others. These clearly distracted the Bank from achieving its own objectives and took it into areas where it clearly had limited expertise.

“Under my leadership, the Central Bank of Nigeria will vigorously address these issues. We will tackle institutional deficiencies, restore corporate governance, strengthen regulations, and implement prudent policies. We assure investors and the business community that the economy will experience significant stability in the short-to-medium term as we recalibrate our policy toolkits and implement far-reaching measures,” He had promised.

His recent statement, thus, brings even more limelight to his fidelity to focus strictly on monetary policy.

…As CBN raises benchmark interest rate to record 22.75%

Following the two-day meeting, Cardoso stated that the committee had unanimously agreed to adjust the asymmetric corridor around the Monetary Policy Rate (MPR) to +100 to -700 from the previous range of plus 100 to -300 basis points. Additionally, the cash reserve ratio was raised from 32.5 percent to 45 percent.

Addressing journalists at the end of the two-day meeting in Abuja, Cardoso said the committee voted to adjust the asymmetric corridor around the MPR to +100 to -700 from plus 100 to -300 basis points and raised the cash reserve ratio from 32.5 percent to 45 percent.

He said, “All 12 members of the committee decided to further tighten monetary policy by raising the MPR by 400 basis points to 22.75 percent from 18.75 percent. Adjust the asymmetric corridor around the MPR to +100 to -700 from plus 100 to -300 basis points.”

“The committee also raised the cash reserve ratio from 32.5 per cent to 45 per cent while retaining the liquidity ratio at 30 per cent.”

At the last meeting in July 2023, the MPC, headed by the former acting governor of the apex bank, Folashodun Shonubi, increased the monetary policy rate by 25 basis points to 18.75 percent, from 18.5 percent in May last year.

The capital requirement ratio was retained at 32.5 percent while the liquidity ratio stood at 30 percent.

Since then, the MPR has risen from 13 percent in May 2022 to 18.75 percent in July 2023 when the last MPC was held.

Analysts’ expectations had been divergent ahead of the first MPC meeting, but the new rate surpassed all projections by financial experts.

According to a Reuters poll released on Friday, Nigeria is expected to implement two aggressive interest rate hikes in less than two months to control inflation and strengthen the naira, following a few missed monetary policy sessions.

It said the policy rate is expected to increase by 225 basis points to 21.00 percent despite the local currency still trading near its record low on the black market.

President Bola Ahmed Tinubu had said interest rates needed to be reduced to increase investment and consumer purchasing in ways that sustain the economy at a higher level.

…As forensic analysis reveals $2.4bn false FX claims

The Governor also disclosed that contrary to wide speculations $2.4 billion of FX claims were not valid after the bank instituted a forensic audit of the claims.

Cardoso made this known when he announced that the Apex Bank has paid an additional $400 million of valid foreign exchange (FX) backlog to individuals and businesses who were genuinely identified.

He stated, “In terms of the backlog, we are committed to clearing the backlog of identified and genuine requests that are pending. We are committed to doing that and I can tell you that just today, we paid out $0.4 billion to those that were identified, and we are committed to continuing doing so in one form or the other to those genuinely identified and proven cases.”

The Governor of the CBN upon assumption into office was faced with an FX backlog in the region of $7 billion. However, the Governor stated in an interview that the legitimate FX obligation of the bank stood at over $4 billion of which the bank had cleared around $2.3 billion with up to $2.2 billion remaining.

Under the guidance of Yemi Cardoso, the CBN has implemented a series of reforms with the goal of rebuilding trust in the bank, stabilising the naira, and managing inflation.