GTCO grows gross earnings by 20.4%, to pay N3.10 total dividend

By Philemon Adedeji

Guaranty Trust Holding Company Plc (“GTCO” or the “Group”), a multinational financial services group, in its Audited Consolidated and Separate Financial Statements for the year ended December 31, 2022, to the Nigerian Exchange Group (NGX) and London Stock Exchange (LSE) delivered show a commendable top-line performance as gross earnings increased stronger.

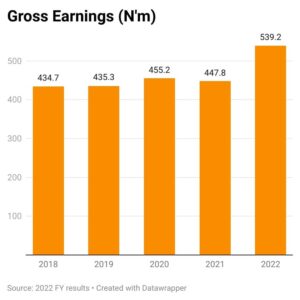

In the audited results the group gross earnings rose significantly by 20.42 per cent year-on-year to N539.23 billion as of end of December 31, 2022 from N447.81 billion recorded in the previous year, this was largely driven by a 21.92 per cent y/y rise in interest income to N325.40 billion which was buoyed by the increase in interest income on financial assets from N15.43 billion in 2021 to N30.28 billion in the period under review.

Similarly, Interest expense surged by 42.82 per cent y/y to N66.09 billion due to the 43.70 per cent y/y rise in deposit from customers to N59.75 billion, while other borrowed funds rose by 62.08 per cent y/y to N4.36 billion.

Moreso, Non-Interest Income witnessed an increase of about 16.36 per cent y/y to N200.68 billion for full year 2022.

“We opine that the aggressive contractionary policy moves by the CBN which has led to higher interest rates and tighter financial conditions, as well as the decline in CASA mix (+93.82 per cent in FY 2022 vs +97.09 per cent in FY 2021) pushed cost of funding higher. Nonetheless, net interest income remained positive and higher for the period by 17.54 per cent at N259.30 billion.

Moving further down the line, loan impairment charges grew by 40.50 per cent to N11.98 billion, resulting from an increase in loans and advances to banks and customers by 10.17 per cent and 38.17 per cent to N129.44 billion and N11.91 billion, respectively.

Furthermore, a significant increase in net impairment charge on financial assets amounted to N35.94 billion in FY 2022, compared to N760.79 million recorded in the prior financial year 2021.

The steep rise in net impairment charge can be mostly attributed to the group’s exposure to securities issued by the Ghanian Government which were hit by substantial losses after the decision to restructure both local and external debt to secure a $3 billion bailout from the IMF.

In addition, operating expense (OPEX) was up by 43.44 per cent y/y to N197.89 billion on the back of increases in administrative expenses (+67.11 per cent y/y), general welfare expenses (+76.00 per cent y/y) and customer service-related expenses (+135.06 per cent y/y).

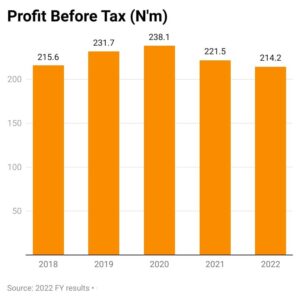

Consequently, bottom-line was marginally suppressed due to the expansion in impairment charges and operating expenses as Profit Before Tax (PBT) declined by 3.3 per cent y/y to N214.2 billion in full year 2022 from N221.5 billion achieved in Full year 2021.

From the profit and loss figures the group Profit After Tax (PAT) reported decreased by 3.25 per cent y/y from N174.8 billion accounted in 12 months of 2021 to N169.2 billion accounted in 12 months of 2022

However, the board of Director has recommended the payment of a final dividend of N2.80k per ordinary share of 50 Kobo, bringing the total dividend for the financial year ended December 31, 2022, to N3.10K.

On a sequential basis, the increase in interest income (+8.93 per cent q/q) and non-interest income (+108.76 per cent q/q) supported gross earnings which grew by 39.93 per cent q/q.

However, the 4498.43 per cent q/q and 46.15 per cent q/q rise in loan impairment charges and OPEX weighed on PBT, leading to a decline of 215.35 per cent q/q. Also, the significant jump of 308.39 per cent in tax rate further drove PAT downwards by 358.07 per cent q/q.

Earnings per share recorded for the period under review declined by 3.1 per cent to 5.95 Kobo in 2022 from 6.14 Kobo in 2021.

Essentially, the group recorded impressive top line performance despite the challenging macroeconomic condition and losses on debt instruments which affected bottom-line performance.

Nevertheless, we are of the view that Guaranty Trust Holding Company (GTCO) remains one of the key names for opportunities in the banking sector given its strong fundamentals and formidable historical performance.

The Group’s loan book (net) increased by 4.6 per cent from N1.80 trillion as of December 2021 to N1.89 trillion in December 2022, while deposit liabilities grew by 11.6 per cent from N4.13 trillion to N4.61 trillion during the same period.

The Group’s balance sheet remains resilient with total assets and shareholders’ funds closing at N6.45 trillion and N931.1 billion, respectively, while Total liabilities added 21.1 per cent to N5.5 billion in 2022 from N4.552 billion in 2021.

While shareholder return, quality service delivery to customers, and the firm’s value are essential, the Group posted a Pre-tax Return on Average Assets of 3.6 per cent and a Pre-tax Return on Average Equity of 23.6 per cent despite the muted net interest margin/loan growth and challenges in the operating environment, which had negative implications for individuals, households, and businesses.

Capital Adequacy Ratio (CAR) remained very strong, closing at 24.1 per cent . Similarly, asset quality was sustained as IFRS 9 Stage 3 Loans ratio (NPLs) improved to 5.2 per cent in December 2022 from 6.0 per cent in December 2021, however, Cost of Risk (COR) inched up marginally to 0.6 per cent in FY-2022 from 0.5 per cent in December 2021 due to impact of worsened macros on PDs.

The Vice Chairman of Highcap Securities Limited, David Andori commented on the results that the decline in Profit despite huge Gross earnings is due to high operating cost. The increase in total assets may be due to exchange rate revaluation. Despite decline in profit, the dividend payout is commendable.

Conclusion

Commenting on the results, the Group Chief Executive Officer of Guaranty Trust Holding Company Plc (GTCO Plc), Mr. Segun Agbaje, said that the Group’s ability to navigate the peculiar challenges in the different markets where it operates underscores its strong business fundamentals and unwavering commitment to sound business strategies.

“Despite the varying challenges and headwinds that weighed on growth in 2022, we were determined to deliver a decent performance and scale effectively to strengthen our competitive edge and drive long-term growth.”

He further stated; “As an organisation, 2022 was quite significant for us being the first year after our corporate restructuring into a financial holding company in August 2021.

Today, across our Banking, Payment, Funds Management, and Pension businesses, we have successfully built a robust ecosystem with immense potential to deepen our addressable market and create more value for all our stakeholders.

“We will continue to prioritise innovation, service excellence, and execute seamlessly towards achieving our vision of leading financial services in Africa.”