By Esther Agbo

Overview

Nigeria’s housing market, a critical component of its economy, reflects the broader economic trends and challenges facing the country. Despite significant obstacles, including economic volatility and a substantial housing deficit, the sector exhibits resilience and potential for growth.

Nigeria’s housing market, as highlighted by recent statements from the Minister of Housing and Urban Development, Ahmed Dangiwa, holds immense potential to drive economic growth, potentially unlocking a $1 trillion economy.

The Minister’s recent statements emphasised on the transformative power of the housing sector.

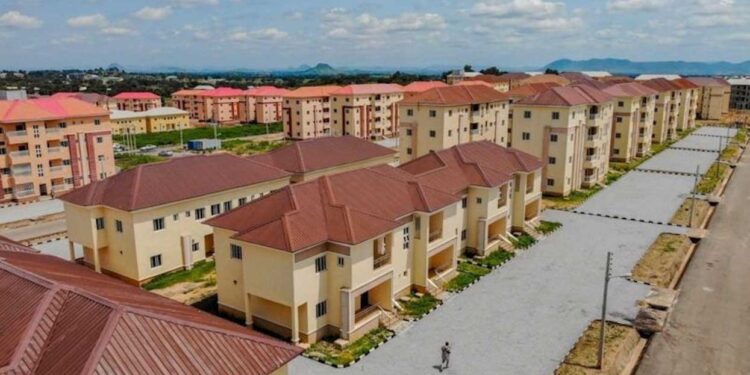

The Renewed Hope Estate projects, launched across various states, are designed to provide affordable housing while stimulating local economies. For example, the 250-unit project in Akwa Ibom aims to create over 6,500 jobs, highlighting the sector’s capacity to generate employment and spur economic activities.

Current state of the housing market, trends and challenges

The Nigerian housing market is however influenced by rapid urbanisation, population growth, and evolving economic policies. Nigeria is one of the fastest urbanising countries globally, with an urban population expected to reach 300 million by 2050. This rapid urbanisation fuels the demand for residential properties, creating opportunities for investors and developers.

Despite this demand, the housing sector faces a significant deficit, estimated at 28 million units in 2023, up from 14 million in 2010. The lack of affordable housing remains a critical issue, driven by economic challenges and insufficient government intervention.

An exclusive interview with the National Public Relations Secretary of the Nigeria Institute of Town Planners and Chairman of the Association of Town Planning Consultants of Nigeria, Lagos State Branch, Dr. David Olawole, provides a critical perspective on the current trends in Nigeria’s housing market.

He noted a significant decline in housing stock due to skyrocketing building material costs, making it difficult for the average Nigerian to afford new homes. This situation has exacerbated the housing deficit, currently estimated at 28 million units, requiring an investment of over N21 trillion.

He said, “When you talk about the current trends in Nigeria’s housing market and if you want to compare it to the previous years, the current housing market in Nigeria, to my own understanding, is not the way it used to be in the previous years because the cost of building materials at the moment is not something that a common man can conveniently afford.

“So as a result of that, it has drastically reduced the housing stock in the country at the moment. So compare this current housing trend with the previous years, you will see that it has drastically dropped. So there is a sharp drop in the housing provision in the country.”

Government policies and private sector involvement

Government efforts, while commendable, have not been sufficient to address the housing deficit comprehensively. Dr. Olawole emphasises the need for a robust public-private partnership (PPP) framework. Effective PPPs can leverage the strengths of both sectors, with the government providing land and regulatory support and private developers bringing in capital and technical expertise.

Dr. Olawale said, “Developers are trying, but you should have it in mind that what every business owner will have at the back of our mind is to make profit, to maximise profit, and that is the best a private developer can do.

“So, coming together the public-private partnership really contributes a lot to the development of affordable housing projects in the country, because, you know, when it comes to public-private partnership, government will provide maybe land, and private developers will come in and develop the houses, and at the same time, they come up with the sharing formula, the strategy of how the individual wants to equip his or her own funds contributed to the development of the housing.

“But in Nigeria, when we look at it, are we really achieving that? Are we really achieving that? Because the scope and the terms of reference, when it comes to public-private partnership, is not really favourable to some developers, and that’s why some of them are opting out, or at the end of the day, they provide the houses with low quality. So, that is another issue.”

However, current regulatory and tax policies have been deterrents rather than incentives for private sector investment. High taxes and stringent regulations have driven many developers away, further straining the housing market.

“Of course, the government is trying, but there is little that the government can do. The ideal thing should be both government and private sectors coming together in addressing the housing deficit in the country, whereby governments provide a certain percentage and private developers, private sectors also provide a certain percentage. That will help us to meet with the housing demand in the country. But the way it is, based on the current housing market, there is a problem, especially when you talk of the housing provision in the country.

