Flour Mills of Nigeria grows revenue 35%, amid impressive performance

By Philemon Adedeji

Flour Mills of Nigeria Plc (FMN), Nigeria’s leading food and agro-allied business, in its unaudited nine months (“9M”) financial results ended December 31, 2022, shows remarkable revenue growth. Continuous product innovation and effective route-to-market strategies were largely responsible for the continued solid financial performance across the Group’s core business segments with the Honeywell integration well underway and performance in line with integration plan.

The group revenue in nine months of 2023 achieved over a trillion Naira (N1,114 trillion) for the first time to N825 billion in nine months of 2022, these results demonstrate sustained momentum across all business segments compared to previous year.

Overall revenue grew by 35 per cent across all business segments, with Food, Agro-Allied and Sugar all growing between 34 to 39 per cent respectively.

FMN’s Food business recorded 36 per cent top-line growth largely due to continued focus on retail expansion and proactive pricing to cushion steep input costs.

The breakdown of revenue revealed that, the revenue generated from Agro-Allied business grew by 39 per cent driven by robust performance across its categories, as the revenue generated from Fertilizer business recorded a 64 per cent growth in revenues and 82 per cent profit growth driven by the commissioning of new fertilizer blending plant in May 2022, while the oils and fat business grew by 54 per cent driven by increased volumes due to intensified milling activities, while the animal feeds business reported 20 per cent topline growth owing to increased product availability.

Golden Sugar recorded an impressive 34 per cent revenue growth; this was achieved due to increased volumes, various customer engagement and popularity of our locally produced brown sugar.

Gross profit reached N103 billion in 9M’ 23, up 29 per cent compared to 9M’ 22 and 33 per cent quarter on quarter.

Operating Profit grew by 28 per cent in 9M’ 23, with a 32 per cent growth quarter on quarter.

From the released statement under the platform of Nigeria Exchange Limited (NGX), Profit After Tax (PBT) declined by 40.80 per cent to N14.952 billion in nine months of 2023 from N25.255 billion in nine months of 2022.

Profit After Tax (PAT) recorded during the period amounted to N10.018 billion in nine months of 2023, reflecting a decline of 41.23 per cent from N17.046 billion in the corresponding period.

The group balance sheet, well structured, rose significantly by 7.3 per cent to N198.427 billion in nine months of 2023 from N184.968 billion in the previous year.

Higher net finance costs weaken earnings

FLOURMILL’s revenue grew by 35.0 per cent year-on-year, driven by a broad-based growth across the Food (+35.5 per cent y/y), Agro-Allied (+38.9 per cent y/y), Sugar (+34.2 per cent y/y), and Support Services (+5.0 per cent y/y) business segments.

The results indicated that (1) its retail expansion and proactive pricing of food products, (2) the commissioning of a new fertilizer blending plant, and (3) increased volumes across the oils and fat, and sugar product lines, as the key drivers of the stellar revenue expansion.

However, gross dipped by 46 basis points year-on-year to 9.3 per cent and operating also depreciated by 29 basis points Year-on-Year to 6.8 per cent margins recorded declines, reflecting the overwhelming cost pressures in the year, most predominantly in Q3-23.

We highlight that most of the pressure on profitability emanated from the significant expansion of net finance costs in the year, attributable to the increased loan facilities on the company’s books.

As of nine months of 2023 (9M-23), total borrowings increased by 69 per cent year-on-year to N303.72 billion from N178.85 billion in 2022 financial year.

Consequently, Earnings Per Share (EPS) recorded for the period declined by 28.3 per cent year-on-year to N2.87 in 2022 from N4.00 achieved in the comparable period.

Net finance costs to mask topline gains

For 2023 FY, the group raised topline growth projections to 37.3 per cent year-on-year from the previous 14.6 per cent year-on-year, reflecting price adjustments made by the company across its products to higher levels and stronger than expected contribution from the food segment.

“Over the medium term (2024 – 2027E), we expect revenue to grow at a CAGR of 8.8 per cent. We expect cost pressures to remain elevated in fourth quarter 2023, due to the high inflationary environment and the pass-through impact of currency devaluation on input costs.

“Further down, we believe the significant increase in net finance costs witnessed in 9M-23, will significantly influence the EPS outturn for 2023FY. Thus, we forecast that earnings per share (EPS) will decrease by 15.3 per cent year-on-year to N5.30 in 2023 financial year Further out, we forecast an EPS CAGR of 19.1 per cent in 2024-2027E.

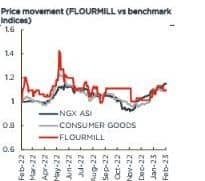

“Following the revisions to our forecast, we have reduced our target price to N50.64 from N63.12/s, implying a potential upside of 69.1 per cent based on the price of N29.95 on 7th February. Thus, we maintain our ‘BUY’ recommendation on the stock. Based on our estimates, FLOURMILL is trading on a forward P/E and EV/EBITDA of 5.7x and 2.8x compared to the EM peer average of 18.5x and 9.5x, respectively.”

Profitability Ratios

FLOURMILL’s profitability was dampened by the significant expansion in net finance costs, which was largely influenced by the Honeywell Flour Mills Plc acquisition and integration. For 2023 financial year, while we believe the company remains well positioned to outperform 2022 Financial Year revenue print, earnings expansion will remain subdued given the effects of the new debt on the company’s books, amid margin pressures from higher costs.

The gross margin declined by 9.7 per cent in nine months of 2022 to 9.3 per cent in nine months of 2023, as Operating Expense margin rose from 3.8 per cent in nine months of 2022 to 4.0 per cent in nine months of 2023, while cost of sales margin grew significantly from 90.3 per cent in nine months of 2022 to 90.7 per cent in nine months of 2023.

The Profit Before Tax (PBT) margin declined by 3.1 per cent in nine months of 2022 to 1.3 per cent in nine months of 2023, Profit After Tax (PAT) margin depreciated by 2.1 per cent in nine months of 2022 from 0.9 per cent in nine months of 2023.

Conclusion

Commenting on the Q3 Financials, Boye Olusanya, the Group Managing Director, said, “The Q3 earnings trend is a clear demonstration of the Group’s commitment to carrying out its overall long-term strategy of maintaining growth and sustaining profitability by significantly investing in the development of local content through product innovation across our core value chains.

“Also, as is established by the significant increase in revenue and growth from the Agro-allied category of the Group’s touch points, we are committed to achieving economies of scale in food production via crop-specific value chain by increasing productivity and ultimately driving the nation’s attainment of food self-sufficiency.”