Story behind the figures

GTCO grows gross earnings by 20.4%, to pay N3.10 total dividend

By Philemon Adedeji

Guaranty Trust Holding Company Plc (“GTCO” or the “Group”), a multinational financial services group, in its Audited Consolidated and Separate Financial Statements for the year ended December 31, 2022, to the Nigerian Exchange Group (NGX) and London Stock Exchange (LSE) delivered show a commendable top-line performance as gross earnings increased stronger.

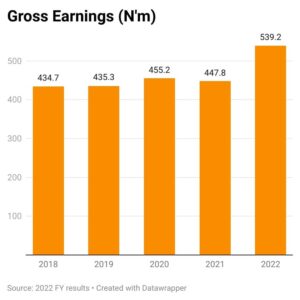

In the audited results the group gross earnings rose significantly by 20.42 per cent year-on-year to N539.23 billion as of end of December 31, 2022 from N447.81 billion recorded in the previous year, this was largely driven by a 21.92 per cent y/y rise in interest income to N325.40 billion which was buoyed by the increase in interest income on financial assets from N15.43 billion in 2021 to N30.28 billion in the period under review.

Similarly, Interest expense surged by 42.82 per cent y/y to N66.09 billion due to the 43.70 per cent y/y rise in deposit from customers to N59.75 billion, while other borrowed funds rose by 62.08 per cent y/y to N4.36 billion.

Moreso, Non-Interest Income witnessed an increase of about 16.36 per cent y/y to N200.68 billion for full year 2022.

“We opine that the aggressive contractionary policy moves by the CBN which has led to higher interest rates and tighter financial conditions, as well as the decline in CASA mix (+93.82 per cent in FY 2022 vs +97.09 per cent in FY 2021) pushed cost of funding higher. Nonetheless, net interest income remained positive and higher for the period by 17.54 per cent at N259.30 billion.

Moving further down the line, loan impairment charges grew by 40.50 per cent to N11.98 billion, resulting from an increase in loans and advances to banks and customers by 10.17 per cent and 38.17 per cent to N129.44 billion and N11.91 billion, respectively.

Furthermore, a significant increase in net impairment charge on financial assets amounted to N35.94 billion in FY 2022, compared to N760.79 million recorded in the prior financial year 2021.

The steep rise in net impairment charge can be mostly attributed to the group’s exposure to securities issued by the Ghanian Government which were hit by substantial losses after the decision to restructure both local and external debt to secure a $3 billion bailout from the IMF.

In addition, operating expense (OPEX) was up by 43.44 per cent y/y to N197.89 billion on the back of increases in administrative expenses (+67.11 per cent y/y), general welfare expenses (+76.00 per cent y/y) and customer service-related expenses (+135.06 per cent y/y).

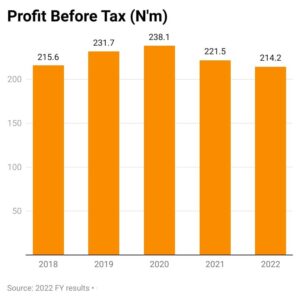

Consequently, bottom-line was marginally suppressed due to the expansion in impairment charges and operating expenses as Profit Before Tax (PBT) declined by 3.3 per cent y/y to N214.2 billion in full year 2022 from N221.5 billion achieved in Full year 2021.

From the profit and loss figures the group Profit After Tax (PAT) reported decreased by 3.25 per cent y/y from N174.8 billion accounted in 12 months of 2021 to N169.2 billion accounted in 12 months of 2022

However, the board of Director has recommended the payment of a final dividend of N2.80k per ordinary share of 50 Kobo, bringing the total dividend for the financial year ended December 31, 2022, to N3.10K.

On a sequential basis, the increase in interest income (+8.93 per cent q/q) and non-interest income (+108.76 per cent q/q) supported gross earnings which grew by 39.93 per cent q/q.

However, the 4498.43 per cent q/q and 46.15 per cent q/q rise in loan impairment charges and OPEX weighed on PBT, leading to a decline of 215.35 per cent q/q. Also, the significant jump of 308.39 per cent in tax rate further drove PAT downwards by 358.07 per cent q/q.

