Osun APC, reinventing from emerging unity (II)

By Isaac Olusesi

The issues for agenda setting, also continue around why, and when will the local government councilorship aspirants’ monies for the expression of interest form, mismanaged, diverted or converted, be refunded? How could the disobedience to the state party leader, former Osun Governor Gboyega Oyetola’s order to the party to refund the monies to owners, be avoided in future? How could the party’s posture, against the order issued more than once by the state party leader, be deflected from recurrence in future? And in view of another order to the party to have the party daily managed from the party office, ignored, what and how could the daily management of the party from private residence be permanently stopped and never to happen again?

The Osun APC, currently, not in the instance of electioneering campaigns, but seriously on mobilization, orientation and sensitization outings to get the party reinvented, reanimated and reinvigorated on strongly electoral footings, any sort of jamboree or carnival at this time is an infraction, obstructive to the all-important, thoughtful objectives of MOS with the reunification of the party and reprioritization of its electoral fortunes as far-reaching ends, pervasive. Hear the more serious Lawal: “I enjoin all the stakeholders in the party to imbibe unity, put behind them what might be their grouses with the party or any of its members and work together as a team in the overall interest of the party in the state. I commend the doggedness and high spirit of the members of the party.”

And at every turn of the Osun APC’s mobilization, orientation and sensitization (MOS), Lawal, with all seriousness of Oliver Twist, spoke pointedly, asking for increased membership propel and membership patronages. “It’s the task of all the members and leaders of our party to boost our membership drive by bringing in more members and engage in the reintegration of any disenchanted members of the party who have genuinely sought forgiveness over their past malfeasance against the party, Lawsl stated, adding, “the party remains an indivisible and impenetrable one. The party will look into the challenges as presented by each of the council areas just as I can tell you that everything within the ambit of the law and constitution will be done to remove the oddities in the 2026 elections.”

The writer’s analysis of Lawal and his MOS is, the man spoke with glee and his voice, thumbed up with refreshing pitch and he’s not given to flippancy to ride on the wave of angst at the party’s painful, regrettable past and despise anyone or splash mud or voice verbal attacks as some are wont want to do, forgotten at all times that “The fault lies not in our stars but in ourselves,” the Shakespearean wise saying. Meaning, the party men and women were responsible for the pains or regrets of the past, not fate. Lawal is worthy of the state party higher-up that he’s; he is a revered Osun APC leader who’s very sensitive to party issues and electoral calculations. “Reconcile with the disenchanted party members in your domain and reconcile with anyone of them who’s genuinely repentant as politics is a game of numbers.I charge you all, leaders and members of our party to close ranks and operate in unison in the interest of the party,” Lawal passionately appealed to the party.

Impliedly, Lawal as Osun APC chairman is asking the party members and leaders, top down in the local government council areas of the state to leave behind them needless embroilment in the mathematics of unsettled issues on some contextual factors with emphasis placed almost exclusively on intra party dynamics. That’s Lawal’s MOS, springing up party unity and nurturing the same, and no battle rages. And for him, no black dog, no white dog; no love lost, no love found; no power broker, no power loser; and no marginalization of anyone or anyone being marginalized. The party, under him is reinventing to stand together, act together and speak together. And never again will the party crawl, or taken to task for any lapses, or to the cleaners to be bested, defeated in any future elections.

There’s no failure of leadership in Lawal, the Osun APC chairman. His mobilization, orientation and sensitization train has risen to the challenges of the party’s present situation which is the hallmark of true leadership. What’s needed now by the Lawal example, is the change of attitude of the party leaders and members to party processes, values and principles that would earn the party leadership the respect of the party members as it’s just the best that members should be ready to function at the bell and call of the party leadership. And it’s good today, every party man and woman wants to “serve in heaven and no one wants to reign in hell.”

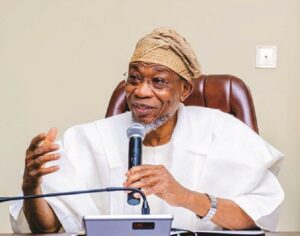

Behind Lawal, APC’s progress in Osun, showing by the party’s decisive match forward to reacquire political power, establish government and act as a link between the governed and government, comes 2026, is Oyetola Honourable Minister of the Federal Republic of Nigeria who has consistently said, “the party will regain its strength and vitality and very soon, there will be tremendous progress.”

I share the Osun APC leadership concern on crucial niceties of the continued peace and progress of the party and the urgent and concerted efforts towards the renascence or resurrection of the right party culture through a coherent, thoroughly and clearly guided and executed programme of mobilization, orientation and sensitization (MOS). The state APC leadership is convinced that the effectively mobilized party, consciously orientated party and properly sensitized party is the greatest deterrent to bad _’partysim’_, the kind on the ground, preparatory to the last general elections in the state. It’s also an assurance that the state APC people would have been so strongly motivated as to acquire an understanding of the party general processes and participate meaningfully.

Let the Osun APC apex leadership note this. The party in the state, rightly in search of self reconstitution for success at the next rounds of general elections, must re- emphasize mobilization, orientation and sensitization of the party, ad-infinitum, on continuous basis and not without corresponding emphasis on party supremacy, party discipline, party loyalty, party patriotism, and party accountability

Olusesi writes via [email protected]