FG refutes reports of VAT increase to 10%

The Federal Government has debunked claims that it plans to increase the Value Added Tax (VAT) rate from 7.5 percent to 10 percent.

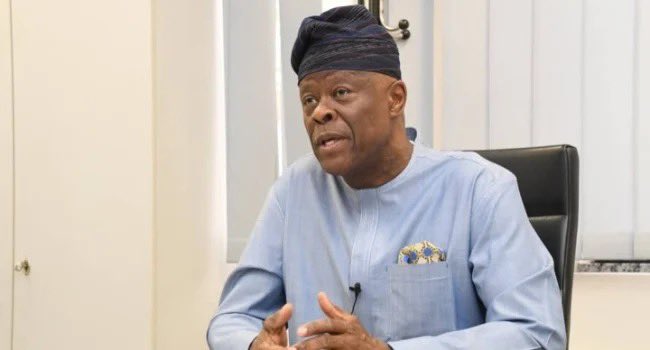

The Minister of Finance and Coordinating Minister of the Economy, Wale Edun disclosed this in a statement posted by the Special Adviser on Information and Strategy, Bayo Onanuga.

Edun explained that the tax system is built on three pillars: tax policy, tax laws, and tax administration.

He emphasised that these elements must function cohesively to establish a robust system that strengthens the government’s fiscal position.

The Minister noted that the government’s priority is to leverage fiscal policy to foster sustainable economic growth, reduce poverty, and create a flourishing business environment.

He said, “The current VAT rate is 7.5%, and this is what the government charges on a spectrum of goods and services to which the tax applies. Therefore, neither the Federal Government nor its agencies will act contrary to what our laws stipulate.”

“The imputation in some media reports on the issue of VAT and the opinion articles that have sprouted from them seem to wrongly convey the impression that government is out to make life difficult for Nigerians.”

The media in the past week has been awash with reports of a proposed increase in the VAT rate following the interview of the Chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, Taiwo Oyedele on Channels Television.

Recall that Former Vice President Atiku Abubakar strongly criticised the federal government’s rumoured plan to raise the Value Added Tax (VAT) rate from 7.5 percent to 10 percent, warning that such a move would worsen Nigeria’s already challenging economic conditions.

In a post on his official X (formerly Twitter) account on Sunday, Atiku voiced concerns that the proposed tax increase, alongside other recent government policies, would intensify the cost-of-living crisis, harm businesses, and disproportionately burden the poor.

He also criticised the Tinubu-led administration for being “profoundly insensitive” to the struggles of ordinary citizens by engaging in unnecessary luxury spending

The World Bank has urged the federal government to raise the Value Added Tax (VAT) rate as a strategy to increase non-oil revenue and boost the nation’s fiscal resources.

In the report, the bank suggested increasing the current VAT rate of 7.5 percent as a step toward creating more fiscal space and enhancing non-oil revenue streams.

The bank also emphasised that this VAT hike should allow for input tax credits and recommended removing exemptions on petrol as part of broader measures aimed at boosting non-oil revenues.

In their staff report, the Executive Directors of the International Monetary Fund (IMF) commended the current administration for its decisive actions in key areas, including revenue mobilisation, improving governance, and bolstering social safety nets.