Earnings per share recorded for the period under review declined by 3.1 per cent to 5.95 Kobo in 2022 from 6.14 Kobo in 2021.

Essentially, the group recorded impressive top line performance despite the challenging macroeconomic condition and losses on debt instruments which affected bottom-line performance.

Nevertheless, we are of the view that Guaranty Trust Holding Company (GTCO) remains one of the key names for opportunities in the banking sector given its strong fundamentals and formidable historical performance.

The Group’s loan book (net) increased by 4.6 per cent from N1.80 trillion as of December 2021 to N1.89 trillion in December 2022, while deposit liabilities grew by 11.6 per cent from N4.13 trillion to N4.61 trillion during the same period.

The Group’s balance sheet remains resilient with total assets and shareholders’ funds closing at N6.45 trillion and N931.1 billion, respectively, while Total liabilities added 21.1 per cent to N5.5 billion in 2022 from N4.552 billion in 2021.

While shareholder return, quality service delivery to customers, and the firm’s value are essential, the Group posted a Pre-tax Return on Average Assets of 3.6 per cent and a Pre-tax Return on Average Equity of 23.6 per cent despite the muted net interest margin/loan growth and challenges in the operating environment, which had negative implications for individuals, households, and businesses.

Capital Adequacy Ratio (CAR) remained very strong, closing at 24.1 per cent . Similarly, asset quality was sustained as IFRS 9 Stage 3 Loans ratio (NPLs) improved to 5.2 per cent in December 2022 from 6.0 per cent in December 2021, however, Cost of Risk (COR) inched up marginally to 0.6 per cent in FY-2022 from 0.5 per cent in December 2021 due to impact of worsened macros on PDs.

The Vice Chairman of Highcap Securities Limited, David Andori commented on the results that the decline in Profit despite huge Gross earnings is due to high operating cost. The increase in total assets may be due to exchange rate revaluation. Despite decline in profit, the dividend payout is commendable.

Conclusion

Commenting on the results, the Group Chief Executive Officer of Guaranty Trust Holding Company Plc (GTCO Plc), Mr. Segun Agbaje, said that the Group’s ability to navigate the peculiar challenges in the different markets where it operates underscores its strong business fundamentals and unwavering commitment to sound business strategies.

“Despite the varying challenges and headwinds that weighed on growth in 2022, we were determined to deliver a decent performance and scale effectively to strengthen our competitive edge and drive long-term growth.”

He further stated; “As an organisation, 2022 was quite significant for us being the first year after our corporate restructuring into a financial holding company in August 2021.

Today, across our Banking, Payment, Funds Management, and Pension businesses, we have successfully built a robust ecosystem with immense potential to deepen our addressable market and create more value for all our stakeholders.

“We will continue to prioritise innovation, service excellence, and execute seamlessly towards achieving our vision of leading financial services in Africa.”

Story behind the figures

Honeywell Flour Mills Plc: A tough year

By Folakemi Emem-Akpan

Introduction

Honeywell Flour Mills Plc went the way of most other Nigerian companies in 2023, recording lower turnover. It went one step further and recorded downright end of the year losses. Because of the losses, the company did not have good profitability ratios and seems to be floundering. All in all, it was a tough year for the company.

Growth indices

Honeywell followed the general rule of earning more income in 2023 than it did in 2022. The growth in gross earnings, at 8.0 percent, was however lower than most other companies recorded. Gross earnings stood at N147.3 billion, a little higher than N136.4 billion in the prior year. Even though the company was careful to curtail cost of sales, it couldn’t quite do the same for operating expenses (inclusive of advertising and promotion, distribution, administrative and interest expenses). These grew much faster collectively in 2023 than in 2022.

For the second year in a row, Honeywell recorded a loss rather than a pre-tax profit. Loss before tax obligations for 2023 stood at a staggering N8.9 billion, a deeper loss than the N170 million pre-tax loss recorded in the prior year. After-tax loss was N260 million for the 2023 financial year, still a loss, but better than the N980 million loss recorded in 2022.

Total assets deployed by the company for the 2023 year grew to N165 billion, 11 per cent more than the N148.7 billion assets deployed in 2022. Meanwhile, shareholders’ funds declined by 27.5 per cent to N32.0 billion in the review year.

