Breakdown of Nigeria’s 2023 budget proposal presented by Buhari

By Seun Ibiyemi

President Muhammadu Buhari presented a total expenditure of N20.51trillion as the 2023 budget proposal before a joint session of the National Assembly on Friday.

The record N20.5trillion Naira proposed expenditure “reflects the serious challenges” faced by Nigeria and contains key reforms necessary to address them, Buhari told lawmakers while presenting the budget in Abuja on Friday.

The budget is about N750 billion higher than the N19.76trillion earlier proposed in the 2023-2025 Medium Term Expenditure Framework and Fiscal Strategy Paper.

The budget expected to be approved and take effect in January 2023 is 19 per cent higher than this year’s government expenditure and is also Nigeria’s highest ever, prioritising fiscal sustainability, economic growth and security.

As Nigeria still battles violent extremism in its Northeast and armed attacks in the Northwest and central regions, resulting in loss of thousands of lives in the last year. Buhari allocated the most funds to defense and internal security.

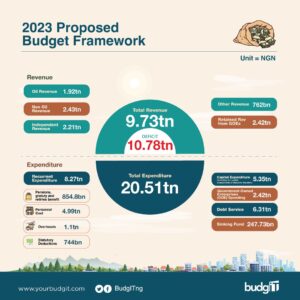

The projected revenue for the Federal Government (including 63 government-owned enterprises, GOEs) is N9.73 trillion, which is mere 47.5 per cent of the proposed budget. The budget deficit has expanded, both in absolute numbers and in percentages.

The proposed deficit for 2023 is N10.78 trillion or 52.5 per cent of the budget, meaning that total government revenue is not expected to cover up to half of the budget. The deficit this time comes to 4.78 per cent of GDP as opposed to the 3.99 per cent for the 2022 amended budget, both above the 3 per cent threshold set by the Fiscal Responsibility Act.

To plug the gap in the 2023 budget, FG plans to raise the N10.78 trillion through new loans of N8.8 trillion, N206 billion from privatisation and concessions, and drawdown of N1.77 trillion in concessionary loans.

A breakdown of the projected revenue shows that FG hopes to get N1.92 trillion as its share of oil revenue. This is 19.7 per cent of the projected revenue. This is a mix-bag: on the positive side, it indicates that FG is now less dependent on oil for funding its budget; but on the less cheery side, it underscores the precipitous decline in the value of a sector that used to account for more than 70 per ent of government revenue, and coincidentally not a time of low oil prices.

On a brighter note, non-oil tax revenue and independent revenue are projected to bring in N2.43 trillion and N2.21 trillion respectively.

The little hope held out by diversification of revenue sources is quickly eclipsed by the prominence of debt service in the proposed expenditure.

FG proposes to spend N6.31trillion on debt service and N247.73billion on sinking fund in 2023. This means that debt service alone is 31.7 per cent, almost a third of the total budget for FG and its enterprises.

In the same appropriation bill, N6.19 trillion has been proposed for personnel, pension/gratuities and overheads, while N5.35 trillion is indicated against capital expenditure.

Debt service is thus 105 per cent of personnel and overheads combined and 121.5 per cent of capital expenditure. Also, debt service will consume 66.80 per cent of the N9.73 trillion revenue projected to be retained by FG and its enterprises. So, for every N100 that FG hopes to get as revenue in 2023, N66 or about two-thirds will go to debt service alone.

And bearing in mind that revenue hardly performs to expectation, FG’s fiscal position may get worse. To get a fuller picture of the approaching fiscal cliff, hard expenditure (personnel and debt service) is N12.57 trillion or 118 per cent of projected revenue. This means that government’s revenue will still fall short if all money that comes in is devoted to just salaries and debt service, and with zero release for pension/gratuity, overhead and capital.

The President of the Senate, Senator Ahmad Lawan urged the Executive to ensure that the 2023 budget of fiscal stability and transition is used to complete a lot of ongoing projects across the country.

He said it in his welcome address as President Muhammadu Buhari presented his last budget of N19.76 trillion 2023 Appropriation Bill before the Senate and the House of Representatives.

Lawan said, “This administration has been consistent in ensuring the delivery of landmark infrastructure across the country.

“The last three budgets have made generous provisions for different projects. While some have been completed, others are ongoing at high paces.” The 2023 Budget should therefore focus on completing a lot more.”

Lawan also lamented the high level of oil theft in the country which he said has worsened, with the loss of Oil to the tune of one million barrels per day. Lawan said, “With conflicting figures, projections have put our losses from this malaise at between 700,000 to 900,000 barrels of crude oil per day, leading to about 29 to 35 per cent loss in Oil revenue in the first quarter of 2022.” This represents an estimated total fall from N1.1 trillion recorded in the last quarter of 2021 to N790 billion in the first quarter of this year.

