FG’s revenue increases to N9.1trn in Q1, no increase in taxes – minister

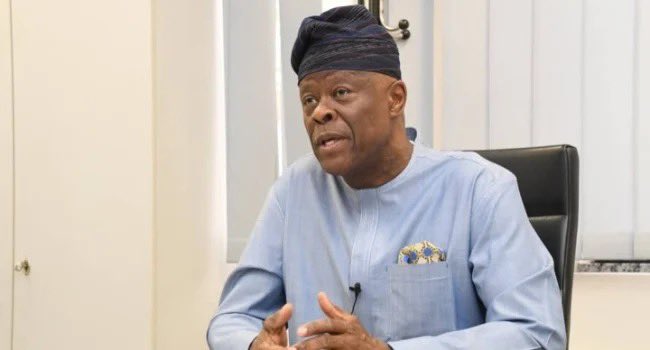

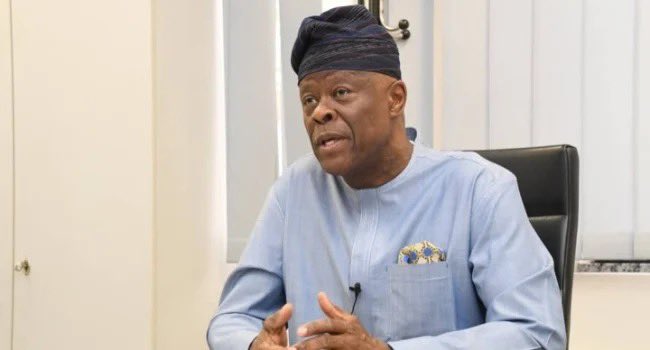

The Minister for Finance and Coordinating Minister of the Economy, Wale Edun says that Federal Government’s revenue for the first quarter of 2024 has increased to N9.1 trillion.

According to Edun, this is more than double in the same period in 2023.

Edun said this at the 17th Annual Banking and Finance Conference organised by the Chartered Institute of Bankers of Nigeria (CIBN) in Abuja on Tuesday.

The minister, however, said that the government had not increased taxes.

The minister, represented by Dr Armstrong Takang, the Managing Director, Ministry of Finance, Incorporated, said the increase reflected the success of the government’s revenue collection policies and the effective deployment of technology.

He said the administration was committed to ensuring that revenue generation met or exceeded the set target.

“Such progress will enable us to essentially make social and capital investments that positively impacts both the economy and its citizens.

“In spite of this progress, our primary challenge remains addressing the sharp increases in food prices. Several initiatives are on their way to boost food supply and curb food inflation,’’ he said.

The Governor of the Central Bank of Nigeria (CBN), Dr Olayemi Cardoso, said the bank was looking forward to actionable solutions from the conference, adding that it would benefit them as they journeyed toward achieving a one trillion-dollar economy.

Cardoso, represented by Dr Blaise Ijabor, the Director, Risk Management Department of CBN, said that bankers were critical stakeholders in the growth and development of the economy.

Mr Bello Hassan, the Managing Director of the Nigeria Deposit Insurance Corporation (NDIC), congratulated the CIBN for the conference, saying that the Corporation would continue to work toward engendering confidence in the banking system.

In a keynote speech, Mr Tony Elumelu, the Chairman, United Bank for Africa (UBA) Group, said that access to electricity, adequate security and youth entrepreneurship were key to accelerating development in the country.

Speaking on the topic ‘Accelerated Economic Growth and Development: The state of play and the way forward’, Elumelu said the current food insecurity was caused by insecurity in the country.

He commended the past and present governors of the CBN for championing reforms in the banking sector, adding that the reforms had positively transformed the sector.

In an address of welcome, Prof. Pius Olanrewaju, the President of CIBN, said the conference was not just a forum for discussion, but a platform for actionable outcomes.

He said that data from CBN showed that net credit from the banking industry to private sector as at July 2024, was N74.9 trillion compared to N46.3 trillion of July 2023.

”I am pleased to report that critical resolutions were taken.

”The Conference recommended lifting of ban on the prohibited items and in October 2023, the CBN announced the lifting of foreign exchange restrictions hitherto placed on the importation of 43 items.

”Our sector is at the heart of our economic engine providing much-needed funds for businesses to thrive,” he said.

The president said the country’s economic potential were vast, but realising them required effective policies, investments, and governance.

He said the banking industry was not only a participant in realising the potential but also a driver of the country’s economic growth and development.

”Let us embrace this opportunity with vision and determination by working together- private sector, government, civil society, and individuals to build a prosperous, and resilient economy for Nigeria.

”Indeed, only when we collectively work together to achieve these goals would we see the success we so desire,” he said.

The Vice President Kashim Shettima, Vice President , Jeremiah Kpan Koung of the Republic of Liberia attended the conference.

The conference also attracted bankers from across Africa.