Profitability ratios

Not only did Honeywell record losses instead of profitability on a stand-alone analysis basis for the 2023 financial year, all parameters also showed a regression when compared to its preceding years’ result. First to achieve a regression was the profit margin of the company. Instead of a profit margin, there was a loss margin of 6.0 percent, meaning that for every N100 earned by the company in the course of the year, N6.00 of it translated to loss. This is as compared to a loss of 10 kobo in 2022.

Also to record a decline was return on assets (ROA). Loss on assets was 5.4 percent, as compared to a loss on assets of 0.1 percent in the erstwhile year. For the 2023 financial year, Honeywell deployed equity valued at N32.9 billion and for every N100 equity deployed, the company made an after-tax loss of 78 kobo.

The operating margin (which measures what proportion of turnover a company spends on operations and which must be kept as low as possible without compromising standards) was one of the reasons for the company’s bad results for the year. This is because such operating margin was 6.9 percent, higher and worse than the 5.2 percent recorded in the prior year.

Staff matters

As regards staff matters, pre-tax loss per employee stood at N10.9 million on the average. This is as compared to the N204 million pre-tax loss employees contributed on the average to the company’s pre-tax loss in 2022.

Average staff cost then increased significantly to N8.84 million from N5.99 million within the course of 12 months. This means that there was a N2.85 million addition to what an employee earned (on the average) between 2023 and 2022.

Perhaps, because it increased its staff costs, Honeywell did not succeed in deflating its staff costs as a proportion of income earned. Staff costs as a portion of turnover grew to 4.4 per cent in 2023, higher than 3.6 percent in 2022.

Other ratios

At 0.9 times, Honeywell’s current ratio was a little lower than the industry average for 2023. What this means is that for every N1.00 of short-term obligations, the company had 90 kobo in short-term assets, and was not fully able to meet short term debts from short term assets.

Having a debt-to-equity ratio of 4.0 shows that the company is using N4 of liabilities in addition to each N1.00 of stockholders’ equity. In other words, the company is using N5.00 of total capital for every N1.00 of equity capital, higher than it did in 2022.

Honeywell Vs Flour Mills: Still a loss

We have established that Honeywell did not improve its lot when its results are compared on a year on year basis. We can also establish that Honeywell did not compete favourably against other companies in the flour milling business for the 2023 FY. A comparison against Flour Mills buttresses this point.

While Flour Mills is easily the bigger of the two companies (in fact, it is the parent company of Honeywell), a bigger size does not automatically translate into better profitability. For the 2023 review year, Flour Mills was also the clear leader in terms of performance. Of six profitability ratios examined, Flour Mills led in all.

Turnover growth rate

For the 2023 financial year, Flour Mills had a turnover growth rate of 32.8 percent, as compared to Honeywell’s turnover growth rate of 8 per cent for the same period under review. Analysis shows that Flour Mills was the winner in this respect.

Pre-tax profit growth rate

For the year, Flour Mills’ profit before tax grew by a mere 1.5 percent. Yet, this was much better than the 5,074 percent decline Honeywell recorded. However, it is also important to note that while Flour Mills witnessed an actual growth, Honeywell had a pre-tax loss of N8.9 million.

Between turnover and profit

For the 2023 financial year, pre-tax profit margin (which measures a company’s ability to squeeze as much profit as is possible from turnover) for Honeywell was actually a pre-tax loss margin of (6.1) percent. Flour Mills, on the other hand, had a better pre-tax profit margin of 2.6 percent.

Return on equity

Flour Mills led its peers in terms of return on equity (ROE), recording an ROE of 13.1 per cent. Analysis shows that while every N100 worth of equity deployed by Flour Mills earned it N13.10 in after-tax profit, such N100 equity deployed earned Honeywell 78 kobo as after-tax loss.

Return on assets

ROA for Flour Mills was 3.7 percent, down from 5.9 percent in the prior year. This means that of every N100 worth of assets deployed by Flour Mills, N3.70 accrued to it as pre-tax profit while Honeywell recorded a N5.40 pre-tax loss from every N100 worth of assets employed.