“The situation has worsened. Recently, the loss of our Oil has reached 1 million barrels per day. Translated into monetary terms, our loss is monumental. The figures show we are not able to meet the OPEC daily quota of 1.8 million barrels per day.”

President Buhari was at the National Assembly to present N19.76 trillion 2023 Appropriation Bill before the Senate and the House of Representatives. This is the 4th joint session and would be the last budget presentation by President Buhari in the life of his administration.

Also, Senate has approved the 2023-2025 Medium Term Expenditure Framework (MTEF) and Fiscal Strategy Paper (FSP).The MTEF/FSP is a document that contains parameters upon which the annual budget is prepared.

While approving the MTEF/FSP on Wednesday, it pegged the crude oil benchmark price at $73 per barrel for 2023 – higher than the corresponding benchmark of $57 for 2022. The Senate resolved that the oil price of $73 per barrel of crude oil be approved as a result of continuous increase in the oil price in the global oil market and other peculiar situations such as continuous invasion of Ukraine by Russia as this will result in savings of N155 billion.

The lawmakers also pegged the exchange rate at N437.57 with continuous engagement between the Central Bank of Nigeria (CBN) and Federal Ministry of Finance, Budget and National Planning with a view of bridging the gap between the official market and parallel market.

The 2023-2025 MTEF/FSP was approved after the lawmakers considered and adopted recommendations of the Senate Joint Committees on Finance and National Planning.

Earlier, the Minister of Finance, Zainab Ahmed, said the Federal Government would borrow over N11 trillion and sell national assets to finance the budget deficit in 2023.

On Subsidy:

She also said the government’s budget deficit is expected to exceed N12.4 trillion should it keep the petroleum subsidy for the entire 2023 fiscal cycle.She proposed two options for the lawmakers to consider for the 2023 budget.

First, the deficit is projected to be N12.4 trillion in 2023, up from N7.35 trillion budgeted in 2022, representing 196 per cent of total revenue or 5.50 per cent of the estimated GDP. In this option, she said, the government would spend N6.72 trillion on subsidy.

The second option, she explained, involves keeping subsidy till June 2023 and this scenario will take the deficit to N11.30 trillion, which is 5.01 per cent of the estimated GDP. In this option, the PMS subsidy is projected to gulp N3.3 trillion.

Key Parameters:

The Chairman of the committee, Adeola Olamilekan, who presented the report, said the committee recommended the second option suggested by Ms Ahmed.This means, the Federal Government will service subsidy until July 2023.

The Senate also approved daily crude oil production of 1.69m bpd, 1.83m bpd, and 1.83m bpd for 2023, 2024 and 2025 respectively, while the projected GDP growth rate was put at 3.75 per cent.

An inflation rate of 17.16 per cent was also approved.

The projected new borrowings of N8.4 trillion (including foreign and domestic borrowing) was approved – subject to the approval of the borrowing plan by the National Assembly.

Recommendations:

In his presentation, Mr Olamilekan said all relevant agencies of the government will be required to take necessary action to keep the petroleum subsidy cost to government within a N1.7 trillion ceiling in 2023.This, he said, would save about N737.3 billion which should be used to reduce the fiscal deficit of N11.3 trillion of the government as contained in the MTEF/FSP.

The fiscal deficit of N11.3 trillion, he said, should be reduced with the savings from the subsidy regime of N737.31 billion to N10.5 trillion.

“The Committee recommended significant reduction in both waivers and tax exemptions of corporate organisations to cushion the effect of budget deficit”, he stated.

“And that all revenue generating agencies should reconcile their accounts with the Fiscal Responsibility Commission and the Office of the Accountant General of the Federation (OAGF), the report of which should be submitted to the Committee of Finance for consideration and approval.”

The lawmaker said there should be a common electronic platform for reconciliations amongst the government MDAs, OAGF and Fiscal Responsibility Commission for effective monitoring and remittances.” That there should be strict compliance with the Constitution, Fiscal Responsibility Act and other extant laws by all agencies of the government with regards to revenue remittances. And relevant oversight committees of the National Assembly are at liberty to remove recycled projects in their budget proposal during the Committee’s budget defense. He suggested that 10 of the 63 GOEs (government owned enterprises) be placed on cost of collections to serve as a test case for other GOEs which can be added in the future.

The suggested GOEs are: NCC, CAC, NPA, NIMASA, NUPRC, FIRS, CUSTOMS, NMPDRA, JAMB, NAFDAC, with immediate effect with the proposed finance bill 2023 coming up with the amendment of the existing Act of the above mentioned agencies.