Hike in CBN interest rate will affect growth of manufacturing sector – MAN

By Esther Agbo

Following the hike in CBN interest rate, the Manufacturers Association of Nigeria (MAN) has warned that the new rate would further constrain the growth of the manufacturing sector, affecting consumer purchasing power, production levels, competitiveness, and sales.

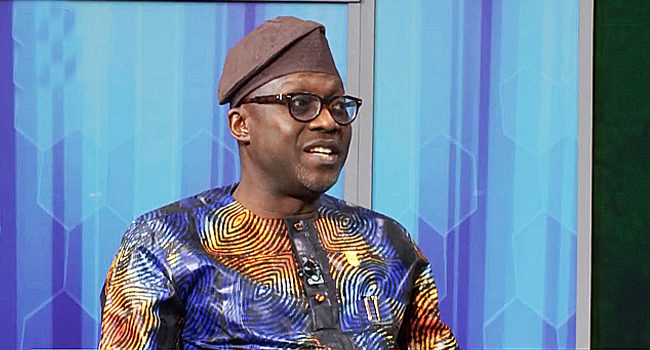

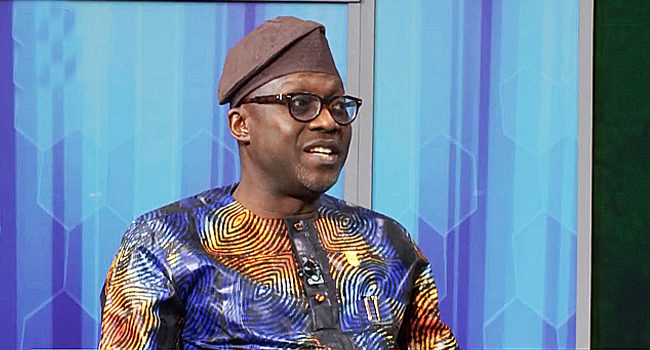

The Manufacturers Association of Nigeria (MAN), through a statement by the Director General, Segun Ajayi-Kadir, mni, expressed significant concern over the persistent rise in the MPR, which has seen a substantial increase of 1,475 basis points over the past two years, reaching 26.25 per cent in May 2024.

He said despite these measures, inflation remains at a staggering 34.19 per cent as of June, the highest since March 1996, warned that the latest rate hike would further constrain the growth of the manufacturing sector, affecting consumer purchasing power, production levels, competitiveness, and sales.

The manufacturing sector, a vital component of Nigeria’s economy, is grappling with numerous challenges that threaten its sustainability and contribution to economic growth. MAN highlighted that the continued increase in borrowing costs would escalate production expenses and the prices of finished goods, which could lead to higher unemployment and social instability.

The DG said the increase will further compound the prevailing issues of low consumer demand, capacity utilization, and profitability within the sector.

The rising cost of borrowing is also expected to stifle new investments and innovation, curtailing opportunities for growth.

MAN noted that the sector’s ability to compete in regional and global markets would be constrained, potentially leading to distress for more manufacturing concerns.

Adding that the capacity for reinvestment and expansion would be limited as a significant portion of revenue would be directed towards interest payments.

Access to capital remains a critical issue, with only 16 per cent of total commercial bank credit being disbursed to the manufacturing sector in the first quarter of the year.

This reduction in available funds would further hamper the sector’s ability to invest in retooling, upgrading facilities, and procuring new technologies.

Highlighting the adverse impact on the sector’s export potential, MAN pointed out that manufacturing investments had significantly declined, as corroborated by the National Bureau of Statistics (NBS), which reported a drop in manufacturing investment in the second quarter of the year.

The statement partly reads, “It is noteworthy to state that the worrisome trend occasioned by increase in cost of borrowing is corroborated by the report of NBS, to the effect that manufacturing investment declined significantly in the second quarter of the year.

This drop underscores the critical link between domestic investment confidence and foreign investor sentiment. In addition, the share of manufactured exports in non-oil exports also declined from 21.4% in Q4 2023 to 15.1% in Q1 2024.”

Furthermore, while recognizing the MPC’s efforts to stabilize prices, MAN urged that the survival of the manufacturing sector be prioritized in monetary policy decisions.

The association emphasized that the sector is crucial for employment creation, productivity, stable foreign exchange earnings, and sustained economic growth.

To mitigate these challenges, MAN recommended that the government direct the CBN to conduct a comprehensive assessment of the impact of previous MPC decisions on inflation and the productive sector over the last five years.

They also called for a shift from continuous MPR hikes to allow the real sector time to recover. Additionally, MAN urged stronger collaboration between the CBN and the Ministry of Finance to ensure coherence between monetary and fiscal policies.

MAN also suggested that the government expedite action on the disbursement of special funds earmarked for the manufacturing sector, including the N75 billion single-digit loan approved over a year ago and the recently announced N1 trillion.

They advocated for fiscal support to enable the sector to import raw materials, spares, and machines at concessionary duty rates, and incentivize backward integration to reduce reliance on imported products.

However, enforcing Executive Order 003 to support local industries, addressing the high-level insecurity affecting productivity, utilizing subsidy savings to improve industrial infrastructure, and encouraging investments in renewable energy were also recommended measures to enhance the sector’s competitiveness.

The Manufacturers Association of Nigeria, established in 1971, continues to advocate for the competitiveness of the manufacturing sector, job creation, and GDP growth through research, technological development, and environmental sustainability.

Recall that as part of its efforts to stabilize the economy, the MPC decided to increase the Monetary Policy Rate (MPR) by 50 basis points from 26.25 per cent to 26.75 per cent, and widen the asymmetric corridor around the MPR from +100 to -300 basis points to +500 to -100 basis points.

The Cash Reserve Ratio (CRR) for deposit money banks remains at 45 per cent and for merchant banks at 14 per cent, while the Liquidity Ratio is retained at 30 per cent.