Pre-tax profit per employee

For the 2023 financial year, Flour Mills recorded a pre-tax profit per employee of N6.72 million, much better than Honeywell’s N10.9 million pre-tax loss per employee.

Conclusion

Honeywell’s loss for its 2023 financial year shows how events beyond a company’s control can have an effect, either negative or positive, on its bottom line. It is clear that the economic recession Nigeria has been experiencing had a severely limiting effect on Honeywell’s revenues and performance. It remains to be seen what the 2024 FY will hold for the company.

Story behind the figures

PZ Cussons Plc: A commendable outing

Introduction

A thorough analysis of PZ CussonsPlc current financial report shows that it is yet growing. It was able to step up the level of its business activities as shown by a growing turnover base. It was also able to increase profit during the course of the year. Profitability ratios for the year were a progression over the preceding year’s. Profit margin improved, as did return on assets, return on equity, and pre-tax profit per employee.

Truth be told, the conglomerate’s results for the 2023 financial year was extremely commendable, given the stressful operational environment in Nigeria for the review year.

Growth indices

For its 2023 financial year, PZ Cussons recorded a level of growth in all of its major parameters. First to receive a boost was the company’s gross earnings. Gross earnings for the year stood at N113.96 billion, 14.5 percent higher than the N99.5 billion recorded in the preceding year. This 14.5 percent growth rate is as compared to a higher growth rate of 20.5 per cent in 2022.

Because direct costs grew at a slower pace than turnover did, gross profit advanced by 35.6 percent to N32.9 billion. After deducting operating expenses from the gross profit and adding other income (including interest income), PZ Cussons was left with a pre-tax profit of N20.46 billion, a whopping 104.4 percent higher than the N10.01 billion pre-tax profit recorded in the erstwhile year. This 104.4 percent growth rate is as compared to a pre-tax profit growth rate of 213.8 percent in the preceding year.

After-tax profit (which was also the same as distributable profit) grew over the preceding year’s by as much as 114.2 percent to N14.35 billion. For the first time in a while, the conglomerate chose not to dedicate any portion of its distributable profit to dividend. Thus, shareholders did not receive any dividend.

Total assets for the year stood at N166.38 billion, up from N109.47 billion in 2022 and translating into a 52.0 percent growth rate. Total liabilities also grew by 64.5 per cent to N118.0 billion from N71.73 billion while shareholders’ funds grew by 28.1 per cent to N48.36 billion from N37.74 billion in the erstwhile year.

Profitability ratios

For the year, operating margin (which calculates what proportion of turnover is used to finance operations) was 21.7 percent, slightly lower and therefore better than the 24.7 percent that was recorded in 2022. What this means is that the probable margin for PZ Cussons to be profitable expanded, albeit slightly during the course of the year.

Perhaps because of this, the profit margin for the year increased. Profit margin for 2023 stood at 18.0 percent, higher than 10.1 percent in the preceding year. What this means is that N18.00 made it to the profit position for every N100 earned in 2023, up from N10.10 in 2022.

Return on assets (ROA) followed the same pattern. ROA for the year increased to 12.3 percent from 9.1 percent in 2022, meaning that every N100 worth of assets deployed contributed N12.30 to the pre-tax profit for the year, higher than the N9.10 recorded in 2022.

Also, return on equity (ROE) grew to 29.7 percent from 17.8 percent, meaning that every N100 worth of equity employed contributed N29.70 to the after-tax profit in 2023, up from N17.80 in the prior year.

Our examination of this conglomerate’s profitability ratios shows that the company recorded quite a profitable year in 2023, which was not the case for many other manufacturing companies in Nigeria.

Staff matters

In terms of staff matters, the conglomerate did not do too shabbily for the year ended December 31 2023. On the average, each employee contributed N20.54 million to the company’s pre-tax profit, commendably up from N9.63 million in the prior year.

To this end, PZ Cussons reciprocated by increasing its staff cost per employee. On the average, wages and salaries earned by each staff increased to N8.04 million during the course of the year, up from N7.23 million in the preceding.

It is however worthy of note and laudable that despite increasing average staff costs, the company did not actually put itself out more than was necessary. Staff costs as a proportion of turnover decreased (and by so doing, improved) to 7 per cent.

