Again, Nigeria’s inflation rate declines to 32.15%

By Seun Ibiyemi

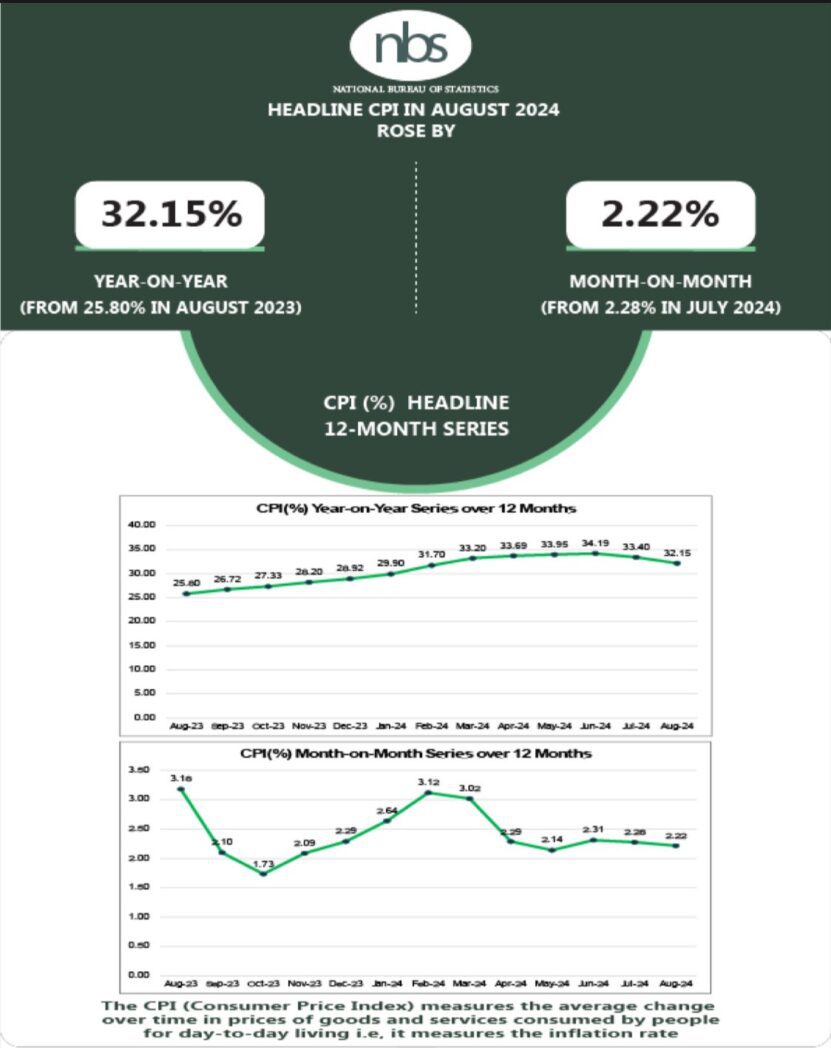

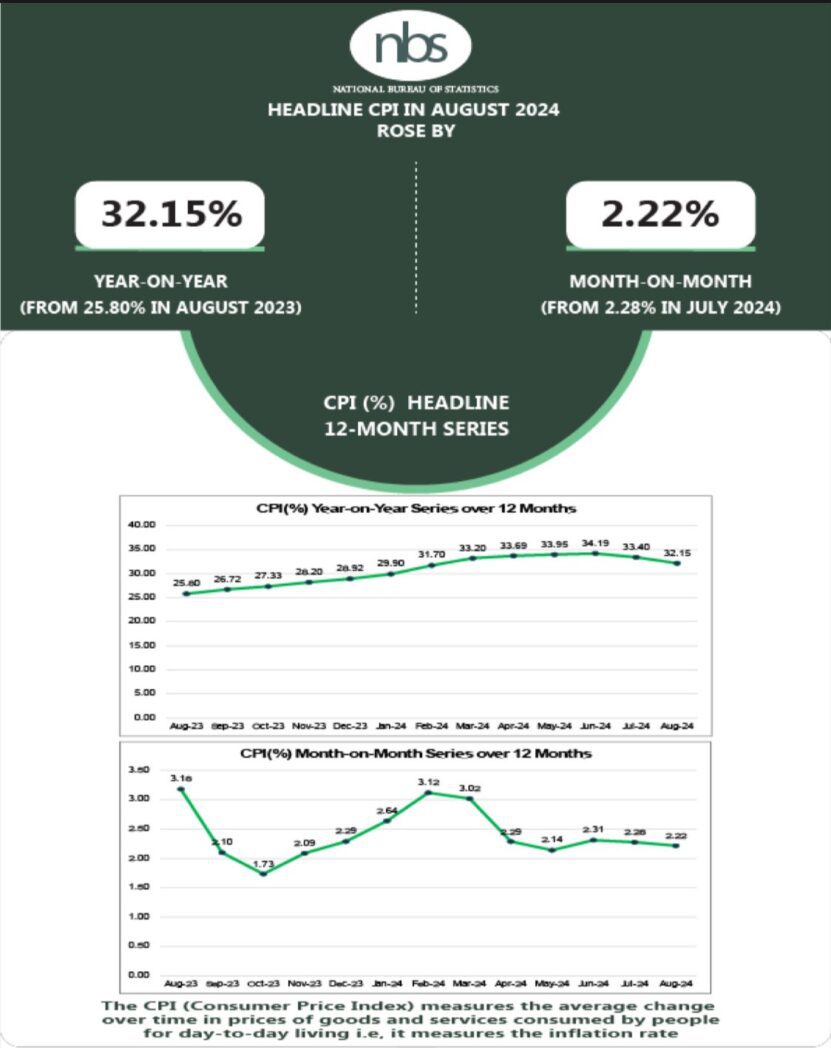

Nigeria’s headline inflation rate eased to 32.15 percent in August 2024 down from the 33.40 percent recorded in July 2024, reflecting a decrease of 1.25 percentage points.

The NBS said this in its Consumer Price Index (CPI) and Inflation Report for August 2024, which was released in Abuja on Monday.

According to the report, the is 1.25 percent points lower compared to the 33.40 percent recorded in July 2024.figure

It said on a year-on-year basis, the headline inflation rate in August 2024 was 6.35 percent higher than the rate recorded in August 2023 at 25.80 percent.

In addition, the report said on a month-on-month basis, the headline inflation rate in August 2024 was 2.22 percent, which was 0.06 percent lower than the rate recorded in July 2024 at 2.28 percent.

“This means that in August 2024, the rate of increase in the average price level is lower than the rate of increase in the average price level in July 2024.”

The report said the increase in the headline index for August 2024 on a year-on-year basis and month-on-month basis was attributed to the increase in some items in the basket of goods and services at the divisional level.

It said these increases were observed in food and non-alcoholic beverages, housing, water, electricity, gas, and other fuel, clothing and footwear, and transport.

Others were furnishings, household equipment and maintenance, education, health, miscellaneous goods and services, restaurants and hotels, alcoholic beverages, tobacco and kola, recreation and culture, and communication.

It said the percentage change in the average CPI for the 12 months ending August 2024 over the average of the CPI for the previous corresponding 12-month period was 31.26 percent.

“This indicates an 8.88 percent increase compared to 22.38 percent recorded in August 2023.”

The report said the food inflation rate in August 2024 increased to 37.52 percent on a year-on-year basis, which was 8.18 percent higher compared to the rate recorded in August 2023 at 29.34 percent.

“The rise in food inflation on a year-on-year basis is caused by increases in prices of bread, maize, grains, guinea corn, yam, Irish potatoes, water yam, cassava tuber.

“Others are palm oil, vegetable oil, Ovaltine, Milo, Lipton, etc.”

