Foreign reserves surge by $2.35bn, bolstering naira stability — Edun

…As Coca-Cola plans to invest $1bn in Nigeria

By Esther Agbo

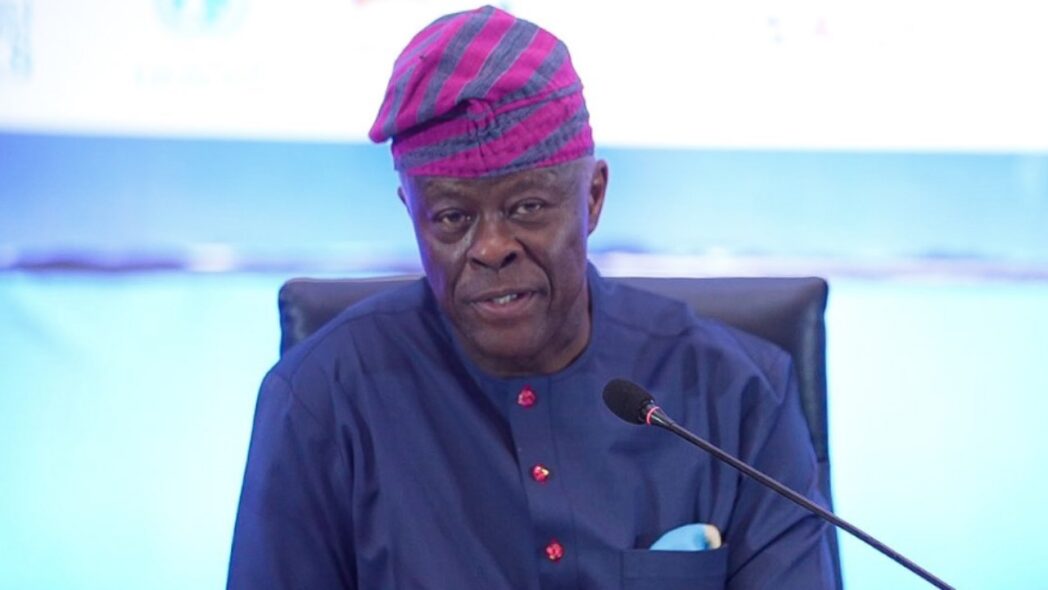

Nigeria has recorded a monthly net inflow of $2.35 billion into its foreign reserves, a development that is helping to stabilise the naira and strengthen the nation’s economic position, according to the Minister of Finance and Coordinating Minister of the Economy, Wale Edun.

Speaking at the 2024 Access Bank Annual Corporate Forum in Lagos, Edun attributed this inflow to the government’s recent reforms and the Central Bank of Nigeria’s (CBN) strategies to enhance liquidity and attract foreign investment.

“We have relative currency stability. And of course, the all important margin of the rates. We’ve seen a gradual elimination of multiple exchange rates.

“We also have foreign exchange liquidity. The gross reserves are up. There have been a net inflow in the first seven months of this year of about $2.35 billion every month.

“On the fiscal side as well, government revenues are growing and the key to government revenue is not so much that the government has revenue to compete with the private sector.

“It’s the fundamentals, the social and the key infrastructure spending. The social safety net spending. And historically, our figures are low. Our tax to GDP ratio is as low as 10 per cent. Our revenue to GDP is also around 15 percent,” Edun stated.

In addition to the foreign reserves inflow, Edun pointed to efforts to increase crude oil production as a crucial factor in strengthening Nigeria’s fiscal position. He reaffirmed the government’s commitment to hitting a production target of 2 million barrels per day by the end of 2024, a move that would further support the country’s fiscal revenues.

He said, “There is a commitment to ramp up oil production to 2 million bpd before the end of the year.

“In addition, our exports need to be significantly diversified and an important area we need to look at is the services. We have the demographics as well as the relatively skilled population which means we can export our services.”

The CBN’s policies, including raising interest rates and devaluing the naira, have played a significant role in boosting Nigeria’s foreign reserves. As of June 2024, Nigeria’s foreign reserves reached a record $34.66 billion, supported by increased remittances and rising foreign investments.

With remittance inflows surging by 130 percent to $553 million as of July 2024, the continued inflow of foreign exchange is providing a much-needed buffer for the country’s financial stability.

…As Coca-Cola plans to invest $1bn in Nigeria

In a related development that will boost Nigeria’s foreign investments, the Coca-Cola Company has announced plans to invest $1 billion in Nigeria over the next five years.

The announcement was made at a meeting between the President and the global leadership team of Coca-Cola Company, led by Mr John Murphy, its president and chief financial officer, and the Chairman of Nigerian Bottling Company, Ambassador SegunApata.

President Tinubu commended Coca-Cola for its long-standing partnership with Nigeria and for promoting investment opportunities that have employed over 3000 people across nine production facilities.

“We are business-friendly, and as I said at my inauguration, we must create an environment of easy-in and easy-out for businesses.

“We are building a financial system where you can invest, re-invest, and repatriate all your dividends. I have a firm belief in that,” he said.

President Tinubu told the delegation that private sector partnerships, which sustain investments, are central to his government’s far-reaching reforms to improve the business environment.

He pledged that the government would continue partnering with Coca-Cola to expand investments in Nigeria and address environmental issues, including climate change.

“The size of this country is enormous in Africa, and the consumption capacity of Nigeria is expanding daily,” President Tinubu added while commending the company for scaling up its skill development and community initiatives as part of its corporate social responsibility.

Presenting an overview of Coca-Cola’s business in Nigeria, Murphy noted that the company generates N320 billion annually through nearly 300,000 customers and contributes almost N90 billion in revenue to the Nigerian government.

“We are very proud of the growth of the business over a long period and its impact on the daily lives of many Nigerians.

“Beyond the financial impacts, we are also very committed to supporting the communities, and over the last number of years, we’ve had a special focus on several areas in the world of sustainability, water packaging and others,” he said.

CEO of Coca-Cola Hellenic Bottling Company, ZoranBogdanovic, explained that the company’s confidence in Nigerian government policies had encouraged it to make the $1 billion investment pledge.

“Mr President, in your inaugural address, we were very pleased to hear of your invitation for foreign investors to invest and your assurance that foreign businesses can repatriate dividends and profits.

“That assurance gives us the confidence to continue our investments. Since 2013, we have invested $ 1.5 billion in Nigeria in capacity expansion, transformation of our supply chain infrastructure capabilities, training, and development.

“I am very pleased to announce that, with a predictable and enabling environment in place, we plan to invest an additional $1 billion over the next five years.

“We believe Nigeria’s potential is tremendous, and we are committed to working with the government to realise this potential,” he said.