Other ratios

For the year, PZ Cussons’ short-term assets increased to N148.1 billion while its short-term liabilities increased to a collective N94.68 billion. The interplay between these two had an upping effect on its current ratio. At 1.6 times (higher than 1.4 in the preceding year), current ratio was on par with industry standards. What this means is that for every one Naira of short-term obligations, the company had N1.60 in short-term assets, and was more than able to meet obligations as at when due.

The company had a debt-to-equity ratio of 2.4 and this shows that the company is using N2.40 of liabilities in addition to each N1.00 of stockholders’ equity. In other words, the company is using N3.40 of total capital for every N1.00 of equity capital.

PZ Cussons Vs Nestle: PZ Cussons larger and superior

PZ Cussons Plc and Nestle Nigeria Plc are competitors, and both have been operating in the Nigerian conglomerate scene for years. While Nestle is currently the bigger of the two in terms of sales generation and assets employment, PZ Cussons is better when it comes to profit retention. Of the six profitability ratios we examined, Nestle only took the lead in turnover growth rate, while PZ Cussons took the lead in the remaining five.

Sales generation and profit retention

As usual, Nestle recorded more sales in 2023 than PZ Cussons did. Also, Nestle’s growth rate for the year was much better than PZ Cussons.’ This said, PZ Cussons excelled better in translating its sales into profit. It had a positive pretax profit growth rate as compared to Nestle’s decline rate. It also had a profit margin, as compared to Nestle’s loss margin for the year under review.

Returns

PZ Cussons recorded better returns on assets and on equity for the 2023 financial year. Return on assets (ROA) and return on equity (ROE) were 12.3 percent and 29.7 percent respectively. Meanwhile, Nestle had negative returns. For Nestle, ROA was negative 17.9 per cent while ROE was negative 101.9 per cent.

Conclusion

In an operating environment where most companies recorded either negative or slowed down profitability ratios, PZ Cussons is an exceptional, a very laudable one. Its ability to not only generate sales but also to maximise profits for the 2023 financial year is indeed commendable.

Story behind the figures

University Press Plc: Slow-paced profitability

Introduction

University Press’ result for the 2023 financial year was not as great as that of 2022, both in absolute growth terms and in terms of profitability ratios. The company’s sales generation ability slowed down a bit, as did its profit retention capabilities.

Also, profitability ratios were not as sterling as those of the preceding year’s, even though these ratios were in and of themselves applaudable. This slowed profitability is keeping in trend with what most other Nigerian companies experienced for the 2023 FY.

Growth indices

Growth indices for the 2023 financial year were not very impressive. For instance, there was a six percent decline rather than a growth in the company’s ability to generate sales. Gross earnings for the year stood at N2.17 billion in 2023, less than N2.3 billion in the erstwhile year. This is as compared to a 62.5 percent increase in sales revenue the year before.

The company also recorded a lower level of pre-tax profit for the year under review than it did in the prior year. Pre-tax profit was N222 million, about 38.5 percent less than the N361 million profit recorded in 2022. After-tax profit followed the same pattern, dipping by 31.4 percent to N142 million.

Despite these lower growth rates, the company paid its shareholders dividend for the year, showing consistency in dividend payouts. Also, the dividend declared was higher than the dividend declared in the preceding year.

Total assets deployed by the company for the 2023 year (N4.24 billion) was also lower in size than in 2022 (N4.28 billion), although the percentage decrease was very low (1.2 percent). Total liabilities the year were also collectively lower than that of 2022, while shareholders’ funds grew by 3.1 percent to N3.27 billion.

Profitability ratios

The company recorded profitability in 2023 but at a lower rate than it did in 2022. For instance, while the company still retained its ability to effectively translate revenue into profit, it was at a slower rate. As per profit margin, the company made a pre-tax profit of N10.20 from every N100 sales made, high enough in its own right but lower than the N15.70 made in the preceding year.

When it comes to return on assets, every N100 worth of assets employed by the company for the 2023 financial year yielded N5.20 in pre tax profit, high enough, but lower than the N8.40 in the prior year.

This trend was repeated in return on equity. Each N100 block of shareholders’ funds yielded N4.30 in after tax profit, lower than N6.50 in the prior year.