It said on a month-on-month basis, the food inflation rate in August was 2.37 per cent, which was a 0.10 per cent decrease compared to the rate recorded in July 2024 at 2.24 per cent.

“The decline in food inflation on a month-on-month basis was caused by a decrease in the average prices of tobacco, tea, cocoa, coffee, Groundnut oil, and milk.

“Others are yam, Irish potatoes, water yam, cassava tuber, palm oil, and vegetables etc.”

The report said that “all items less farm produce and energy” or core inflation, which excludes the prices of volatile agricultural produce and energy, stood at 27.58 per cent in August on a year-on-year basis.

“This increased by 6.43 percent compared to 21.15 percent recorded in August 2023.

“The exclusion of the PMS is due to the deregulation of the commodity by removal of subsidy.”

It said the highest increases were recorded in prices of rents, bus Journey intercity, Journey by motorcycle, etc.

“Others are accommodation service, laboratory service, x-ray photography, consultation fee of a medical doctor, among others.”

The NBS said on a month-on-month basis, the core inflation rate was 2.27 per cent in August 2024.

“This indicates a 0.11 percent increase compared to what was recorded in July 2024 at 2.16 per cent.

“The average 12-month annual inflation rate was 25.18 per cent for the 12 months ending August 2024, this was 6.00 per cent points higher than the 19.18 per cent recorded in August 2023.”

The report said on a year-on-year basis in August 2024, the urban inflation rate was 34.58 percent, which was 6.89 percent higher compared to the 27.69 percent recorded in August 2023.

“On a month-on-month basis, the urban inflation rate was 2.39 percent, which decreased by 0.07 per cent compared to July 024 at 2.46 per cent.”

The report said on a year-on-year basis in August 2024, the rural inflation rate was 29.95 per cent, which was 5.87 percent higher compared to the 24.10 percent recorded in August 2023.

“On a month-on-month basis, the rural inflation rate was 2.06 percent, which decreased by 0.04 per cent compared to July 2024 at 2.10 per cent.”

On states’ profile analysis, the report showed that in August, all items’ inflation rate on a year-on-year basis was highest in Bauchi at 46.46 per cent, followed by Kebbi at 37.51 per cent, and Jigawa at 37.43 percent.

It, however, said the slowest rise in headline inflation on a year-on-year basis was recorded in Benue at 25.13 percent, followed by Delta at 28.86 percent, and Imo at 28.05 percent.

