H1: Influx of local investors, favourable policies contribute to market stability

…Naira closes month at N769.25 to a dollar at I&E window

…Nigeria’s electricity deficits require a five-fold increase in annual investment

By Seun Ibiyemi

The Nigerian Exchange Limited (NGX) concluded the first half of the year on a positive note, with the NGX All-Share Index reaching its highest level in 15 years at 60,968.27 points.

Despite concerns, investor confidence remained strong, driven by positive sentiments surrounding the peaceful transition of power and favorable policies introduced by President Bola Tinubu’s administration.

The stock market witnessed a rally, breaking a four-year streak of losses in June and recording the best monthly performance in over two years.

The market’s performance was influenced by factors such as increased demand for long-term instruments, changes in the foreign exchange framework, and the suspension of the Central Bank Governor.

The equities market gained 18.9 per cent in the first half of the year, with market capitalisation also experiencing significant growth. The influx of local investors and favorable policies contributed to market stability and increased capital gains.

The market’s positive trajectory is expected to continue during the earning season, driven by investors’ anticipation of attractive dividends and a promising yield environment.

…Foreign Exchange Market

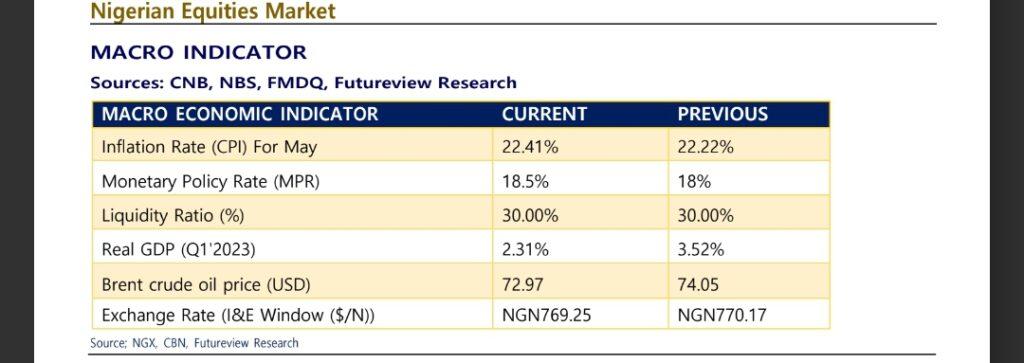

During the course of the week, there was a slight appreciation of the Naira by 12 basis points, bringing its value to N769.25 against the US Dollar at the I&E FX window.

The Nigerian currency, Naira, ended the month of June with a slight depreciation against the US dollar at the Investors and Exporters (I&E) window.

According to data from FMDQ Securities Exchange, the Naira closed at N769.25 to a dollar on Friday, June 30, 2023, a 0.82 per cent drop compared to N763 to a dollar on Tuesday, June 27, 2023.

According to a recent report by Bank of America analysts, the Nigerian naira has undergone a significant shift in its valuation after the foreign exchange reform that enabled the naira to float freely. The report, dated June 28, stated that the naira has changed from being overvalued to undervalued, implying a potential for appreciation in the future.

The daily currency update tracked and compiled from FMDQ Exchange according to Nairametrics, a leading financial news platform in Nigeria, revealed that the naira experienced a significant depreciation against the dollar on Monday, as it opened at N758.56 and closed at N769.25.

The naira also fluctuated within a wide range of N461.50 and N841 to a dollar during the day, indicating high volatility in the currency market.

The foreign exchange market witnessed an increase in its daily turnover on Wednesday, as it reached $263.45 million, up by 7.25 per cent from the previous day’s figure of $245.65 million.

According to the Central Bank of Nigeria (CBN), the country’s foreign exchange reserves experienced a slight decrease on Tuesday, 27th June 2023, dropping from $34.22 billion on Monday to $34.19 billion. This represents a 0.09 per cent decline in the external reserves, which are vital for maintaining the stability of the naira and facilitating international trade.

The black-market exchange rate of the Naira to the US Dollar remained unchanged at N770/$1, according to BDC traders’ reports. This was the same rate as the previous day’s trading session, indicating a stable trend for the Naira.

Similarly, the Naira maintained its value against the Euro, exchanging at an average rate of N840/€1 on June 30, 2023, showing no change from the previous day’s session.

On June 30, 2023, the Naira gained value against the British Pound, closing at an average rate of N995/£1. This was a 0.50 per cent improvement from the previous day, when the Naira exchanged at N1000/£1.

The FX rate for cryptocurrency P2P Exchange market showed a marginal increase of 0.04 per cent on Friday 30, June 2023, closing at N773.29/$1. This was a slight improvement from the previous trading session, when it was N773.61/$1.

The debt market size of the exchange increased slightly to N38.44 trillion on Friday 30th June 2023, compared to N38.52 trillion on Tuesday 27th June 2023.

The Money market overnight rate, which reflects the cost of borrowing funds for one day, dropped to 2 per cent on Friday 30th June 2023. This was a decrease of 14 basis points compared to the rate of 2.14 per cent on Tuesday 27th June 2023, while the Open Repo rate, which measures the cost of borrowing short-term funds, remained unchanged at 1.36 per cent in the latest trading session, indicating that the liquidity conditions in the market were stable.

…Treasury Bills and Bond Market

Throughout the three trading sessions of the week, the Nigerian T-bills market witnessed subdued interest. This subdued activity resulted in a marginal decline of 16 basis points in the average yield, settling at 6.21 per cent compared to the previous week’s rate of 6.22 per cent.

During the Primary Market Auction (PMA), the Debt Management Office (DMO) made a substantial offering of N187.12 billion, attracting a total subscription of N753.47 billion. The stop rates for the 91-day, 182-day, and 364-day papers were recorded at 2.87 per cent, 4.27 per cent, and 6.23 per cent respectively.

These rates indicated a decrease of 2.02 per cent, 0.75 per cent, and 2.01 per cent from the levels observed in the previous auction.

This week witnessed a notable strengthening of demand in the FGN bond market, with investors showing increased interest across all tenors. The growing appetite for long-term instruments has intensified, leading to heightened competitiveness in bond prices. As a result, the average benchmark yield experienced a significant decline of 5.19 per cent, settling at a favorable rate of 13.16 per cent for the week.

…Renewed emphasis on Nigeria’s electricity sector

The World Bank has approved a $750 million loan to strengthen Nigeria’s power sector under President Bola Tinubu’s administration.

This funding aims to address challenges in the electricity infrastructure and improve access to reliable electricity.

The International Bank for Reconstruction and Development (IBRD) will provide $449 million, while the International Development Association (IDA) will contribute $301 million towards the newly approved additional financing.

However, analysts recognise that Nigeria’s electricity deficits require a five-fold increase in annual investment to reach the desired power supply by 2030.

The Nigeria Electrification Project, supported by the World Bank, focuses on solar power as a viable alternative. While solar and gas are reliable options, the cost of solar energy still reflects Nigeria’s reliance on imported panels.

Nigeria is in the early stages of solar power adoption, primarily focusing on installation and fabrication processes.