Dangote takes lead, declares N808bn in revenue as BUA, Lafarge report 375bn in H1

By Seun Ibiyemi

Both Dangote cement, BUA cement and Lafarge cement are popular amongst cement producers in Nigeria. Also they are all listed on the Nigerian stock exchange.

The similarity ends here, however,for the 2022 half year review, Dangote cement led the two in all the profitability ratio examined, making it clear winner in respect to this comparison analysis

Turnover growth rate

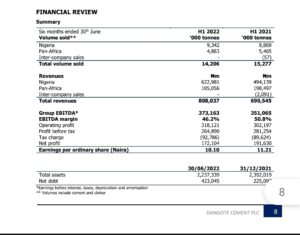

For the 2022 financial half year, Dangote Cement reported N808.04 billion revenue in H1 2022, representing an increase of 17 per cent from N690.5 billion earned in H1 2021. On its part, BUA Cement recorded a revenue of N188.56 billion in H1 2022, representing an increase of 51.7 per cent over N124.3 billion reported in H1 2021.

Also, Lafarge Africa announced N186.6 billion revenue in H1 2022 from N146.02 billion recorded in H1 2021, representing an increase of 29 per cent.

Analysis of the three companies’ H1 unaudited results for the period under review showed that revenue grew by 23.3 per cent to N1.18 trillion from N959.84billion reported in Half year ended June 30, 2021.

With about 14,206,000 tonnes sales volume in H1 2022 from 15,277,000 tonnes reported in H1 2021, Dangote Cement maintained lead in revenue generation, followed by BUA Cement and Lafarge Africa Plc.

Capacity

In terms of capacity, Dangote Cement is Africa’s leading cement producer with nearly 51.6 million metric tonnes/pa capacity across Africa, followed by BUA Cement, the largest producer of cement in North-West, South South and South-East regions; with a combined installed capacity of 11million metric tonnes/pa and with plans underway to increase existing capacity to 20 million metric tonnes/pa, through the commissioning of three new lines.

Lafarge Africa has a current installed cement production capacity of 10.5 metric tonnes/pa and its cement operations in the South West (Ewekoro and Sagamu in Ogun State), North East (Ashaka, in Gombe State), South East (Mfamosing, Cross Rivers State) with Ready-Mix operations in Lagos, Abuja and Port Harcourt.

Specifically, Dangote Cement reported 16.8 per cent increase in cost of sales to N322.46 billion in H1 2022 from N276.12 billion in H1 2021, driven primarily by 31.3 per cent hike in fuel & power consumed that closed H1 2022 at N129.96 billion from N98.98 billion in H1 2021.

The leading cement company also suffered N40.66billion foreign exchange loss in H1 2022 from N4.94billion reported in H1 2021, attributable to dwindling Naira at the foreign exchange market.

For BUA Cement, its production cost rose by 47.4 per cent to N97.5 billion in H1 2022 from N66.16 billion in H1 2021, while Lafarge Africa announced N90.52billion in production cost of sales in H1 2022, representing an increase of 25 per cent from N72.54billion reported in H1 2021.

As a result of increase in production cost and finance expenses, Dangote Cement closed H1 2022 with profit of N172.1billion, representing a decline of 10.2 per cent from N191.63billion in H1 2021.

Contrarily, BUA Cement’s grew its profit by 41.4 per cent to N61.36billion in H1 2022 from N43.4 billion in H1 2021, while Lafarge Africa announced N37.4 billion profit in H1 2022 from N28.32 billion reported in H1 2021.

Reacting on the results, Dr Muda Yusuf said that marginal increase in price of cement impacted on these companies profit declaration in the period under review.

He stressed that these companies might surpasses 2022 performance, given demands by government and domestic use of their products.

According to him,“The demand in the construction sector has contributed to these companies revenue which eventually impacted on profit in the H1 2022. Since there is improvement in government spending as a result of hike in global oil prices and non-oil revenue, we have seen government spending more in infrastructure and it is expected to grow cement sales.

“I know also that some of these companies export to neighbouring countries and it also contributed to their price. Mind you, we have seen hike in prices of cement which is responsible for an impressive profit.”

Analysts at Vetiva research in a report titled, ‘Nigeria H2’22 Outlook: A strange labyrinth,’ explained that over the past six months, overall cement demand has increased, owing to the significant rise in real estate activities from private sector housing constructions as well as ongoing infrastructure construction by the Federal Government.

According to the report, “This was reflected in the sector’s contribution to GDP which improved 4.08ppts q/q to 9.57 per cent in Q1’22. Another factor underpinning this growth is investors’ renewed interest in alternative investment outlets, due to the lowered yields in the Fixed Income market. Consequently, cement producers recorded double-digit revenue growth in Q1’22. For context, backed by increased real estate activities by the private sector, Julius Berger’s building works increased by 85 per cent.

“Cement producers have benefited from the ongoing construction of infractrucure projects, like rail and roads by the Federal Government and the demand for housing infrastructure by the private sector. During the Q1 2022 period, Real estate sector growth expanded by 2.67ppts to 4.14 per cent, reflecting the surge in housing demand.

“Furthermore, raw input costs have remained elevated, driven by persistent FX challenges and rising inflationary pressures. Also, the upward impact of the ongoing Russian-Ukraine crisis on energy prices has caused an increase in diesel and gas prices, which has emerged as a major threat to profitability. To combat these rising cost lines, cement players like Dangote Cement, through its Alternative Fuel Project, and Lafarge Africa, through its subsidiary geocycle, are tilting towards alternative fuels like biomass for cement production in their plants.

“Most of the components of the biomass fuel are locally sourced, reducing their dependence on imported and costly energy sources. Consequently, input cost worries moderated, thereby improving profitability margins. Looking ahead, as the election period draws close, we expect a sustained rise in cement demand, as the current administration aims to complete all ongoing infrastructure projects, which could drive revenue growth for cement manufacturers.”