The report, however, said in August 2024, all items inflation rate on a month-on-month basis was highest in Kwara at 4.45 per cent, followed by Bauchi at 4.22 per cent, and Adamawa at 3.99 per cent.

“Ogun at 0.21 percent, followed by Abuja at 0.92 percent and Kogi at 1.14 percent recorded the slowest rise in month-on-month inflation.”

The report said on a year-on-year basis, food inflation was highest in Sokoto at 46.98 per cent, followed by Gombe at 43.25 percent, and Yobe at 43.21 percent.

“Benue at 33.33 percent, followed by Rivers at 33.01 percent and Bayelsa at 33.36 percent recorded the slowest rise in food inflation on a year-on-year basis.”

The report, however, said on a month-on-month basis, food inflation was highest in Adamawa at 5.46 percent, followed by Kebbi at 4.48 percent, and Borno at 3.88 percent.

“Ogun at 0.08 per cent, followed by Akwa Ibom at 0.45 percent and Sokoto at 1.00 percent, recorded the slowest rise in inflation on a month-on-month basis.”

…FAAC allocation up 1.42% in Q2, 2024 – NEITI

Meanwhile, the Nigeria Extractive Industries Transparency Initiative has stated that the Federation Accounts Allocation Committee disbursed N3.473tn to the three tiers of government in the second quarter of 2024.

This reflects an increase of N46.77 billion (1.42 percent) compared to the first quarter of 2024.

This was disclosed by the agency’s Assistant Director, Communications and Advocacy, Chris Ochonu, in a statement on Monday.

Ochonu noted that these figures are part of NEITI’s latest Quarterly Report on Federation Account Revenue Allocations for Q2, 2024.

Unveiling the report in Abuja, the NEITI Executive Secretary, Dr Orji Ogbonnaya Orji, emphasised that “The Quarterly Review aims to highlight the sources of funds into the Federation Account and the factors affecting the growth or decline in revenues and distributions over time.

“The ultimate goal of this disclosure is to enhance knowledge, increase awareness, and promote public accountability in the management of public finances.”

He said the Federal Government received N1.102 trillion, representing 33.35 percent of the total allocation while 36 states received N1.337 trillion (40.47 percent) and the 774 local government councils shared N864.98 billion (26.18 percent).

Additionally, nine oil-producing states received N169.26 billion as their derivation share from mineral revenue.

“A comparison with the previous quarter shows that the Federal Government’s allocation decreased by N41.44 billion (3.76 percent), while state governments saw an increase of N58.13 (4.29 percent), and local government councils experienced a rise of N30.82 billion (3.57 percent).

“The Nigeria Upstream Petroleum Regulatory Commission, the Federal Inland Revenue Service, and the Nigeria Customs Service were identified as the main revenue-generating agencies for the Federation Account.

“Their contributions included oil and gas royalties, petroleum profit tax, company income tax, value-added tax, and import & excise duties,” the statement noted.

The report highlighted an upward trend in revenue allocations in the latter months of 2023 and early 2024. Total monthly disbursements increased from N1.094 trillion in January 2024 to N1.098 trillion in February but then declined slightly to N1.065 trillion in March.

On state-by-state allocations, Delta received the largest share of allocations in Q2 2024, with a gross allocation of N137.36 billion, including oil derivation, Lagos followed with N123.28 billion and Rivers came in third with N108.104 billion. Nasarawa, Ebonyi, and Ekiti states received the least, with N24.735 billion and N25.40 billion, respectively.

Among local governments, Alimosho in Lagos received the highest allocation at N5.72bn, followed by Ajeromi/Ifelodun (N4.59bn) and Kosofe (N4.54bn). Ifedayo received the smallest share of N661.82m.

“Nine states benefited from 13 percent oil derivation revenue, with Delta State leading at 40.153 percent, followed by Bayelsa (38.112 percent) and Akwa Ibom (36.117 percent). Rivers State recorded a derivation ratio of 27.272 percent, while the other oil-producing states had ratios below 20 percent.

“However, solid minerals-producing states did not receive derivation revenue in Q2 2024 due to insufficient revenue generation from the sector.”

Continuing, the NEITI boss stated that Bauchi State recorded the highest debt deductions in Q2 2024 at N6.49 billion, followed by Ogun State. Anambra State had the least deductions at N115.6 million, while Lagos and Nasarawa recorded no debt deductions for the quarter.

Making its recommendations, the NEITI urged states to take advantage of ongoing reforms in the solid minerals sector to diversify their revenue sources.

It added, “The Central Bank of Nigeria should strengthen measures to stabilise the exchange rate and reduce fluctuations in Federation Account remittances.

“States should adopt realistic budget benchmarks for oil production and exports to minimise fiscal shocks from price volatility.

“While, the Revenue Mobilisation Allocation and Fiscal Commission and the Office of the Accountant General of the Federation should take decisive steps to increase transparency and accountability, particularly in the payment of special revenue accruals like derivation arrears and debt repayment refunds.”

The NEITI boss also urged the citizens and civil society organisations, particularly those involved in revenue and expenditure monitoring, to show interest and strengthen their capacity in budget tracking and monitoring of allocations and disbursements to all tiers of government