“Even the government is finding it difficult to provide affordable housing this time around. You discover that houses that are not supposed to be more than probably 5 million, getting those kinds of flats from the government, are now running to about 20 million. How many people can afford that? So there is a serious issue in addressing the housing deficit in the country.

“However, both governments and the private sectors are supposed to come together. And if you look at the policies, especially the taxes, it is driving a lot of private sectors away from housing provision in the country,” Dr. Olawale stated.

Moreover, improving mortgage accessibility and financing options is crucial for expanding homeownership. In advanced economies, accessible mortgage facilities allow individuals to own homes without significant upfront capital. Nigeria needs to adopt similar strategies, ensuring that mortgage facilities are available and affordable to a broader population segment.

“Somebody who has not eaten, how do you expect such a person to be thinking of building a house? Where will he get the resources from? And that is why if the government is really doing the right thing by making sure that the mortgage facility is accessible to everybody, you have the finances that you can use to provide shelter for yourself, and you pay back over a longer period of time. There is nobody that doesn’t want something good for himself.

“The housing market currently is affecting the local communities, that’s why when you see where some people are putting their heads, you will be marvelled. The measures that can be taken to ensure positive social impact is by making sure that governments make facilities available. Then in terms of public-private sector collaboration, the government should not be too rigid in their regulatory system.

“Make things friendly, not a situation whereby somebody is struggling to build a house, and the taxes that he’s going to pay to the government is running to even the fund that will afford him to build the house to a certain level. That kind of thing will not help us. For us to ensure positive social impact, the government needs to play a vital role and make sure that all their charges are pocket-friendly to the masses.

“At the same time, the private sectors that are involved in the housing provision should also do the right thing. Enough of cutting corners. It will not take us anywhere.

When we do it right, we get better results. We cannot continue to do things the same way and expect different results.”

The broader Nigerian economy, characterised by inflation, fluctuating exchange rates, and recent policy shifts like the removal of oil subsidies, directly impacts the housing market. These factors contribute to rising construction costs and affect the affordability of housing.

“Because if you look at some of the houses that have been developed, especially in recent time, that aspect of the technology is not really there when you talk of eco-friendly practices. Only few are going into that, especially when you talk of green buildings, green this, that, you know, the smart building practices and all of that. Only few of the real estate developers are practising that.

“A lot of them are what will come in at the end of the day, that is their main priority. So, well, it’s plainly, I mean, it’s a good idea, it’s a good approach, and which is sustainable, and if we can go into it or if we can really practise it, it will take us far. And, you know, when you talk of the housing market evolving in the next five to ten years, well, only God knows where we are going in this country.

“If the economy is better, we can do it, we have knowledge, we have what it takes to do all these things in the country. But in a situation whereby the economy is not favourable to people, people will tend to do, you know, what we fetch them, I mean, maximum profit that they can quickly, you know, recoup their money. You know, a lot of people that are going to real estate development, they take loans from banks, from different financial organisations, and they have to pay it back within the stipulated period.

“If not, the interest rates will kill the business, and that is why a lot of them, you see, what they are after is let me just develop it, sell it out, and move out of that place. They don’t think about the sustainability of those houses. And these are things that we need to work out, both government and private sectors, organisations, so that we can balance the equation and make sure that we get it right.

“However, the economy of the nation has a very critical role to play in this matter. If the economy is okay, people will do what is right, and we all get it right. We will not be experiencing a building collapse here and there, and loss of lives, loss of property, waste of resources, and all of that. So all of us need to come together and make sure that we get it right,” Dr. Olawale posited.

Also, reforms such as the amendment of the Land Use Act are essential for resolving land tenure issues and simplifying the process of acquiring land for housing development. These reforms can reduce land-related disputes and make it easier for both public and private sectors to invest in housing.

Impact of urbanisation

Nigeria’s rapid urbanisation presents both challenges and opportunities for the housing market. The increasing urban population intensifies the demand for housing, particularly in cities like Lagos. This trend underscores the need for high-density housing solutions and efficient use of available land. Failure to address this demand could lead to a significant rise in homelessness and inadequate housing conditions.

Additionally, the adoption of sustainable and eco-friendly practices in real estate development is still limited in Nigeria. While green buildings and smart technologies offer long-term benefits, they require initial investments that many developers are reluctant to make due to the current economic climate. Promoting sustainable practices through incentives and regulations can enhance the quality and sustainability of housing projects.

However, technological advancements are transforming Nigeria’s real estate sector. PropTech companies are introducing innovations such as virtual property tours, online marketing platforms, and digital transaction management systems. These technologies enhance efficiency, broaden market reach, and improve the customer experience.

Investment diversification is another emerging trend. Investors are exploring various real estate assets, including commercial properties, mixed-use