The company spent a relatively higher portion of total revenue on operating expenses in 2023 than it did in 2022, which could be a contributing reason for its lower profitability ratios. Proportion of operating expenses to total revenue for the year was a whopping 52.4 percent, higher than the already high 43.3 percent in 2022.

Staff matters

The company did not do as well when it comes to employee productivity for 2023. Pre-tax profit per employee stood at N0.936 million on the average. This is as compared to the N1.467 million employees contributed on the average to the company’s pre-tax profit in 2022.

Meanwhile, the company expended more on its employees in 2023. Average staff cost rose to N2.346 million from N1.764 million during the year, translating into an additional N0.582 million to what an employee earned on the average. As such, University Press incurred a higher proportion of staff costs as a proportion of income earned. Staff costs as a portion of turnover was 25.6 percent in 2023, much higher than the 18.8 percent spent in 2022.

Other ratios

University Press had an impressive current ratio in 2023, just like it had in 2022 and 2021. Its current ratio stood at 2.9, which means that for every N1.00 of short-term obligations, the company had N2.90 in short-term assets, and was more than able to meet short term debts from short term assets.

Its debt-to-equity ratio was however a little low. At 0.3, the company used 30 kobo of liabilities in addition to each N1.00 of stockholders’ equity. In other words, the company had access to N1.30 of total capital for every N1.00 of equity capital it had.

University Press Vs Learn Africa: No comparison

Ask any Nigerian to mention well known press companies in the country and they are likely to mention University Press and Learn Africa.

In terms of size, Learn Africa is the bigger of the two, and while the 2023 FY was not entirely one of growth for Learn Africa as well, it fared better than University Press in many respects.

Turnover growth rate

University Press had a turnover decline rate of 6.0 percent. Learn Africa also recorded a lower level of turnover, such turnover declining by 6.1 percent as well. Both companies are rated equally in terms of turnover growth rate because they recorded comparative decline rates instead of growth rates.

Pre-tax profit growth rate

For the year, University Press’ profit before tax declined by as much as 38.5 percent. This is way worse than the 5.6 percent growth rate Learn Africa recorded. While University Press’ profit before tax shrunk, that of Learn Africa expanded.

Profit margin

When it comes to profit margin, Learn Africa also outperformed University Press. Its profit margin stood at 17.5 percent, higher than and better than University Press’, which stood at 10.2 percent.

Returns on equity and assets (ROE and ROA)

Learn Africa was also the clear winner when it comes to return on equity and return on assets. Its return on equity was 11.3 percent, meaning that every N100 worth of equity contributed N11.30 to the after-tax profit. This was much higher than University Press’ N4.30 contribution.

Learn Africa’s return on assets was also much higher than University Press’. Learn Africa recorded an ROA of 11.3 percent, much higher than University Press’ 5.2 percent.

Employee contribution to profit

For the 2023 financial year, Learn Africa was also the leader in terms of employee contribution to profit. Its employees contributed N3.348 million each on the average to its pre tax profit, higher and better than the N0.936 million University Press’ employees did.

Conclusion

University Press’ slow paced profitability ratios is not reason enough to classify it as not performing. While the company did indeed slow down when it came to profitability, this was to be expected, as this was the case with many other manufacturing companies in Nigeria.

-

Finance3 months ago

Court orders Sen. Victor Umeh to repay N136m bank debt to AMCON

-

Abuja Update2 months ago

Abuja Update2 months agoUNDP, FG partnership needed to achieve inclusion, equity- Minister

-

Abuja Update4 weeks ago

Banks drive stock market performance with N147bn gain

-

Infotech2 weeks ago

Infotech2 weeks agoWorld Backup Day: NITDA urges Nigerians to ensure backup of data

-

capital market2 years ago

Rt.briscoe, FBNH, Others halts negative performance of stock market

-

Health2 weeks ago

Health2 weeks agoImmunisation: FG, GAVI seek synergy with Sokoto Govt.

-

Submission Guidelines3 months ago

CALL FOR SUBMISSIONS: POETRY COLUMN-NND

-

Infotech1 week ago

Forex for Beginners: Unveiling the currency exchange and how to trade it