The banking system in the country is well capitalised to foster economic development.

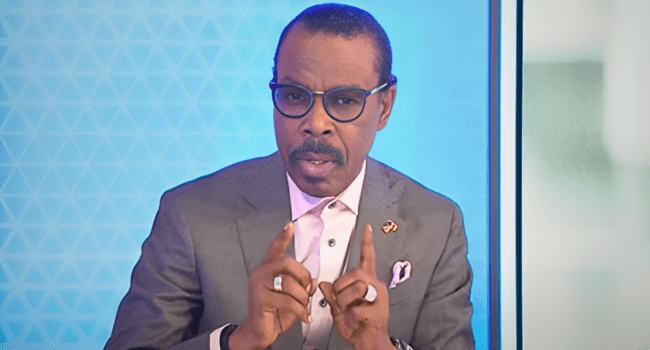

Managing Director, Financial Derivatives Company, Mr Bismarck Rewane said this at the 17th Banking and Finance Conference in Abuja on Wednesday.

Rewane said that banks also had enough risk management tools for development in the financial system.

He said that banks’ recapitalisation exercise would cushion the impact of higher interest rates on asset quality, profitability and capital.

Rewane, however, said that the financial system in the country had remained challenged due to cybersecurity issues.

He said that the country’s financial industry was relatively shallow compared to its peers in Indonesia and Malaysia.

According to him, total bank assets as at five years ago stood at N42.8 trillion but has now risen to N138 trillion which is about 222 per cent increase.

“The industry is profitable but it is getting less attractive because of regulation.

“An improved payment system can potentially boost financial inclusion.

“Nigeria financial industry is relatively shallow compared to its peers like Indonesia, Malaysia,” he said.

Rewane listed some financial systems growth impediments to include infrastructure deficit, weak regulatory framework (heavy taxation on financial services), poor institutional reforms,(increased risk of corruption), among others.

He called for the reorganisation of development in the financial system.

The Managing Director of the First City Monument Bank (FCMB), Yemisi Edun, said that recapitalisation would make funding a little cheaper for SMEs to tap into.

Edun said that technology was a key aspect of financial system development. She said that growth in the system would be propelled by technology.

According to her, we need Artificial Intelligence (AI) to do so many things in the system including driving credit, payment, and creating solutions for speed and efficiency.

Managing Director of First Bank of Nigeria Limited, Olusegun Alebiosu expressed optimism for growth in the sector.

“The outlook for the rest of 2024 for the Nigerian economy is optimistic, with projected growth rates.

“The key drivers of this growth include improved security driven by the need for high level vigilance by the security forces, higher oil production, and stronger consumer demand on local commodities,” he said.

Managing Director of FSDH Merchant Bank, Mrs Bukola Smith said that recapitalisation of the insurance companies should be considered to enable it to be at the same growing par with banks.

The theme of the conference is: ‘Accelerated Economic Growth and Development, the state of play and the way forward.’

The Conference was organised by the Chartered Institute of Bankers of Nigeria (CIBN).